A range of important and unpredictable news events has taken some of the summer froth off the markets.

The move away from risk is in line with the fundamental law of trading that markets hate uncertainty. As last week’s analysis from the Forex Fraud team pointed out, they’ve had a lot of that to deal with recently.

At the start of a new trading week, there are some hints of positivity across European exchanges as traders continue to work through that long list of updates and announcements.

Trading the News Pipeline

It’s not every week that there is a vote on who gets to run the most important economy in the world. Given the unique circumstances, it could be a week for managing risk by trading in a small way or even using a Demo account.

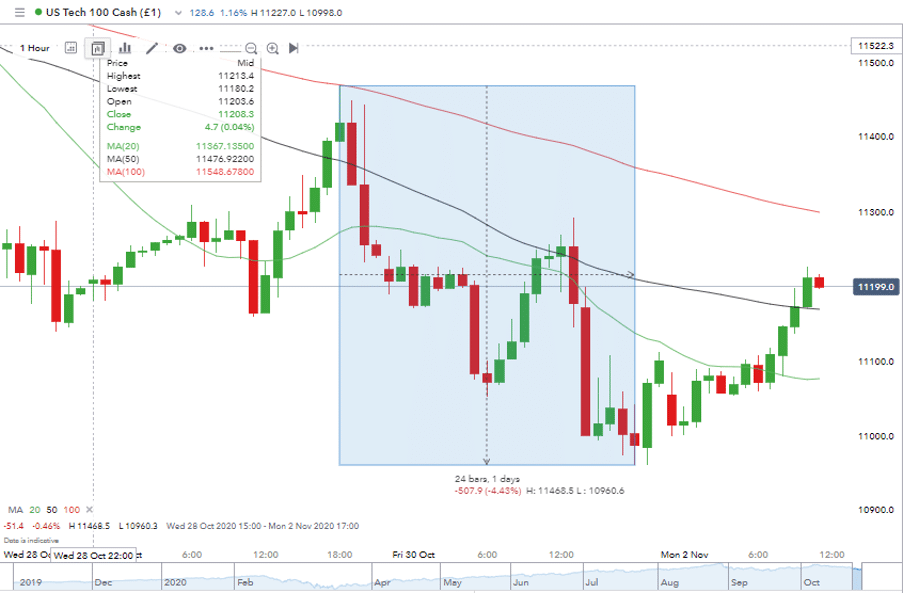

Last Thursday saw 25% of the firms in the S&P 500 index give their Q3 earnings reports on the same day. The mixed bag of good and bad news was enough to trigger a sell-off in tech stocks as even those who ‘beat’ earnings were caught in the cross-fire. But that news is now old news and given the 4.5% trading range in the Nasdaq 100 on Thursday and Friday, is to some extent priced in.

Source: IG

Attention is now turning to the question of how to trade the US presidential election of Tuesday, which is widely regarded as one of the most critical votes for many years.

Bears point to the possibility of a Biden win leading to a slump in the markets. Incumbent president Trump has vowed to fight any defeat in the courts. Another protracted battle could follow in terms of the fiscal stimulus package, which could be harder to process with a lame-duck president in the White House.

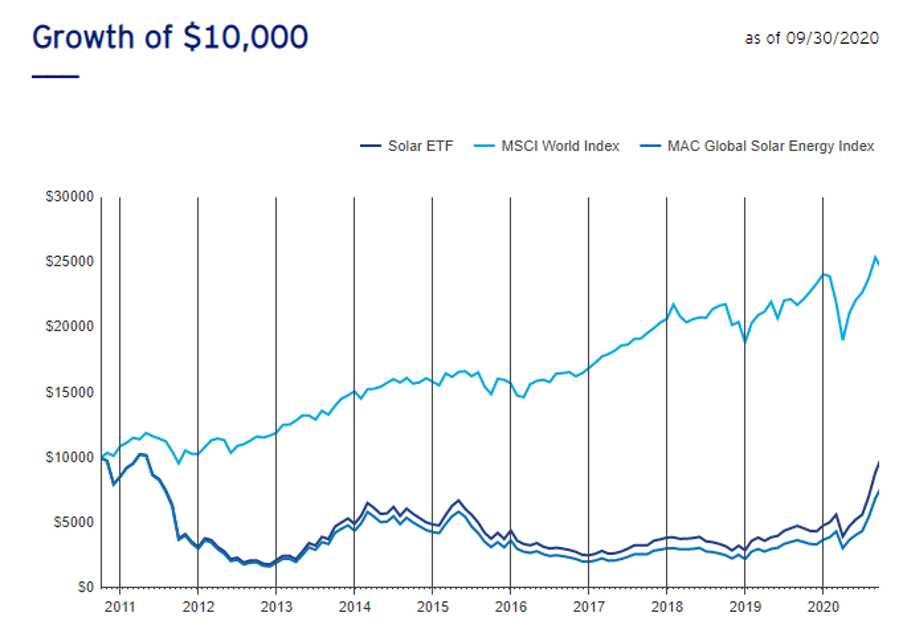

Passions and anxiety levels are running high, but some consider the uncertainty of the outcome weighs too heavily on risk asset prices. Firmly in the “How bad can it be?” camp are those investors piling into green technology. The Invesco Solar ETF climbed about 40% from mid-September to mid-October.

Source: Invesco

What happens to markets following a US presidential election?

Dip-buyers are showing a willingness to pick up equities at Monday’s market open. The recent sell-off has been in the region of 10%, which is ample encouragement for the long-term investors who trade Beta. It can be argued that presidential uncertainty has been already priced in.

Analysts at US Bank have studied market data from the past 90 years and identified patterns relating to presidential election cycles. One of their interesting conclusions is that it doesn’t seem to make much difference which party takes office. When a new president takes control of the White House the following year sees average stock market gains averaged 5%. In instances where the incumbent maintained control equity market returns were only slightly higher, at 6.5%.

There is every likelihood that the trading week will throw up some surprise price moves. Monday morning’s relief rally could already be one of them? The shock nature of the result in the 2016 election appears to be haunting the markets. The inevitable passing of time will see those ghosts exorcised, no matter how complicated and uncertain the process ultimately turns out to be.

Our analysis is based on a comprehensive summary of market data. We use a range of metrics with weighting given to simple and exponential moving averages and key technical indicators.Any information contained on this Website is provided as general market information for educational and entertainment purposes only, and does not constitute investment advice. The Website should not be relied upon as a substitute for extensive independent market research before making your actual trading decisions. Opinions, market data, recommendations or any other content is subject to change at any time without notice. ForexTraders will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox