- A broadly more negative tone for the US Dollar has been seen in early 2019, given a more dovish tone from FOMC Members, including the Fed Chairman, Jerome Powell.

- Furthermore, a global shift to “risk on” has also been seen in early January, with easing trade war concerns.

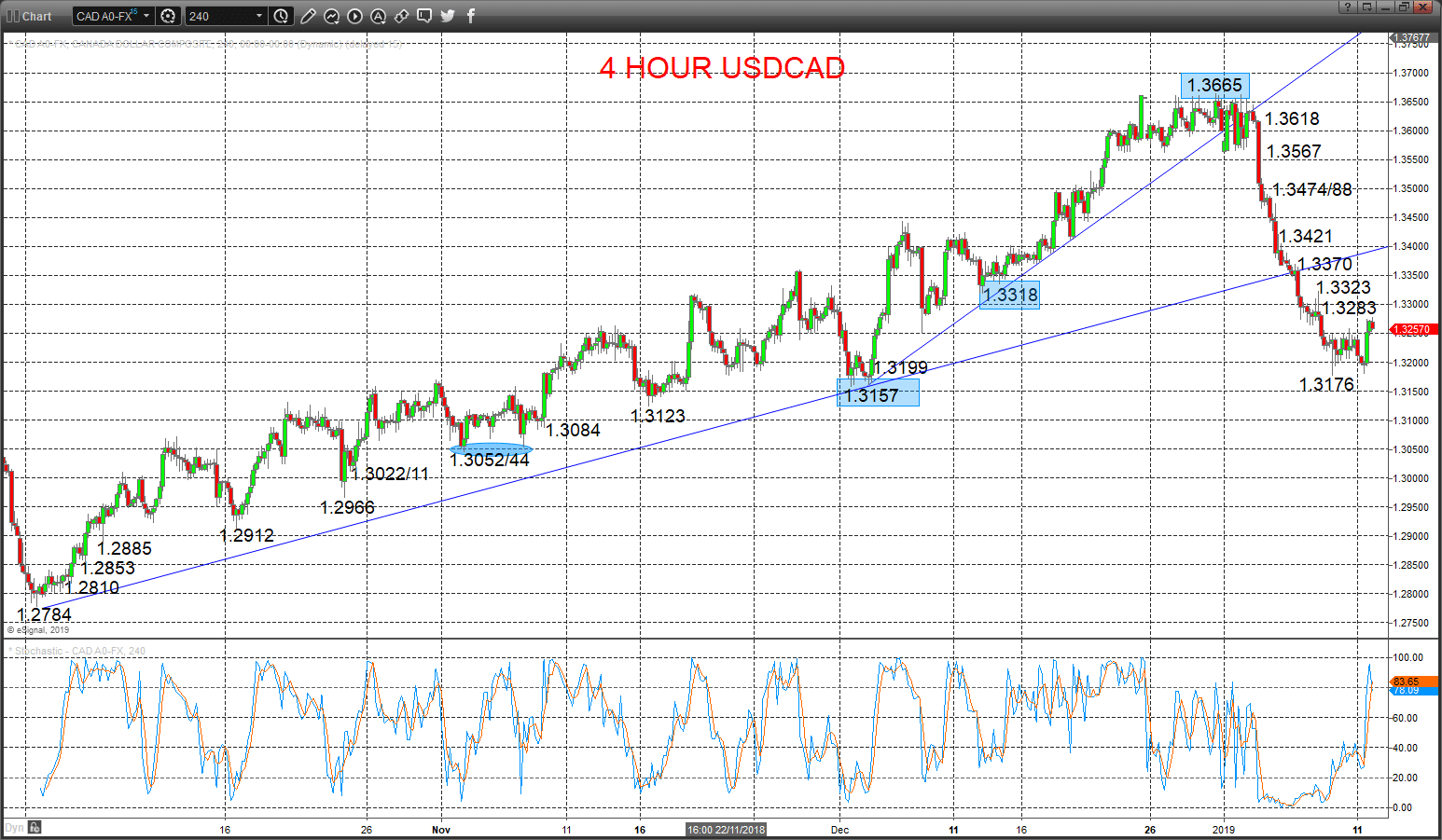

- The above macroeconomic fundamental shifts, alongside a firm rebound in the Oil price (after aggressive weakness in Q4 2018) has seen USDCAD plunge lower, to neutralise an intermediate-term bull trend and threaten an intermediate-term shift to bearish (see below).

- USDJPY did seem an aggressive selloff to start the year with a “risk off flash crash”, but the strong subsequent rebound has seen an intermediate-term shift back to a neutral, broader range environment.

USDCAD Still a downside threat to key 1.3157

A rebound Friday, but capped by initial resistance at 1.3283, to sustain negative forces from the earlier January plunge through the up trend line from October and key 1.3318 support, to leave the bias to the downside Monday.

The early January plunge to push below the 1.3318 level set a neutral intermediate-term range we see as 1.3157 to 1.3665, BUT with skewed risks now towards the lower target.

For Today:

- We see a downside bias for 1.3200 and 1.3176 and quickly for key 1.3157; break here aims for 1.3123 and 1.3084.

- But above 1.3283 opens risk up to 1.3323 and maybe towards 1.3370.

Intermediate-term Range Breakout Parameters: Range seen as 1.3157 to 1.3665.

- Upside Risks: Above 1.3665 sets a bull trend to aim for 1.3777 and 1.4000/17.

- Downside Risks: Below 1.3157 sees a bear trend to target 1.3000, 1.2912 and 1.2784.

Resistance and Support:

| 1.3283 | 1.3323* | 1.3370* | 1.3421 | 1.3474/88** |

| 1.3200 | 1.3176 | 1.3157*** | 1.3123 | 1.3084* |

4 Hour USDCAD Chart

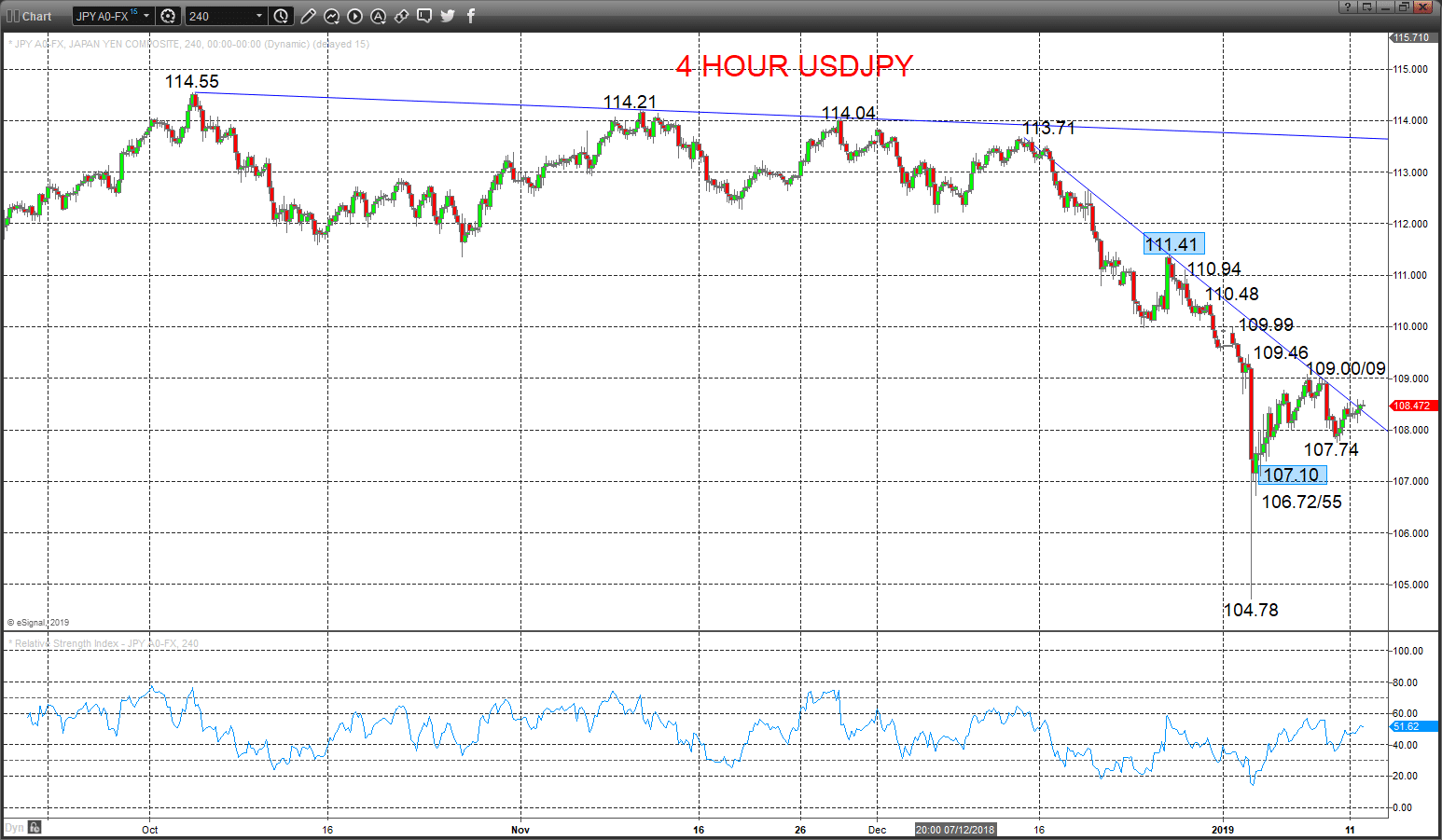

USDJPY Risks just stay lower

A small bounce Friday from 107.74 new support, but whilst contained by the 109/.00/09 resistance area we see negative forces intact from last Wednesday’s selloff from this zone, to keep the immediate risks lower into Monday.

The probe above 108.90 set an intermediate-term range, seen as 111.41 to 107.10.

For Today:

- We see a downside bias for 107.74; break here aims for key 107.10.

- But above 109.00/09 opens risk up towards 109.46.

Intermediate-term Range Breakout Parameters: Range seen as 111.41 to 107.10.

- Upside Risks: Above 111.41 sets a bull trend to aim for 71, 114.55 and 115.00.

- Downside Risks: Below 107.10 sees a bear trend to target 72/55, 104.78/56 and 100.00.

Resistance and Support:

| 109.00/09** | 109.46* | 109.99 | 110.48** | 110.94 |

| 107.74 | 107.10*** | 106.72/55** | 106.00 | 105.53 |

4 Hour USDJPY Chart