The financial markets surged in value during the first week of 2021 with benchmark indices in riskier asset groups posting eye-watering returns.

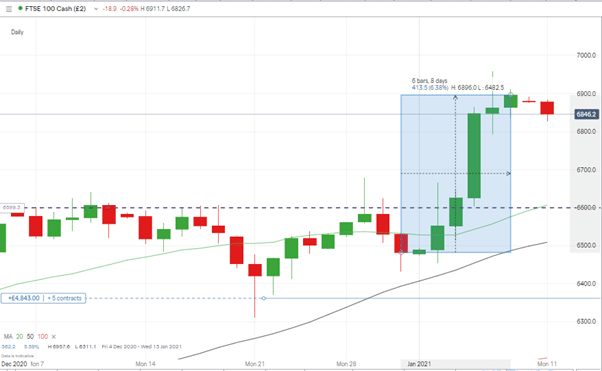

The UK’s FTSE 100 equity index posted a return of 6.38%. With risk-free returns associated with cash in UK savings accounts offering minimal returns the benchmark index in equities trounced annualised risk-free returns in one week.

FTSE 100 Index – Daily chart

Source: IG

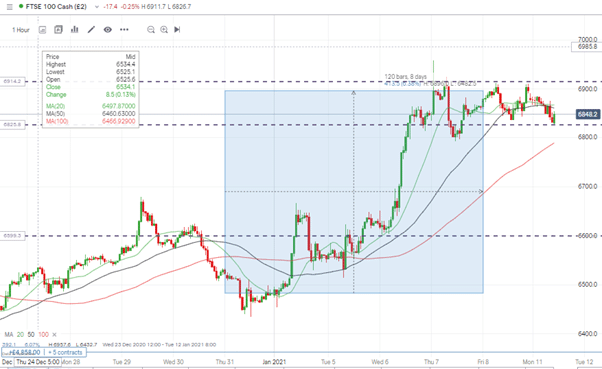

The hourly chart shows price action now trending sideways. Covid infection rates may be climbing to dangerously high levels but equity valuations are based on future earnings. The markets are betting big that the rollout of vaccines means global economies will look very different in 9-12 months-time.

FTSE 100 Index – Hourly chart

Source: IG

For some, the immediate future will involve scalping strategies. The path of least resistance appears to point upwards. While there is some risk of a pull-back, stop loss management could help mitigate the risk of any serious move to the downside.

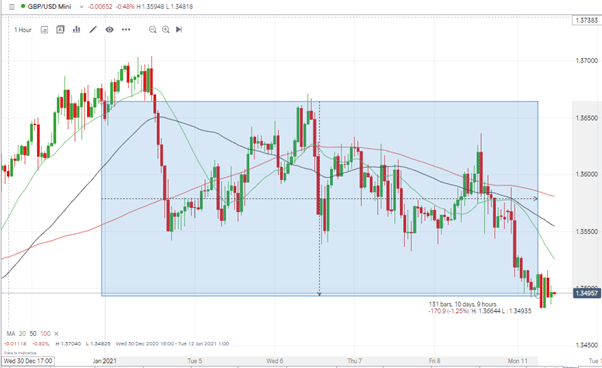

GBPUSD

Equity analysts may be wondering whether the vaccine rollout or infection rates are about to win the race, so they may want to look to other markets for ideas on where equity prices are heading. A key determinant of the prices of large-cap UK equities will be the relative strength of the pound.

Disruption associated with the UK-EU transition to Brexit has been localised and short term. Instead of rallying on the back of a smooth transition, GBPUSD has fallen in value by more than 1.25% since the end of the year.

GBPUSD – Hourly chart

Source: IG

This counter-intuitive move forms a timely reminder that the USD part of that contract is the primary driver of prices and USD could finally be beginning to come out of its months’ long decline. The Forex Fraud analysts raised this possibility in their report of last week.

USD Basket – Hourly chart & RSI

Source: IG

The next update from the US Federal Reserve on interest rate policy is due on 26th – 27th January. That is now looking like a critical date for the diary. Newswires are offering updates on the last days of the Trump regime and are focussing on political point-scoring. Those with cash at play in the markets would do well to look through that and towards the Fed’s announcements.

Investing vs Speculating

The first week of 2021 will go down as a good one for investors. Those who took positions looking to catch the ‘January Effect’ will be sitting on handsome returns. Those looking to implement short-term strategies may have missed the move and might do well to resist the urge to pile in. FOMO can be a trader’s worst enemy and the year has only just begun.

At the end of the month, the Fed’s meeting can be expected to throw up enough surprises and trading opportunities. For those who can’t resist trading the tail-end of last week’s move, then opening a Demo account might for now be the safer option. Selecting a safe broker is key to protecting your capital, but knowing when not to trade forms the second step towards being a profitable trader.

If you would like to know more about this topic or have been scammed by a fraudulent broker, please contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2024

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex & CFD Broker |

Best Trading Conditions

Visit broker

|

||

| #2 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #3 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #4 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

Global CFD & FX Broker |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #7 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #8 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox