The Thanksgiving holiday is here. Given the pivotal role the US economy plays in the world’s financial markets, it can be expected that traders across the globe will take their foot off the gas for a couple of days.

How to Trade Safely During the Holiday

Safer trading involves trading the market as it is rather than how you would like it to be. That is particularly important in 2020 with months of roller-coaster activity coming to an abrupt halt.

There will be some who look to scalp trade the rudderless markets of Thursday and Friday. Momentum traders are likely to have to wait a couple of days for signs of the next break-out trade.

As Business leaders from Wall Street, West Coast private equity houses and Main Street USA start their four-day break, there will be many around the world deciding to join them and sit on their hands. Idle hands and boredom trades can be a sure-fire way to lose money.

Clues from Events Earlier in the Week

The inactivity after a whirlwind November also provides an opportunity for traders and investors to reassess their positions and strategies. A scan of market moves from earlier in the week offers some clues as what to expect on Monday.

When Will the Rotation into Value Stocks End?

The big story of the last two weeks has been a rotation from growth stocks to value ones. That is best exemplified by a surge in demand for pharma and hygiene names such as Pfizer (NYSE: PFE) and Johnson & Johnson (NYSE: JNJ). At the same time, the Nasdaq fell 7% on the news of a COVID Vaccine being confirmed.

The vaccine inspired shift away from COVID-friendly tech stocks showed signs of slowing on Wednesday. In the opening hour, of the last ‘shopping day’ for US equity traders before the holiday, a reversal took place.

Tech is Back!

The opening hour of trading on any exchange is usually the most interesting; Wall Street on Wednesday didn’t disappoint.

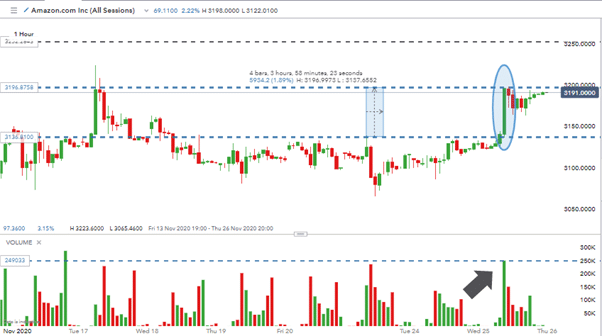

Amazon, one of the winners from the pandemic rose almost 2% in the first hour of the session. That move also involved breaking through a significant resistance level at $3135 which had been suppressing the stock for more than a week.

Not only was there a big green hourly price candle, but there was also an uptick in volume. That hour of trading saw volumes put through at levels not seen since mid-November.

Source: IG

Compare that price move to that of Johnson & Johnson. In the same hour, the hygiene firm saw its hourly candle turn red. The volume traded also fell off.

Is J&J performing more in line with expectations in the run-up to Thanksgiving? Is it disinterest or signs of a more significant rotational shift, out of value and into growth?

Source: IG

It might be early next week before confirmation of that is given. Any moves in Asia and Europe on Thursday and Friday could very possibly be false signals. It wouldn’t be the first time those markets started a movement which was reversed when the big players in the US step back into the market after a break.

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2024

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex & CFD Broker |

Best Trading Conditions

Visit broker

|

||

| #2 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #3 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #4 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

Global CFD & FX Broker |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #7 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #8 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox