Market jitters have left many reconsidering their risk appetite. Nothing is ever certain; however, given the evident temptation to buy the dips, there are some obvious places to look for clues indicating whether that time is now.

Equity markets have started the week underwater. At the open in London, the FTSE 100 was 0.50% lower than Friday’s closing prices. News reports over the weekend pointed towards political events that might slow down the roll-out of Covid-19 vaccinations in the EU and UK. Stalling the return to regular economic activity by up to three-months would be wounding. It would also hint at a gloomier political climate for years to come.

More information on the EU’s approach will be released on Thursday when EU leaders hold a virtual summit. Until then, support for the idea that this might be an opportunity to buy the dips can be found on the other side of the Atlantic in the soothing words of US Fed Chair Jerome Powell.

Powell’s statement, which was delivered last Wednesday, stated that interest rate hikes in the US currently look unlikely until 2013. Instead, policy measures will focus on boosting the sectors of the economy that are still struggling rather than reigning in those that are over-heating.

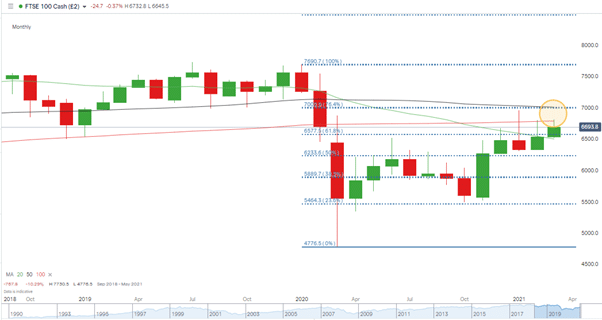

FTSE 100 – Monthly Candles – Fib Retracement and 100 SMA

Source: IG

Could this be the time to buy the FTSE 100?

The FTSE 100 has lagged the S&P 500 and Nasdaq 100 indices over the last 12 months due to the US versions holding far more tech stocks which look likely to benefit from the ‘new normal’. There was news on Monday that the London benchmark may be becoming more tech-friendly. Food delivery service firm Deliveroo confirmed its IPO on the London Stock Exchange will be within a price range of £3.90 – £4.60 per share. Some will baulk at the valuation, especially considering the firm is yet to turn a profit, but the London market has been desperate for more listings of stocks with a higher risk-return profile.

The FTSE’s monthly chart has a 76.4% Fib retracement at 7002, some 300+ points higher than current price levels. The monthly 50 SMA also sits in that region at 7012.

The 100 month SMA (currently at 6791) has been a significant barrier to upward moves. Each of the last three monthly candles shows price breaking higher than the 100 SMA to only retreat by month-end forming a bearish gravestone candle.

Follow the Dollar

As ever, the US dollar is the pivot for other financial markets. Forex Traders analysis of USDJPY last week highlighted the rising wedge pattern in the currency that is an effective barometer of global investor mood.

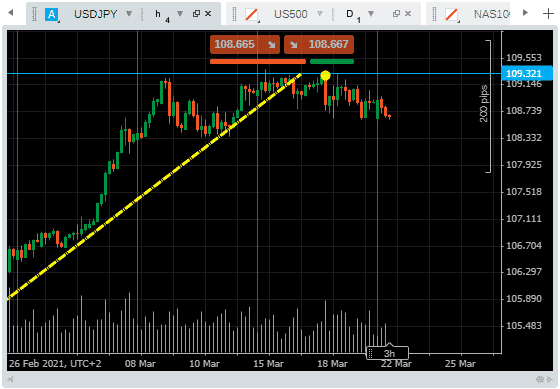

USDJPY – 4h Price Chart – Breakout of Rising Wedge Pattern

Source: Pepperstone

It looks like the bulls are winning that particular battle with price breaking to the downside. It’s a slow-motion move, but that’s often the way with that currency pair. Don’t be fooled by the gradual nature of the shift as the more significant point is that price action looks unwilling to test the 109.55 resistance, let alone break it.

If you want to know more about this topic or have been scammed by a fraudulent broker, please contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox