Headline writers have seized on Donald Trump’s comments regarding the US Coronavirus Stimulus Bill but are they missing the point?

US Coronavirus Stimulus Bill – Last-minute wobbles?

US President Donald Trump has issued statements threatening to derail the US Coronavirus stimulus bill, but it has failed to stir the markets into action. A more in-depth look into what Mr Trump is calling for explains why his comments are not a cause for concern.

The headlines indicating that Trump might not sign off on the bill are more a sign of it being a quiet news day. His claim that the legislation is “unsuitable” is based on him wanting more fiscal stimulus, not less. Further reasons for the bill not being derailed and if anything ramped up include:

- He did not threaten to veto the bill

- Congress has passed the bill with veto-proof majorities

- Political arch-rival and House Speaker Nancy Pelosi agrees with the President that direct payment should be increased from $600 to $2,000

The matter could be resolved as early as Thursday. Comments from the political corridors of Washington suggest the update and improved spending is likely to be approved “this week”. Some Republican Senators will be relishing the opportunity to play the Grinch but hopes are high or much higher than the initial headlines suggest.

“At last, the President has agreed to $2,000 — Democrats are ready to bring this to the Floor this week by unanimous consent. Let’s do it!”

Source: Nancy Pelosi / Twitter

Source: Tickmill

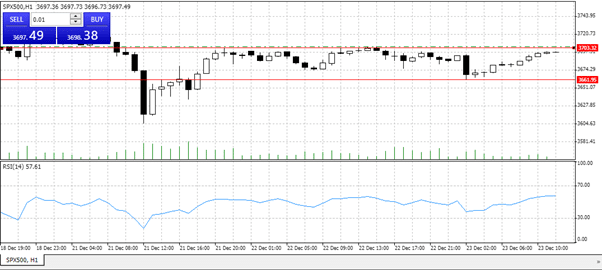

The benchmark equity index the S&P 500 is trading near the upper end of a relatively tight channel which took shape on Monday evening. Monday’s high-excitement based on new COVID strains being reported and European trade grinding to a halt ultimately gave way to much calmer price action.

The RSI gives little indication of a break-out, but it’s volumes that could prove the more important indicator in quiet markets.

Source: Tickmill

With volumes dropping off dramatically in the run-up to the holiday season any further bolstering could be enough to trigger a break of the sideways channel’s upper line.

This note explains why aggressive short-selling is typically put on hold in the run-up to the year-end, which could open up an opportunity to profits from long equity positions.

Could there be a Santa Rally after all?

Scenario 1 – Upward price movement?

- Gap-fill – Half-way through the morning of the European session the S&P500 is trading almost eight points, approximately 20 basis points, below Tuesday’s close of 3694.92. Given the relatively small size of the gap, there is a high probability that it might be filled.

- The next significant resistance level would be the psychologically important 3,700 big number. But if price were to clear that, that number would provide support – for those looking for prices to drift higher on low-trading volumes on Thursday.

This being 2020, nothing is guaranteed. Light volume markets are not the easiest to trade, and it could be a case of using Demo accounts to follow events and build up trading knowledge rather than trading P&L.

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox