The Reddit chat group-inspired events of January – when Main Street took on Wall Street over GameStop – brought an astonishing new twist to the financial markets. Hedge funds nursed million-dollar losses because of the retail-investor short squeeze; brokers closed markets to ‘protect’ retail investors; and the man who started it all faced criminal charges for carrying out fundamental analysis to support his stock-picking.

The likely chance of web-based group buying returning to the markets left many monitoring Reddit chat rooms for news of the next big thing. The surprise was possibly that it took several months for that research to come good. WallStreetBets have bided their time but have recently revealed their next targets. If the closing down of platforms reminded traders of The Empire Strikes Back, then recent events in US stock AMC represent A New Hope.

Source: eToro

Ape Army

The self-named Ape Army of AMC buyers have pushed the stock to a four-year high and over the course of last week pushed the price up 114%. The closing price on Friday of $26.12 marked a slight pull back in momentum as the weekend loomed, but at one point earlier in the day the stock was showing a week-to-date price hike of 185%.

Diamond Hands

It will be interesting to see if the Diamond Hands traders manage to hold onto their positions – many will be bracing themselves to do just that, but the GME story did ultimately result in many getting burned. There will also be questions raised if broker platforms such as Robin Hood and IG once again limit buying activity. So far, the momentum is with the crowd, and research firm ORTEX estimated that short-sellers of meme stocks lost $2.76bn last week.

The Next Reddit Big Thing

Filtering the content on Reddit requires a degree of dedication. As mentioned, the lull between January’s events and those of last week points to some of the stories being slow-burners. The below names have followed AMC and burst out of the chat groups and onto the price charts.

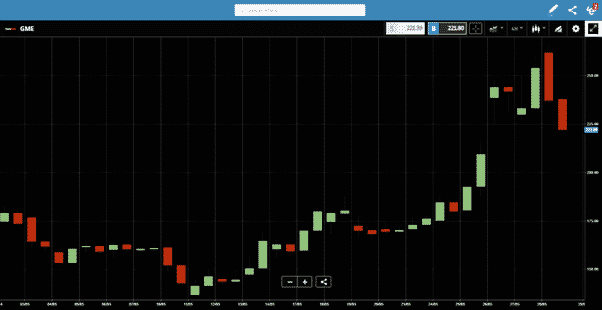

GameStop – GME

GameStop is back. Rumours of a crypto dividend and merger are catnip to Reddit users, and the stock finished the week up 27%. The closing price of $222 is still some way below the year-to-date high of $350. Like AMC, it experienced a slight pull back.

Source: eToro

Virgin Galactic – SPCE

Some of the frenzy in GME and AMC has spilled over into Virgin Galactic Holdings, Inc. The commercial space flight operator saw its shares skyrocket by 50% last week. Some of the impetus was based on the firm successfully completing its third manned flight. The rest was ‘to the moon’ enthusiasm from retail investors who anticipate another short-squeeze. Betting against the prospects of commercial space travel might appear a justifiable proposition, but however illogical the recent price surge is, the market is always right. Interestingly, Virgin stock didn’t suffer the same amount of pull back late in Friday’s session, so its open on Tuesday will be much anticipated.

Source: eToro

If you want to know more about this topic or have been scammed by a fraudulent broker, please contact us at [email protected]

Are you ready to trade?

Sign up with 76% of CFD traders lose money

76% of CFD traders lose money

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2024

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex & CFD Broker |

Best Trading Conditions

Visit broker

|

||

| #2 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #3 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #4 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

Global CFD & FX Broker |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #7 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #8 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox