Recent market events are a timely lesson on how to develop a trading mentality. Successful trading can often be more about avoiding losses rather than making profits. It also requires keeping an eye on the calendar and avoiding potential pitfalls.

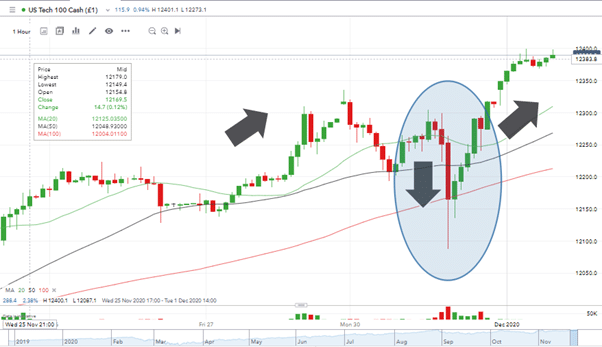

Last week’s mini-rally and subsequent sell-off in riskier assets on Monday coincided with the US Thanksgiving holiday. The flip-flopping was one of those events which could be seen as relatively predictable.

Source: IG

Last Wednesday, when considering how to approach Thursday’s national holiday in the US, the Forex Fraud analysts flagged up one likely scenario in this article.

“It might be early next week before confirmation … is given. Any moves in Asia and Europe on Thursday and Friday could very possibly be false signals. It wouldn’t be the first time those markets started a movement which was reversed when the big players in the US step back into the market after a break.”

The old hands in the market have seen it all before.

As the price charts show, the major equity indices rallied into the end of last week. Taking advantage of low trading volumes due to the US break, prices drifted up – “Whilst the cat’s away the mice will play.”

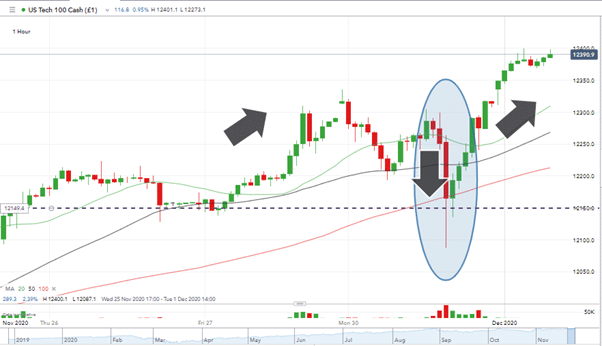

Then on Monday, as represented by the long red candle in the below chart, in the opening hour of US trading, the Nasdaq 100 fell by 1.44%.

Source: IG

This show of strength from US traders took prices as low as 12087. It would have cleared out any Asian and European traders who had set stop losses anywhere near the 12169 closing price of Wednesday, the last day’s trading before the US holiday started.

By breaking through the dotted-line, the US markets exerted their authority before then buying back in. The Nasdaq was by the close of the US session up 1.90% from its intra-day low. Such moves require significant amounts of money to be pouring in and out of the market.

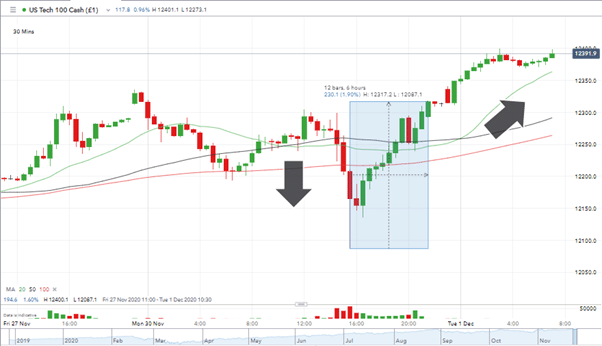

Source: IG

Anyone riding the rising market with a tight stop loss could well have seen their gains over two or three days wiped out. Nursing a loss rather than enjoying the benefits of holding long positions near the 12400 level they are thinking about what might have been.

Crucial lessons

The balance of power might be gradually shifting towards Asia, but while the US, the last market of the day to trade is dominant, that fact needs to be respected. Countless times, Asian momentum is supported by the European markets only to get slammed down by the US.

No-one knows for sure which way the market is going to go, but you can preserve your capital if you heed the marked signposts. This is going to be crucial through December with year-end and an extended Christmas holiday season approaching.

There is some value to be gained from noting the events of the last few days. It’s happened before and it can happen again.

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox