Risk-on as Markets Find Reasons to be Cheerful

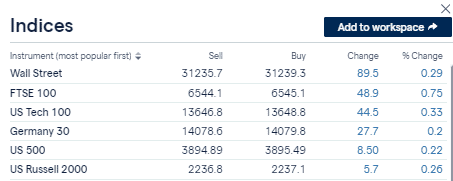

Half-way through Monday’s European trading session, all the major global benchmark equity indices were up at least 20 basis points.

Source: IG

- On Friday, the US jobs report showed that US unemployment fell to 6.3% in January but payrolls barely grew. The absence of a significant rebound would normally be of concern, however, with governments and central banks willing to administer their own brand of financial medicine the disappointing numbers left many thinking that more stimulus is likely.

- Right on cue, US Treasury Secretary Janet Yellen went on record last week to say: “There’s absolutely no reason why we should suffer through a long slow recovery … I would expect that if this package is passed that we would get back to full employment next year.”

The Week-Ahead

The coming week could be quieter than the last.

- The GameStop-Reddit and Silver-Reddit trades have fizzled out.

- Non-Farm Payrolls is done and dusted.

- A bounce in the dollar has lost momentum.

- US earnings season still has some way to go but the bulk of the big numbers have been released and they exceeded forecasts.

- Vaccine roll-outs continue and countries such as those of the EU which were late to that party have begun to administer enough injections to swerve recent negative press headlines about political incompetence.

- Data out of Germany has indicated flat industrial production for December after a strong rise of 1.5% in November. But Germany was flirting with recession even before the Covid-pandemic so any numbers above zero offer hope.

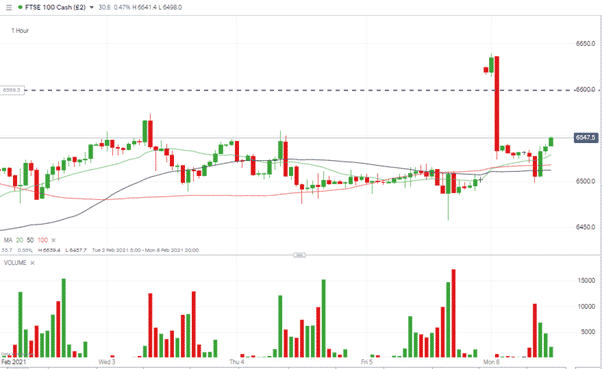

Value in the FTSE?

The beleaguered FTSE100 index failed to rebound with the same vigour as the tech-heavy US benchmarks. It’s still below its Feb 2020 highs but there are signs it could be the index for dip-buyers.

- Takeover activity has picked up. Overseas companies have carried out super-deep due diligence on some top UK brands and have found value.

- Oil stocks which make up a large part of the index are rebounding on the back of higher crude price

Source: IG

Sunday night trading in the index saw prices printing above 6600 and looks over-cooked, for now at least. A break above 6573 would though be a bullish move.

Bank of England Governor offers an embarrassing and personal lesson in client safety

In an extraordinary turn of events, the Governor of the Bank of England will appear before a House of Commons select committee on Monday. Andrew Bailey will have to answer some tough questions relating to his previous role as CEO of the Financial Conduct Authority (FCA) and the London Capital and Finance (LCF) debacle.

Many investors in LCF lost their life savings in the fiasco. The important message to come from the review so far is an affirmation that the onus is on individuals to protect themselves. Regulators can set up an infrastructure designed to counter scams and scammers but the buck stops with the individuals concerned.

The adage goes that if something does look too good to be true then, unfortunately, it probably is. Having the Governor of the Bank involved in a refresher course of that message is not a good look.

Bailey’s seat-squirming date in the diary is a minor part of the financial market jigsaw and markets have started the week in confident mood.

If you want to know more about this topic or have been scammed by a fraudulent broker, please contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox