The US dollar’s role as the world’s base currency is facing a new threat that could dramatically impact the broader financial markets. Not least because if the default ‘safe haven’ currency isn’t believed to be that safe anymore, at the next sign of distress, cash could be scattered across the globe into all sorts of asset groups.

The new threat, like many others, comes from China. It looks like the Beijing administration has got the jump on Washington again, this time by developing a Central Bank Digital Currency (CBDC).

CBDC’s are a growing source of interest around the world. They’re not true crypto’s, as they don’t allow users to remain anonymous. They do, however, tap into the underlying technology of cryptos and offer a next-generation means of storing and transferring wealth.

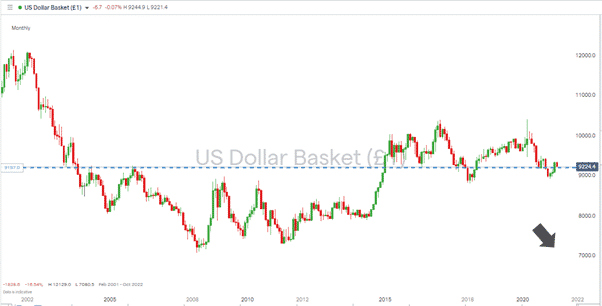

US Dollar Basket

The long-term decline in the US dollar’s value can be attributed to many factors, including the US Federal Reserve’s super-relaxed monetary policy. The long-term price shift has left many wondering how long it might continue. The answer to that question needs to include a reference to China’s CBDC.

US Dollar basket – 1h price chart

Source: IG

US Dollar basket – 1h price chart

Source: IG

Data mining

The People’s Bank of China (PBOC) points to digital currencies being cheaper and easier to use than cash. They’re right on both counts, but the attraction to the PBOC goes deeper than ease of use. Being able to monitor the holdings and transactions of members of China’s economy will offer them a data source of a quality of which central bankers can only dream.

Cross-currency

Another plus for Beijing is that their currency may become more widely adopted and challenge the dollar’s primary position as the world’s global currency. Cross-border transactions in Asian markets are already leaning towards using the Yuan rather than the greenback. The added ease of carrying them out online is likely to add momentum to that trend.

Anonymity

CBDCs also reduce black market transactions, provide obstacles to criminal activity, and tighten the grip that authorities have on their citizens.

The civil liberties angle is holding the US back in developing its own CBDC for the dollar. The wild-west spirit runs so deep that Bitcoin and other cryptos have found the US market a happy hunting ground. Many prefer to give up on using USD altogether and opt to use a virtual currency with protocols that allow users to operate using complete anonymity.

The CBDC model is a halfway house that looks set to build market share. The US dollar is one obvious loser, but there could be others.

Existing platforms which offer a similar service could thrive from the mass adoption of digital payments and share a smaller slice of a bigger cake. Or else China’s CBDC could squeeze them out of the market altogether. The list of digital platforms which have had their risk-return scaled up include:

- WiPay

- AliPay

- SwiftPay

Crypto’s such as Bitcoin could also be challenged. What premium do the users of that coin place on being able to remain anonymous? How many holders of the coins are just speculating on its price rather than taking a bet on its long-term viability?

The development of China’s CBDC is a long-term game, but it is one worth following.

If you want to know more about this topic, or have been scammed by a fraudulent broker, please contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox