Jerome Powell has now been Chair of the US Fed for more than three years, but his statement to the markets due on Wednesday is becoming the most eagerly awaited of his tenure. It’s a high stakes situation with big investors worldwide ready to analyse his every word for clues about whether to buy or sell in size.

Markets are currently pricing in that Powell will once more demonstrate an ability to say just enough, but not too much. Since the early days of his Chairmanship, he’s shown an ability to say what the markets want to hear. While Wednesday’s statement is building up to be the major news event of the month, there is palpable relief that a seasoned campaigner is at the helm.

Markets Pricing in Good News

The trading week has seen an exuberance return to the global equity markets. US stock markets rallied into the close on Monday, a move followed by Asia. Soon after the open on Tuesday, European indices were also in positive territory and positing intraday gains: FTSE 100 + 0.57% and DAX 30 + 0.34%.

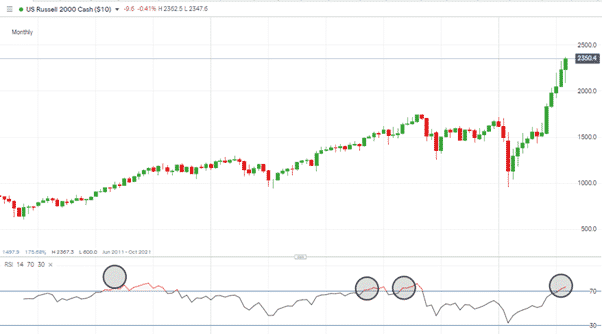

Will the Russell 2000 Continue its Eye-Watering Climb?

The Russell 2000, which is made up of small-cap US firms, is widely regarded as a bellwether of the US economy as a whole. Its membership is largely made up of smaller companies that focus on the US market, and that index on Monday posted an intra-day record high of 2367.

Russell 2000 index – Monthly Candles

Source: IG

The highs seen in the US highlight a growing feeling of optimism that there will be a dramatic economic resurgence, mainly thanks to massive stimulus and reopening plans. The gradient of the price climb since November 2020 will be attracting and repulsing investors in equal measure. The index, which is more ‘Main Street’ rather than ‘Wall Street’, looks like it’s subject to significant interest from speculators.

Russell 2000 – RSI an unreliable indicator on long-term charts

The Monthly RSI is greater than 70. Since 2013 there have been three other occasions when that level was breached and in only one of them did the market subsequently sell off.

Russell 2000 index – Monthly Candles RSI > 70 April 2018 and price correction November 2018

Source: IG

The price moves already seen in the build up to Wednesday’s announcements have been dramatic enough, but Powell’s actions are still likely to move markets later this week, no matter how hard he tries not to do so.

With the surge in interest rates and a rebounding economy, the Fed’s easy-money policies are under scrutiny. A recent surge in bond yields means the light at the end of the tunnel looks very much like an inflationary train. The question is, how will the record-breaking amounts of liquidity be withdrawn from the markets, and when?

During the press briefing, look out for Powell’s answers on the subject of the Fed’s low-interest-rate policies and asset purchasing programme.

The Russell 2000 may escape the worst of the fallout, but Nasdaq and growth stocks could be hit if bond yield rises are forecast.

If you want to know more about this topic, or have been scammed by a fraudulent broker, please contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox