A range of asset prices demonstrates that investors are factoring in a shift towards a new inflationary environment. It’s the big theme running through the markets, and the question is how do investors position themselves for the change in mood? It appears to be a case of when, rather than if, and commodities may be part of the answer.

Move to an Inflationary Environment Has Started

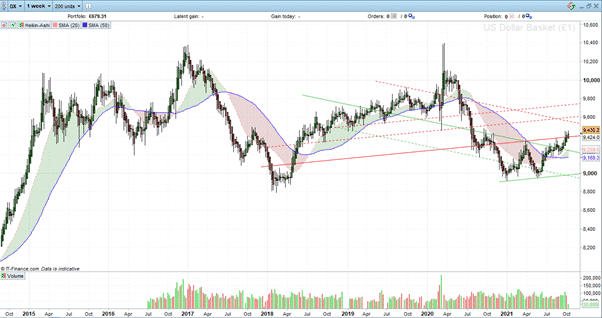

The US dollar basket index, which matches the greenback against the world’s largest free-floating currencies, is pushing on with a multi-month double-bottom breakout. The DXY Basket index chart shows there’s even a claim for the move being based on a triple-bottom pattern – if you factor in the low of 87.86 in February 2018.

Source: IG

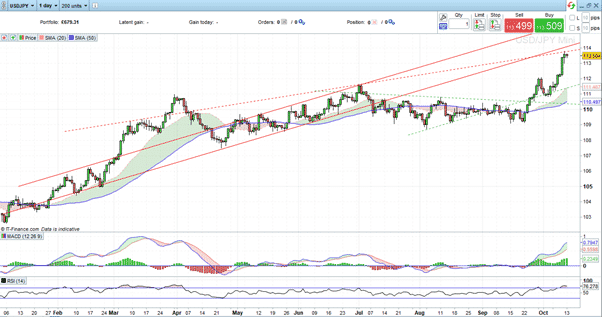

Source: IG

On Monday, the usually low volatility USDJPY currency pair posted an out of character +1% swing in value in favour of the dollar

Source: IG

Growth stocks in the Nasdaq continue to shed support and value as the threat of higher interest rates leads many investors to take a different view of their sky-high valuations. Market titan, Apple Inc, was down 1.2% in after-hours trading on Tuesday. Reports of a chip shortage impacting production capacity were credited as the catalyst. However, there are a lot of slow-burn factors, most of them relating to inflation, which could also be credited with causing the move.

Source: IG

Two traditional methods of riding out inflation and a high-interest rate environment are banks and commodities. The banking sector traditionally outperforms when base rates are higher because the bid-offer spread and margins on their products get squeezed when interest rates are near zero. If they offer unfavourable interest rates to savers, account holders are as likely to stuff cash under their mattress as hold it at a bank.

Financial firms could be months or years from feeling the benefits of the change in the underlying macro trend. Rate hikes are on the cards but might not gain traction until next year and will only move incrementally. The market which looks more likely to respond sooner rather than later is commodities.

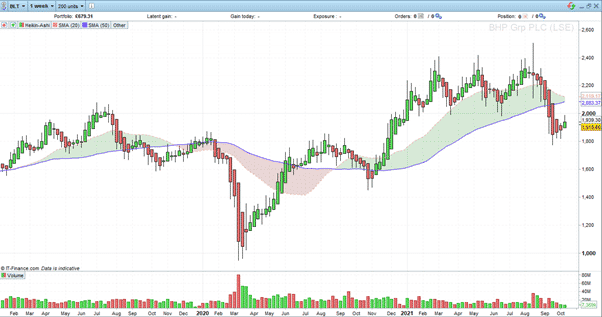

Holding physical assets, or shares in the firms that dig them out of the ground, such as listed iron ore and copper miners like BHP, is one way to hedge against price rises. Like most other stocks, the mining sector firms rebounded from the March 2020 lows, but they’ve since posted a significant pullback that will interest dip-buyers.

Source: IG

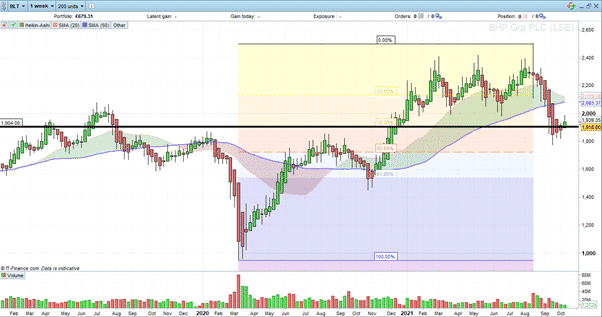

BHP’s year to date high of £25.04 on the 16th of August and the subsequent pullback to the 38.20% Fib retracement level will be catching the eye of those adopting momentum trading strategies. The Fib level offers support, and buyers can take comfort from the stock continuing to print those much-loved higher highs and higher lows.

Source: IG

There is resistance in the region of £20.00. That could be down to it being a ‘big number’, but as the stock is dual listed, there is a need to consider other factors as well. But £20.00 appears an appropriate first price target, and a stop below the previous swing-low of £14.50 of October 2020 offers a cap on downside risk.

Crowdsourcing information about scam brokers can help others avoid falling into the traps set by disreputable brokers and you can share your experiences here. If you want to know more about this particular topic, or have been scammed by a fraudulent broker, you can also contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox