Markets are taking a fairly standard approach to the interval between the Christmas and New Year holidays. With bears lacking any conviction, it’s the bulls who have control of the markets. Risk is being added to trading books, but occasional pull-backs will prove troublesome for shorter-term traders.

For many who are not already in positions, it will be a case of concentrating on keeping their discipline and patience levels high. There is definitely a sense that it’s too late to buy but also too early to sell.

It’s also worth remembering that although all the signals are pointing in the same direction, the recent price moves are based on low trading volumes and gaps caused by exchanges being closed for several days.

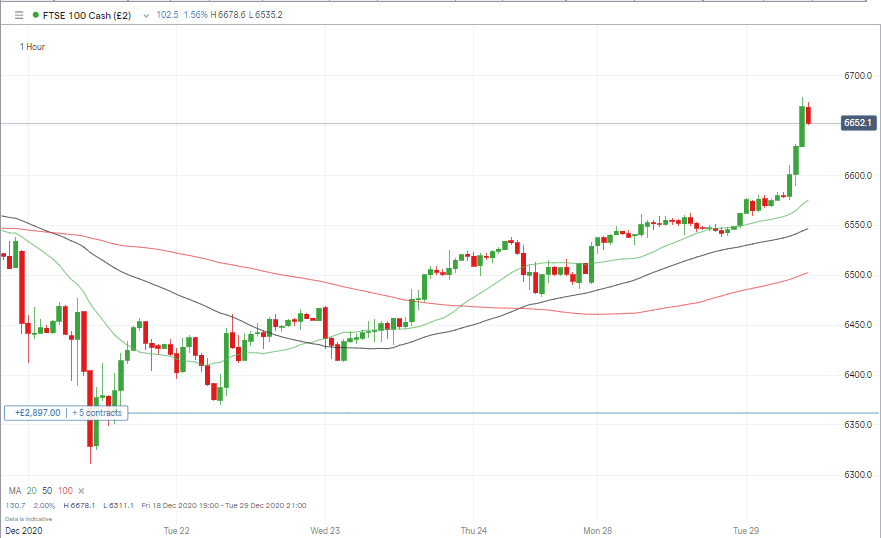

FTSE 100

The benchmark UK equity index continues to build on gains founded on the UK and EU negotiating a trade deal on the 24th of December.

Source: IG

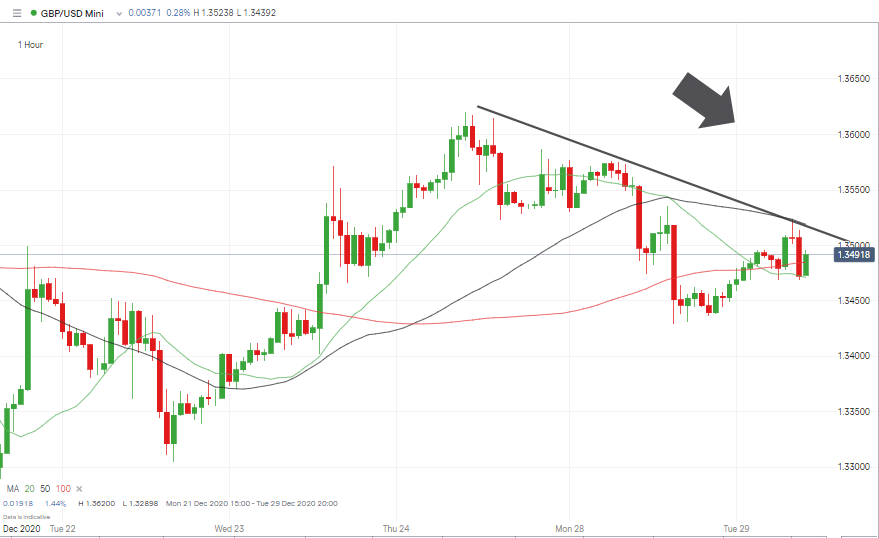

With many firms in the index being multi-nationals that generate profits overseas, the stalling of GBPUSD has offered another kicker. Early trading on Tuesday saw the index up by as much as 1.70%.

Source: IG

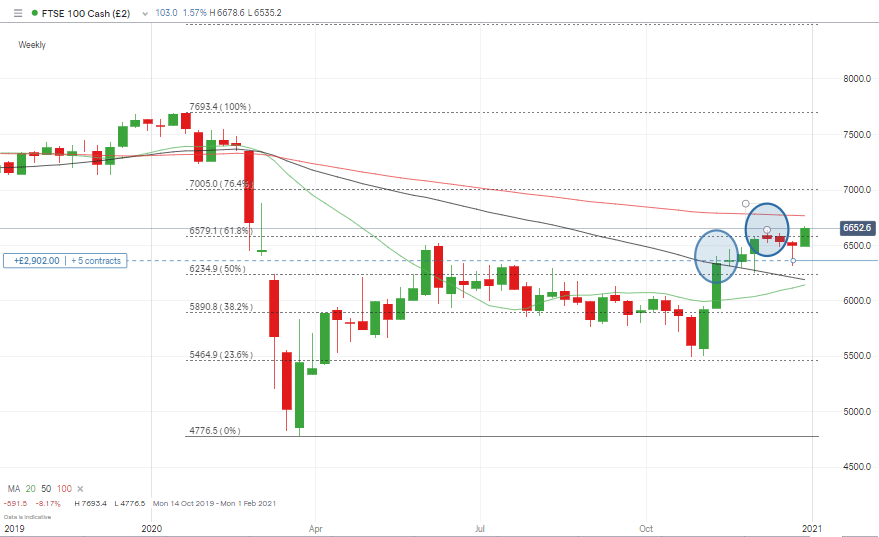

Fibonacci retracements have been reliable indicators of price moves in the FTSE 100. The Weekly price chart shows the 50% and 61.8% Fibs offering resistance at 6,235 between May and July and 6,570 earlier in December. A surge in buying activity over the last week has broken the 61.8% resistance.

Source: IG

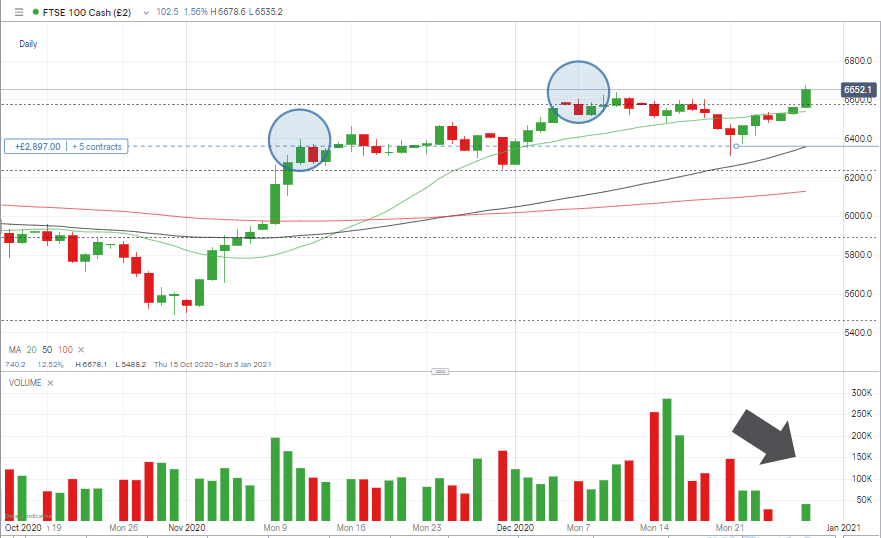

Trading Volumes

The amounts of shares changing hands will remain a concern for those who went long. The histogram of volume traded on the Daily chart shows the expected seasonal fall away in trading activity has indeed taken place.

Source: IG

Scenario 1

A pull-back to 6,570–6,578 would allow the Hourly 20 SMA to catch up with price. It would also form price revisiting the 61.8% Fib, which provided such resistance earlier in the year. Price does like to revisit earlier resistance levels to confirm them as support. A subsequent kick on from that level would not be surprising.

That entry point, though, requires a lot of patience. With price trading at the 6,645 level, halfway through the morning session in European exchanges, it doesn’t look certain that price will retrace to that extent.

Scenario 2

With the odds stacked against the entry-level of 6,578 coming into play, the far riskier trade is catching a smaller retracement. The 12-month high of 7,693 is some way above current price levels and a move up to that level would represent a 15% appreciation in value.

The potential bull-trap for any over-eager trader is price sliding further. With another extended holiday weekend looming, the safer option would be to trade in a demo account.

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox