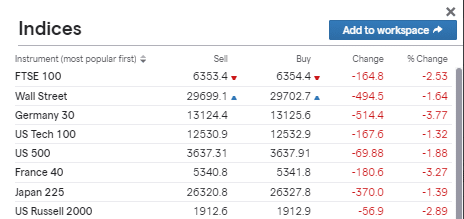

First, there was COVID, now there’s New-COVID, and the markets have taken fright. An outbreak of a new strain of the disease is currently centred on South-East England and London. However, the concern is that the newly detected variant is estimated to be 70% more contagious than the longer-established strain.

The UK government has effectively cancelled Christmas for the population and any investors looking to hold onto riskier assets till the end of the year have also been served up a large helping of seasonal disappointment.

Source: IG

How to trade volatile markets

UK, French and German asset markets have so far suffered the worst of the COVID flare-up. Countries around the world have announced travel bans and freight traffic to the continent has come to a halt, hopefully temporarily.

Those looking to trade safely may want to scale back on their positions as the one lesson from 2020 is that one country’s experience soon becomes that of its neighbours.

The relative strength of the US and Asian indices may be temporary. If so a pairs trade of long European stock indices and Short Asian/US indices could be a way to trade the extra price volatility but in a relatively market neutral way.

Naked positions come with added risk during market conditions such as these. Trading can become emotional, so there is good reason to avoid going simply long or short. As the global equity indices trade 24/5, it’s easy to try pairs trading using virtual funds in a regulated Broker Demo account.

USD bounces signalling Risk-Off

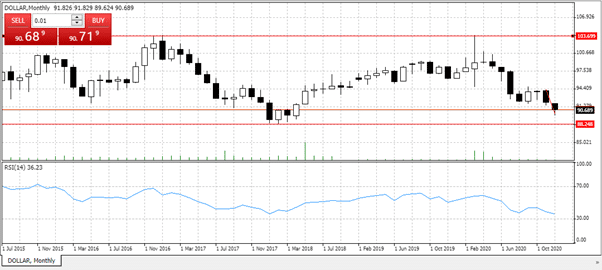

Trading the USD ‘DOLLAR’ index will give traders exposure to the risk-off move.

While buying into DOLLAR would be a naked position, that index has been under significant pressure for some time and has been in ‘over-sold’ territory. The Daily RSI was trading below 30 at the end of last week.

Source: Tickmill

The Daily candle price chart shows Monday’s European session has marked a break of the long-term downward trend line.

Source: Tickmill

Part of the appeal of the long DOLLAR trade is that there appears to be little downside.

- Prices in December have been printing 18-month lows

- The November-December 2017 low of 88.25 will provide significant support

- There is lots of headroom with prices of 101 being printed in March of this year

Source: Tickmill

Risk-management techniques for volatile markets

If you are stepping into the markets, then reducing position size would be an excellent first step in terms of risk management. Bear in mind that stop-losses will be more likely to be triggered if set at standard distances and the worst-case-scenario could be making losing trades and then trying to ‘win’ your money back.

It’s a time for cool heads and clear strategies. If you think you might not have either of those then trading on a Demo account using virtual funds offers a risk-free alternative.

Trading on Demo means you might not make a profit, but nor will you make a loss. The educational benefits of following these markets with virtual positions shouldn’t be underrated.

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2024

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global CFD & FX Broker |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #6 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #7 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox