Last week, some noteworthy price set-ups saw investors step into the markets at trade entry points for long-term positions.

The Outlook for Gold & Silver is Improving

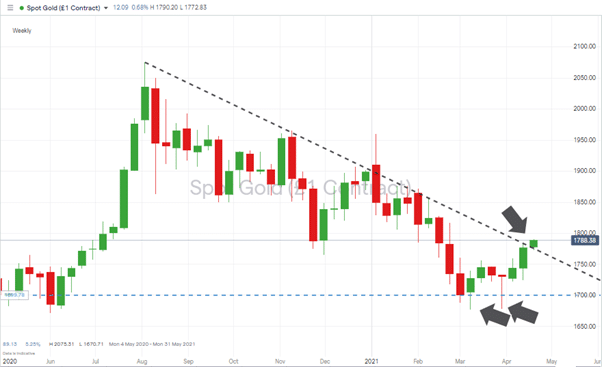

The precious metal found considerable buying support at the 1678 price level. Two tentative breaks to below this level in March have been followed by a break to the upside, through the downward trend line.

Source: IG

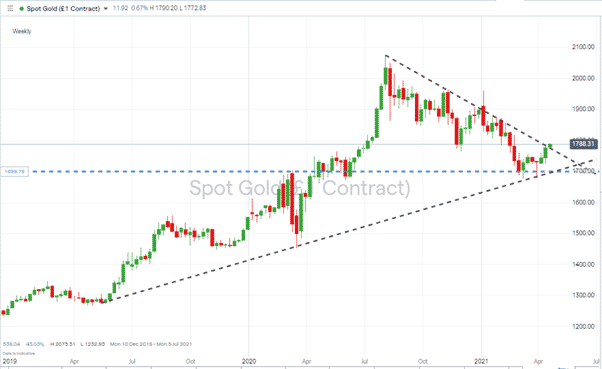

Recent price action points to continued strength in the near term. The metal has had a disappointing start to the year, but the multi-year weekly price chart shows that price is currently sitting on a long-term support line.

Source: IG

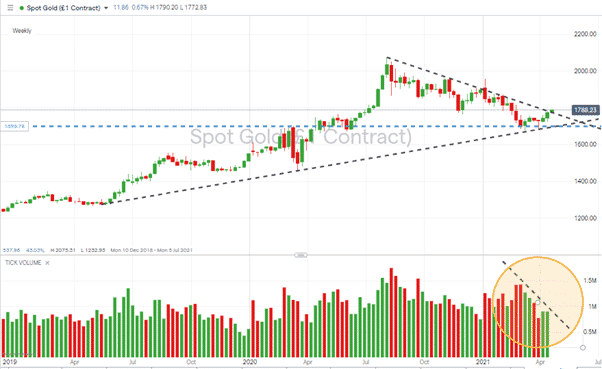

There is the fundamental question of whether crypto will establish itself as the preferred defensive asset for gold-bugs, albeit a virtual one. From a technical perspective, there is also concern that the change in price direction has not been backed up by an uptick in trade volumes. That could be a case of price flip-flopping in quiet markets.

Source: IG

Is Now the Time to Buy Bitcoin?

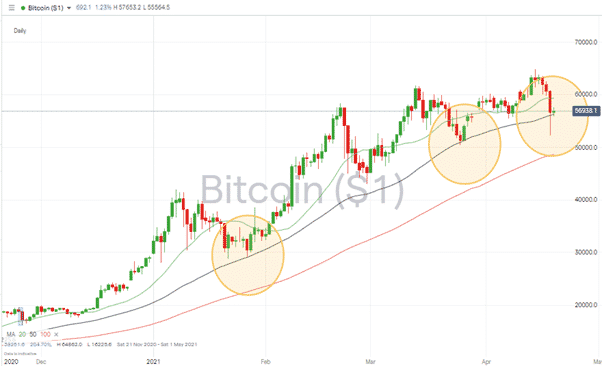

The Bitcoin market is notoriously hard to evaluate. So much of the buying and selling pressure is emotion-driven that technical analysis can sometimes take second place. One interesting set-up is the role the 50 SMA is playing on the daily price charts.

Source: IG

Last week’s price plunge for BTC took the market back to the 50 SMA for the third time this year. On the two previous occasions in February and March, it then rallied, and some will be buying at these levels and hoping that the price rallies from here.

The price drop of the week beginning the 12th of April took almost 5% off BTC’s valuation. That’s by no means atypical for the market, and rumours of Dogecoin challenging Bitcoin’s market dominance do appear to be overdone.

The price of Dogecoin has skyrocketed as hot money has switched to that coin, but it is a case of buyer-beware as the Dogecoin platform has some technical weaknesses. The ultimate crowd-sourced crypto is appealing to purists, but the platform is maintained by its miners rather than any recognised team of Dogecoin staff.

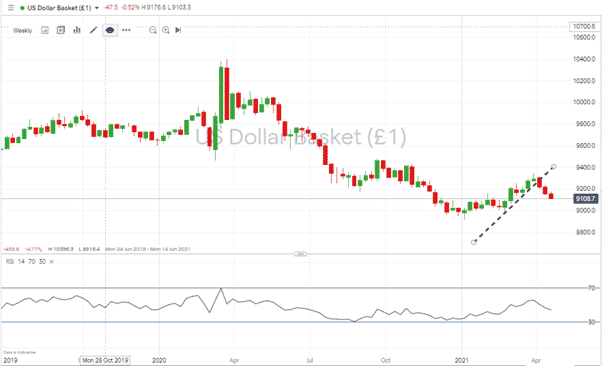

USD Continues to Fall

The baseline to precious metals and cryptos potentially rising in value is the continued slide of the US dollar.

After a show of strength from the second half of February to the end of March, the greenback has returned to its downwards path.

Source: IG

The hourly chart illustrates that selling pressure could be building as the USD Basket index started the week of the 19th of April in a particularly bearish mood.

Source: IG

Short-term (hourly) RSI is well below 30, suggesting the trend may experience a short-term reversal. Balanced against this is the fact that the weekly RSI sits at 45, which gives some breathing room to those betting against the dollar on a longer-term basis.

Key Data Points to Watch Out for This Week

There are a lot of news reports due this week. The pick of the central bank reports is the ECB on Thursday updating the markets on interest reports. Before that, Netflix will share Q1 earnings with its investors on Tuesday, offering a barometer reading for tech stocks in general.

If you want to know more about this topic, or have been scammed by a fraudulent broker, please contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox