- In our last article here on14th January regarding USDCAD and USDJPY Forex rates we highlighted a bearish intermediate-term threat for USDCAD and a neutral tone for USDJPY.

- Subsequently, a more negative US Dollar tone has emerged, as the Federal reserve continues to shift to a more dovish tone into 2019.

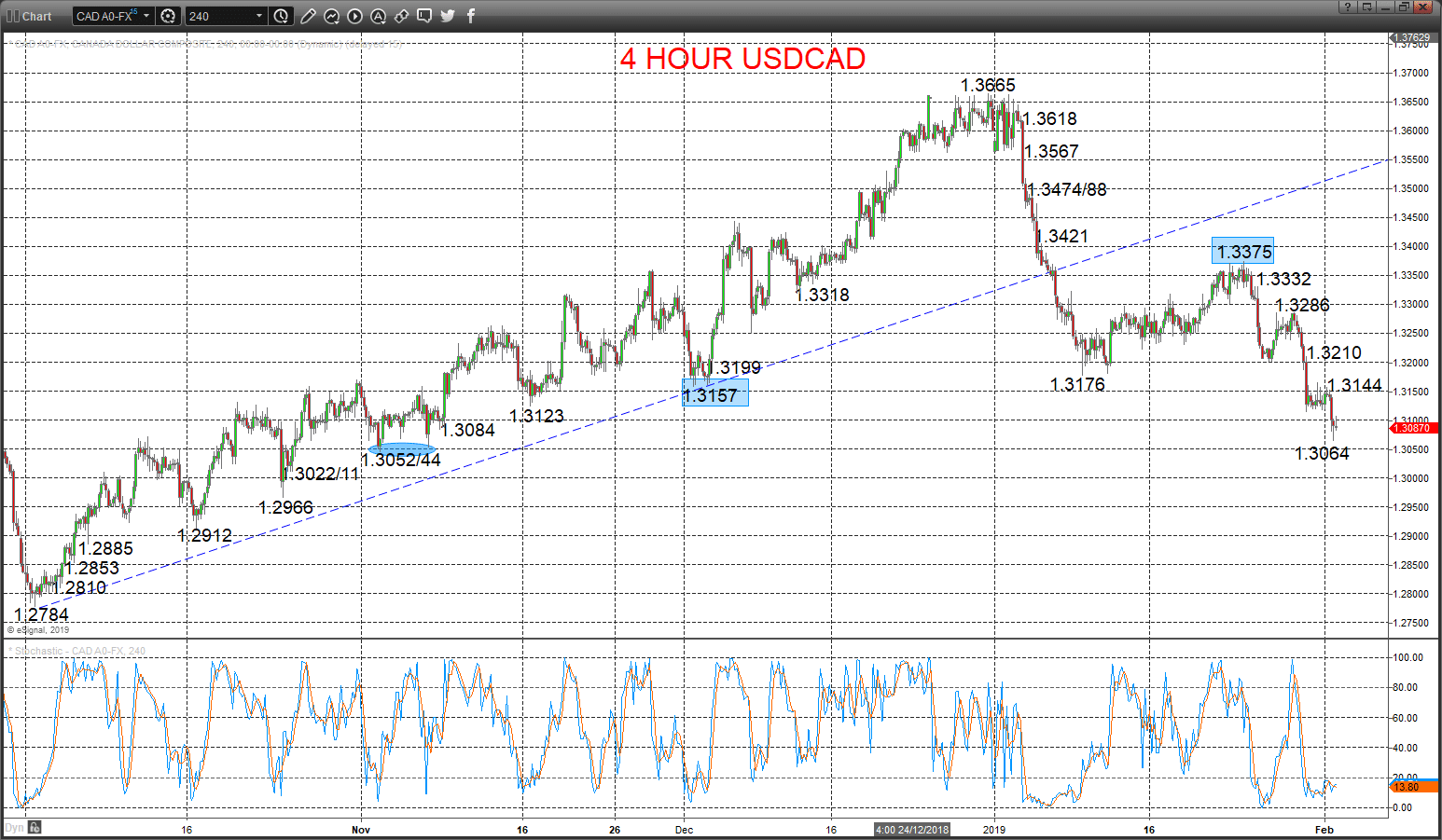

- This has seen broad US Dollar weakness and allowed for USDAD to break below our key 1.3157 level, for an intermediate-term bearish shift.

- Within this environment, USDJPY appears confused as to directional tone and retains an intermediate-term, neutral range theme.

USDCAD bear forces reinforced

Another selloff Friday to reinforce Wednesday’s plunge after the Fed decision through key 1.3157 support, to keep risks lower for Monday.

The late January plunge below 1.3157 shifted the intermediate-term outlook to bearish.

For Today:

- We see a downside bias for 1.3064; break here aims for 1.3052/44 and 1.3022/11, maybe 1.3000.

- But above 1.3144 targets 1.3210 and maybe aims for 1.3286.

Intermediate-term Outlook – Downside Risks: We see a downside risk for 1.3000.

- Lower targets would be 1.2912 and 1.2784.

- What Changes This? Above 13375 shifts the intermediate-term outlook straight to a bull theme.

Resistance and Support:

| 1.3144 | 1.3210 | 1.3286** | 1.3332 | 1.3375*** |

| 1.3064 | 1.3052/44 | 1.3022/11 | 1.3000** | 1.2966** |

4 Hour USDCAD Chart

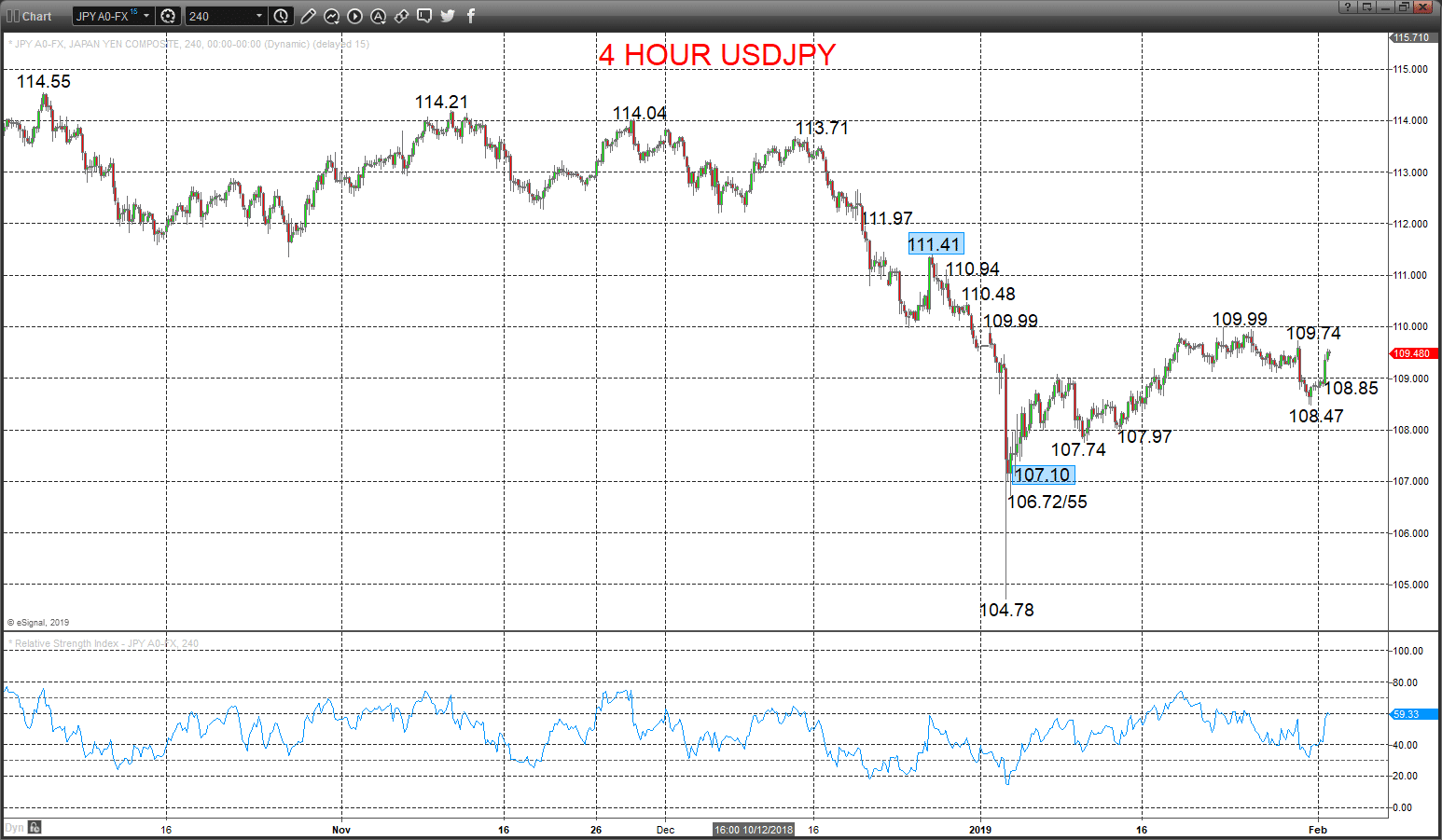

USDJPY holding onto a negative tone

An unexpectedly firm rebound above 109.07 and 109.39 resistances on Friday, to ease negative forces from Thursday’s setback through 108.66 support after Wednesday’s selloff after the Fed through the 109.12/10 support area, to just keep the risks lower into Monday.

The probe above 108.90 set an intermediate-term range, seen as 111.41 to 107.10.

For Today:

- We see a downside bias for 108.85 and 108.47; break here aims maybe towards 107.97, possibly even 107.74.

- But above 109.74 aims for 109.99, which we would look to try to cap. A voice targets 110.48.

Intermediate-term Range Breakout Parameters: Range seen as 111.41 to 107.10.

- Upside Risks: Above 111.41 sets a bull trend to aim for 71, 114.55 and 115.00.

- Downside Risks: Below 107.10 sees a bear trend to target 72/55, 104.78/56 and 100.00.

Resistance and Support:

| 109.74* | 109.99** | 110.48** | 110.94 | 111.41*** |

| 108.85 | 108.47 | 107.97* | 107.74** | 107.10*** |

4 Hour USDJPY Chart

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox