Wednesday the 3rd of March

Move into risk is confirmed

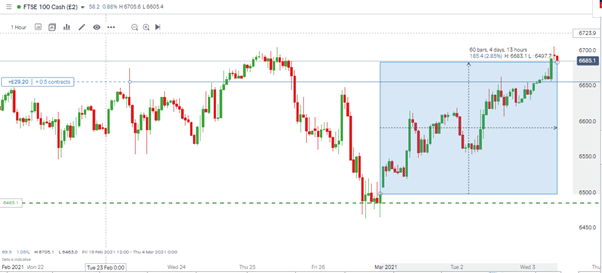

The move into risk predicted by Forex Fraud analysts on Monday has been followed by a 2.85% increase in the value of the FTSE 100 share index. Friday’s closing price of 6497 was below significant resistance, with the psychologically important 6500 at first providing resistance to upwards price moves but now offering equally strong support.

FTSE 100 – 1H price chart – >2% increase in value

Source: IG

The price chart shows the UK benchmark is now approaching the high of last week’s 6704 and another ‘big number’ resistance level at 6700. The hourly RSI has breached 70 suggesting the market is oversold and is due a pullback on that time-frame.

s

Those who have ridden the uptrend and are looking to hold their positions can point to one potential catalyst for the market continuing its bull run. The UK Treasury’s budget is due to be delivered by Chancellor Rishi Sunak later on Wednesday, and there is still some uncertainty about what it might include. Pro-growth policies have not been priced in, with leaks from the Treasury suggesting corporation tax might be raised to 21%.

The material impact of such a move might not be as significant as some fear. Corporations can always adapt to rationalise their tax treatment. The Chancellor’s statement will likely indicate what direction the government’s policies will take for at least the next 12 months.

It can’t be discounted that Chancellor Sunak will revert to classic Tory principles of low taxes. There is undoubtedly political wriggle-room for him to take that approach; if it happens, that could spur UK equities on to higher levels.

FTSE 100 – 1H price chart with RSI

Source: IG

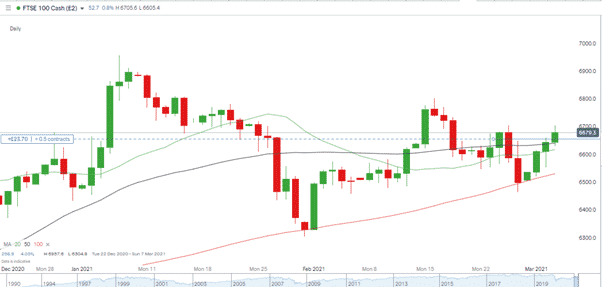

The year-to-date high of 6862 posted on the 7th of January now appears a distant memory for the bulls who started 2021 with such enthusiasm. That does mean the FTSE can move on another 184 points, or 2.7%, before it reaches that sterner test.

Price is currently trading in the middle of its sideways trend-pattern that dates back to November 2020. On a daily timescale, RSI is at only 54, again offering support to the bulls.

FTSE 100 – 1D price chart with RSI – Sideways Channel

Source: IG

The law of Moving Averages

Longer-term investors will also note that price has in the last 24 hrs broken through the 50 daily SMA, and the 20 SMA is converging on the 50 and is possibly heading for an upward intersection.

FTSE 100 – 1D price chart with SMA’s

Source: IG

With prices ‘middling’, it could be the Chancellor’s comments that tip market analysts into determining whether UK large-cap stocks are over or undervalued. Such a degree of influence has been unheard of in recent years and highlights how the markets are still operating in “strange times”. The speech, which starts at 12.30 GMT, will certainly be worth watching.

If you want to know more about this topic, or have been scammed by a fraudulent broker, please contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox