US stock indices posted record all-time highs last week as investors found enough good news in corporate earnings announcements to drive prices upwards. That feel-good mood has continued into the start of the current week, with futures on the Nasdaq, Dow Jones, and S&P 500 indices all in positive territory soon after the opening of European exchanges. How long that lasts is a valid question to ask, particularly as one of the major news events of the new month is due out on Wednesday the 3rd of November.

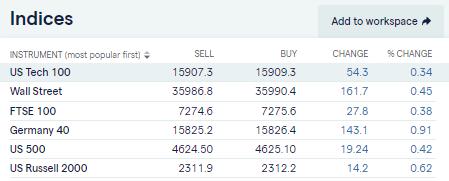

Global Stock Indices – 10 am (UTC) 1st November

Source: IG

Markets are expecting the US Federal Reserve’s FOMC meeting, which takes place on Wednesday, to provide a significant steer on the markets. US stocks often have a buoyant run-up to the end of the year, and some of last week’s buying pressure could be investors positioning themselves for a strong Q4. However, the Fed’s policy statement is an easily identifiable potential banana skin.

Nasdaq 100 Index – Daily Candles June – Nov 2021

Source: IG

FOMC & Tapering

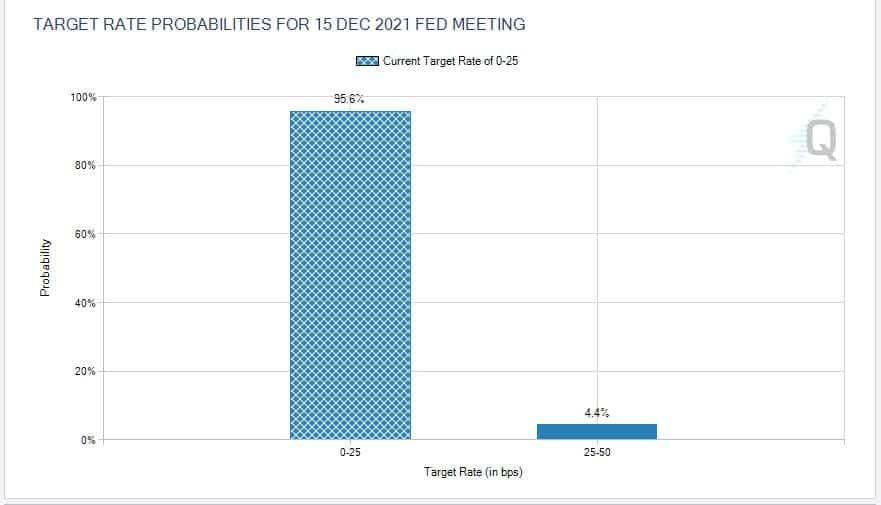

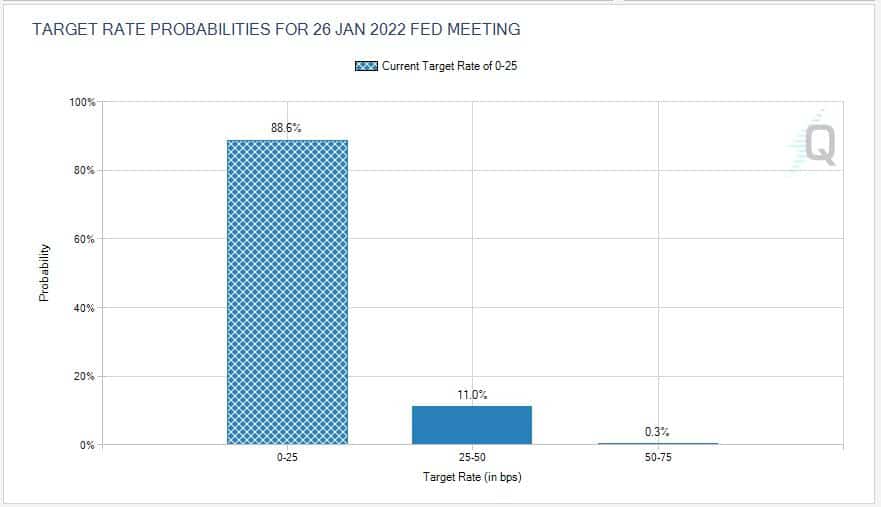

According to the CME Fedwatch Tool, the chances of an interest rate rise on Wednesday are currently priced at 0%. This represents an interesting degree of certainty being shown by the markets, particularly as the same monitor reports an 11% probability of a rate increase in December and a 0.3% chance that interest rates might be 50 basis points higher after the Fed’s meeting in January.

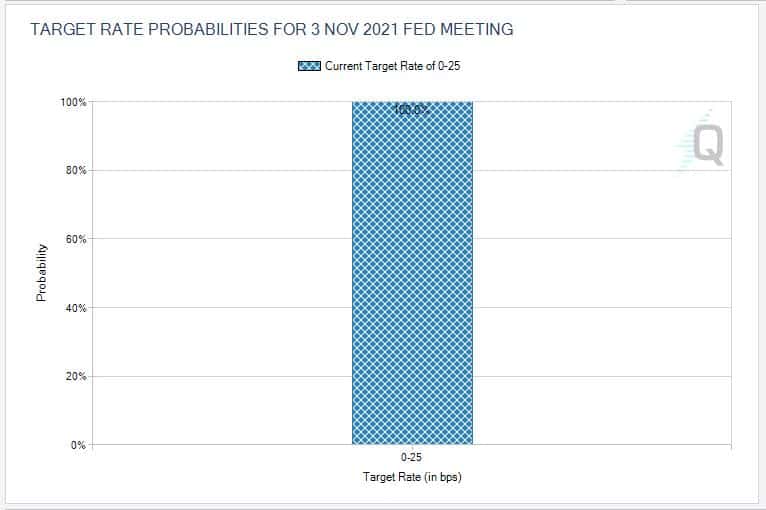

CME Fedwatch Tool – November

Source: CME Fedwatch

CME Fedwatch Tool – December

Source: CME Fedwatch

CME Fedwatch Tool – January

Source: CME Fedwatch

Rate rises might be around the corner, but this Wednesday’s meeting will be all about Fed Chair, Jerome Powell, sharing further information on the much talked about ‘tapering’ of monetary policy.

The starting point of the current analysis is the minutes from the last FOMC meeting in September when officials announced: “The labor market had continued to show improvement since the Committee’s previous meeting,” and with FOMC members drawing the conclusion that “provided that the economic recovery remained broadly on track, a gradual tapering process that concluded around the middle of next year would likely be appropriate.”

Economic data in recent weeks has been mixed, but inflationary pressures appear to be easing. If Jerome Powell’s call that signs of serious inflationary pressures are only “transient” comes good, the Fed could keep the cheap money taps running for longer than previously expected. That extra liquidity would be expected to help a sluggish jobs market. It would have to find a home somewhere, with the most likely destination being the equity markets rather than the other markets that have been picked as good places to invest in times of inflation.

Crowdsourcing information about scam brokers can help others avoid falling into the traps set by disreputable brokers and you can share your experiences here. If you want to know more about this particular topic, or have been scammed by a fraudulent broker, you can also contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox