Set to pick up pace this week is the flow of news feeding into the markets. Major data releases relating to Q4 are due and they will, in many cases, allow for year-end stats for 2020 to be confirmed. The final reporting in black and white on a tumultuous year may bring home quite how damaging the impact of Covid-19 has been.

The anticipation of upcoming news might explain the quiet start to the trading week. With many significant pointers due over the next five days, European indices and major forex pairs are unchanged in early trading.

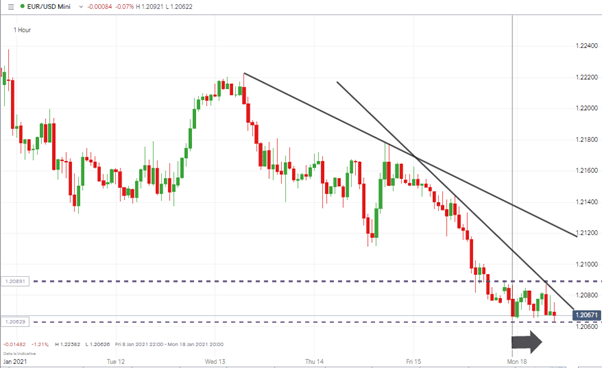

EURUSD

Euro-dollar has failed to break out of its 1.20829 – 1.20839 range. Price may be forced to commit one way or the other as it approaches two (increasingly steep) resistance trend lines.

Source: IG

For EURUSD 1.21 is becoming a key level. As long as price remains below that number, there is room for downside movement with 1.2060 successfully marking itself as the first support level and 1.2040 offering the second price target for those selling the euro.

Major Data releases Week 3

Monday

China Q4 / Annual GDP Growth Rate

Tuesday

Germany ZEW Economic Sentiment Index

US Red Book

Wednesday

The UK – Inflation report, CPI, PPI and RPI

Bank of Canada – Interest rates decision

Thursday – EU – ECB interest rate decision and consumer confidence report

Friday – UK, Germany, France, EU manufacturing and services PMI Flash reports

Week 4 – The US Federal Reserve’s meeting on the 26 – 27th January will overshadow all of the above. Last week, this research from the Forex Fraud analysts picked up that early ‘leaks’ to the press have already begun.

USD Basket

Increasing attention is being given to the USD Basket index, which measures the greenback’s health against the other G7 currencies.

The long-term downward trend has been in place since April 2020 but technical indicators are pointing towards that trend coming to the ‘bend in the end’. While other asset groups are flatlining, USD is rallying, suggesting the broader market could be entering a risk-off phase.

Source: IG

The break of the dotted trend line followed a rush into riskier asset groups at the start of the year. Some kind of reaction to that euphoria was expected but while USD has continued to strengthen, the riskier assets have only given up a relatively small amount of value.

Bulls may be factoring in that USD is still capped by the 50 and 100 SMA and the solid trend line, but the RSI indicates further strength in USD which could cause riskier sectors to suffer a pull-back.

Bitcoin

One interesting statistic which puts the current situation into context is the sudden crash in Bitcoin volatility. The crypto has recently been exceeding its high standards in terms of providing its owners with a roller coaster ride. There is still movement, but the opening price on Monday the 11th was 35,444 and on the 18th of January it was 35,848. That 1.13% change in value on a week-to-week basis being smaller than moves over the same period on the FTSE100 and US500 equity indices.

If you want to know more about this topic or have been scammed by a fraudulent broker, please contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox