Predicted Rise Plays Out

Monday’s Forex Fraud market analysis report predicted that with few news announcements due markets were likely to rise. That has come good as central banks have flooded global economies with cash and all that money needs to go somewhere.

Wall Street continues to lead the way and on Wednesday the Dow Jones Industrial Average closed at an all-time high of 31,438. Nine of the last ten days have recorded green candles and the GameStop inspired sell-off which ended on the 31st of January now appears to have been one of the buying opportunities of the year.

A review of the Reddit-GameStop-WallStreetBets situation suggests that the correction was caused by hedge funds becoming forced sellers of ‘good’ long positions as they looked to generate funds to cover their shorts in GameStop.

Now that most hedge funds have extricated themselves from the uncomfortable shorts in GameStop, there is no need to liquidate funds and the DJIA is now up 5.59% on a month to date basis.

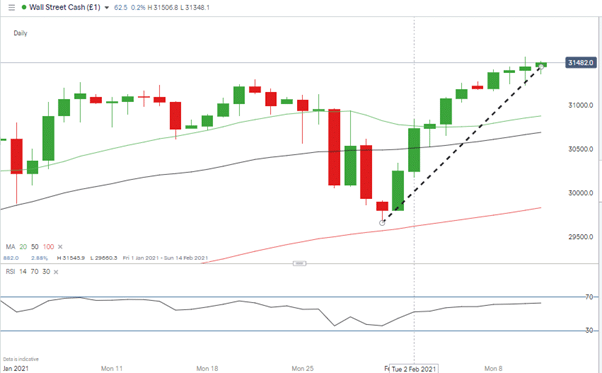

Wall Street – DJIA Daily Candles with RSI

Source: IG

The RSI still sits below 70 and in the absence of bad news, the path of least resistance still looks to be upwards. Price is above the daily 20, 50 and 100 SMA and has spent the first part of the week consolidating at current levels waiting for the averages to catch up.

EURUSD – Euro continues to show strength against the dollar

The H1 chart for EURUSD shows the euro setting a steady but unwavering path upwards. Weakness in USD is positive for Wall Street for various reasons.

- Exports of US products become relatively cheaper in foreign markets.

- These non-USD profits, when converted back to USD at the headquarters of firms like Proctor & Gamble, are inflated by the currency effect.

- Hourly RSI for US 30 is some way off hitting 70 and marking ‘oversold’.

All this adds up to extra revenues for big US multinationals. That can only be good for the price of the US 30 index.

EURUSD – 1H price chart with RSI

Source: Pepperstone

Using the Right Broker for Current Market Conditions

Nothing is ever certain in the markets and with price volatility draining out of the market profit margins could be impacted by frictional costs. Scratching out returns in quiet markets is hard enough without your broker taking more than their fair share.

Therefore, credit should be given to the broker Tickmill which has recently announced it has won the “Commissions & Fees – Professional Trading Category” award for a second year running.

Source: Tickmill

Not only is Tickmill safe, but it’s also cost-effective. During bonanza years like 2020, when prices swing around dramatically, the incremental charges associated with trading can go unnoticed, but half-way through February, we see 2021 as being a quieter year.

Changing brokers should always be on traders’ minds as the sector is highly competitive and good firms keep pushing the boundaries. If you feel your broker is not keeping up with rivals or is just eating into your capital too much, then heading to Tickmill to try out a Demo account might be a profitable experience.

The Forex Fraud research team have recently updated the review of Tickmill and noted significant improvements to what was already a first-rate service. You can read that full in-depth review here.

If you want to know more about this topic or have been scammed by a fraudulent broker, please contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox