Wednesday the 30th of December

If only markets were always like this. With major players taking a break from their desks, there has been just enough liquidity for markets to provide a showcase of price moves.

Predictions such as this one made by the Forex Fraud team don’t always come good. Knowing that is one of the critical parts of successful trading. Making a profit is not about being right all the time, or exactly right some of the time. It’s about managing risk and expectations and accepting but managing your mistakes.

The FTSE 100 Bull-trap is Sprung

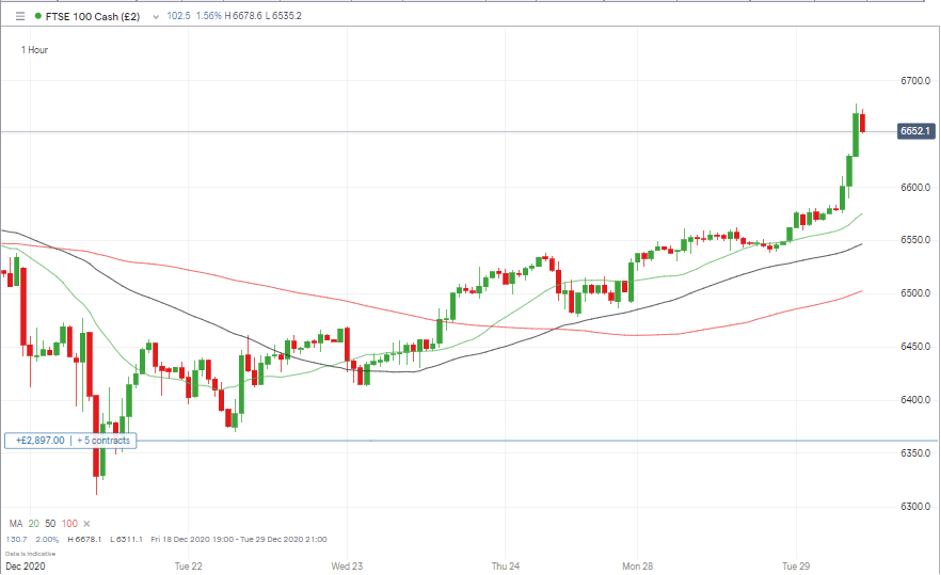

The FTSE 100 bull-trap of Tuesday came into effect within a couple of hours of that day’s opening bell.

Price surged on the back of a Brexit deal being signed and the ‘January Effect’ has been coming into the conversation. Not forgetting the ‘Santa Rally’ which provided some mystical and fact-based support as well.

Then the overexuberance got called out and the price of the FTSE 100 fell back to 6572 before recovering to 6610 in the middle of the European session.

Source: IG

All hope is not lost for those who bought in around 6650 but holding positions might be more down to hope rather than expectation.

Source: IG

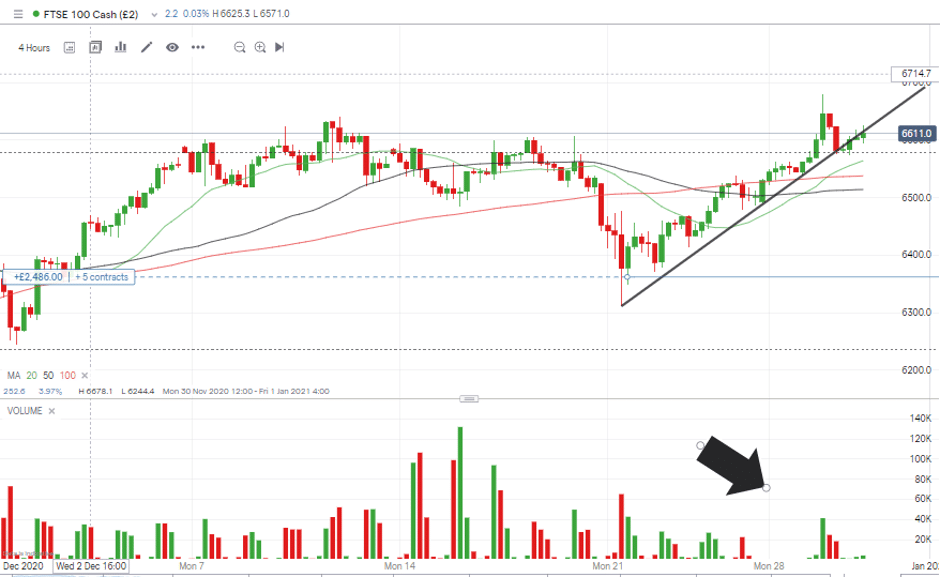

- Trading volumes remain very thin and it’s unlikely that any sizeable short positions will be put on over the holiday period.

- Price is also just holding onto the supporting trend line shown on the 4hr price chart.

FTSE 100 Risk to the Downside?

There is potential for further losses. A pressing concern is that the trading week is shortened by the upcoming New Year holiday. No one likes having time pressure added to the fact that a position is underwater.

- A cleaner break of that supporting trend line could see price head to 6500

- Not only is 6500 a ‘big number’ and psychologically important

- 6494 marks the level of the 50% Fibonacci retracement of the rally which started on 21st December

Quiet markets are an excellent time to study and learn; the absence of noise can make it easier to identify trade entry and exit points.

Now is a good time to provide a timely reminder that no one in the Forex Fraud team has positions open over the Christmas break. The safer option has been to trade the moves using a Demo account and to get a feel for the market.

Half the team are sticking with their original analysis of Tuesday. This raised the possibility of a pull-back to the 6570-78 level which would form an entry point for going long. While price hasn’t kicked on as expected the fact that the 24-hour low of 6572 is bang in the middle of the entry point range there might be something in that Fib-based analysis.

Scenario 1

“A pull-back to 6,570–6,578 would allow the Hourly 20 SMA to catch up with price. It would also form price revisiting the 61.8% Fib, which provided such resistance earlier in the year.”

Source: Forex Fraud

We could, though, be about to see a ‘battle of the Fibs’ with 6494 coming into play for those with a more bearish take on the situation.

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox