Elon Musk just said what everyone’s thinking and claimed that in the heat of the battle, Robin Hood CEO Vlad Tenev sold out the broker’s own clients. Tenev has branded Musk’s comments a “conspiracy theory” but it looks like Musk could have lifted the lid on some shady goings-on.

Every-day Joe’s who used Robin Hood to trade hot-stocks like GameStop and make eye-watering profits, left Robin Hood short of cash. CEO Tenev’s only option to make the payments was to draw down extra funds from the broker’s backers, who just so happen to be the Wall Street establishment. Funny then that at the same time as receiving the cash, the broker threw the rule book in the bin and stopped its clients betting against the big guys.

Monday 1st February

The remarkable events surrounding GameStop and Reddit are continuing to dominate the markets but it’s not just the incredible stock price moves which are demanding attention.

The bigger picture is that the dramatic consequences of last week’s activity run much deeper; the genie is out of the bottle.

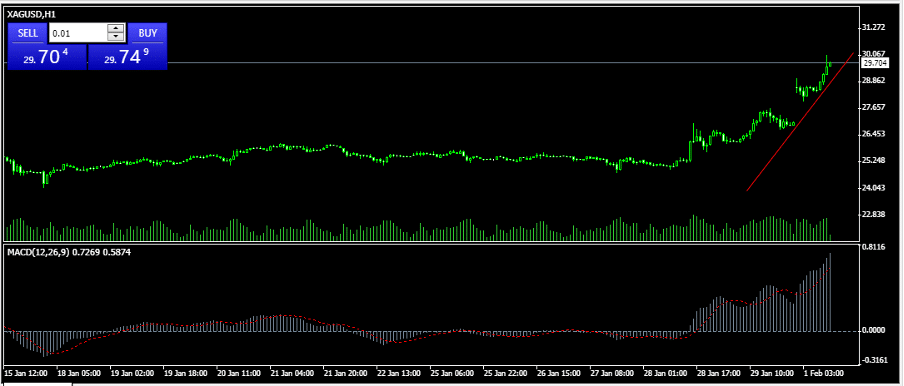

Silver – 1 Hour Price Chart

Source: Pepperstone

As retail investors have swarmed over the financial markets, many have found their broker not willing or able to support their trading activity. US broker Robin Hood has seen hoards of clients close accounts and set up elsewhere. The excitement in the market can after all, only be converted to hard cash if you can get a trade on.

What Happened at Robin Hood?

Until last week the Robin Hood platform had been a darling of the trading community. It’s estimated that the broker onboarded 15m new clients in the first nine-months of 2020. Its user-friendly functionality was claimed by some to be borderline gamification but in terms of user numbers it was an approach which certainly worked.

When GameStop rose in price in January by more than 700% Robin Hood was responsible for supporting a large amount of that buying activity. Disdain from the more established players in the market was followed by an announcement on Thursday that the platform had suspend buying activity in hot-stocks including GameStop and AMC.

The losses for many traders were considerable but the reputational damage done to Robin Hood may be even greater. Many felt their broker had let them down, as a class action lawsuit filed against Robin Hood claims.

“Robinhood’s actions were done purposefully and knowingly to manipulate the market for the benefit of people and financial institutions who were not Robinhood’s customers,”

Where Can Retail Investors Open Accounts?

The continuing battle between Wall Street and Main Street is causing prices in some markets to whipsaw. These are of course trading opportunities, but as this report by the Forex Fraud analysts pointed out last week, increased volatility levels look likely to hold for some time.

To put it another way – there is no need to panic and open an account with a poor broker. In fact, choosing a scam broker could see you lose your initial stake and any paper profits you might make.

It’s a crazy market out there but the fundamental principles relating to broker choice remain.

- Always use a well-regulated broker

- Use a broker which has a good track record

- Use a broker which covers the markets you want to trade.

Source: Tickmill

This list of regulated, legit brokers outlines the names of safe brokers which would be worthy of any selection short-list. Forex Fraud have carried out in-depth reviews of those brokers to ensure they are safe.

Price may well move in those minutes you spend doing due diligence, but it could even go in your favour. On the other hand, the risk associated with opening an account with a fraudulent broker is just too great.

What Market Are WallStreetBets Targeting Now?

Rumours are that the Reddit / WallStreetbets forum is turning its attention to Silver and the price rise in the metal seen on Monday suggest this could be the case.

Whilst the broker selection process ought to be well-thought out, if you are looking for a short-list of safe brokers which supports trading silver then here are three:

- Tickmill – Regulated by FCA, CySEC, FSA and SC – Follow this link to be sure to head to the legitimate site.

- FXTM – Regulated by FCS, CySEC, FSA – Follow this link to be sure to head to the legitimate site.

- Pepperstone – Regulated by FCA and ASIC – Follow this link to be sure to head to the legitimate site.

If you want to know more about this topic, or have been scammed by a fraudulent broker, please contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox