Monday the 1st of March

Equity Markets Rebound

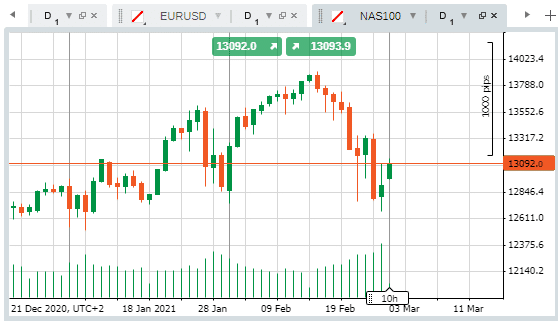

Global equity markets couldn’t maintain their upward momentum during February but have started the new month in a positive mood. Markets in Japan, Australia, China and Hong Kong all posted positive returns overnight. Japanese manufacturing grew at the fastest pace in two years.

The potential for upward price movements extends beyond the current dip attracting value investors.

Forecasts of UK economic growth released at the weekend had a more positive tone, and Rishi Sunak’s budget on Wednesday the 3rd of March could include additional stimulus measures.

US stock futures look set to continue the trend, and before market open, Nasdaq 100 index futures were trading 1.5% higher than Friday’s close.

NAS100 Daily Price Chart – A strong start to March – Is it different this time?

Source: Pepperstone

The rise in equity markets can be partly attributed to House of Representatives members spending some of the weekend passing President Joe Biden’s $1.9trn stimulus package.

Market Reports to look out for on Monday include:

- February’s final read for Markit’s US manufacturing PMI due to be released on Monday at 9:45 a.m. Eastern Time.

- US construction spending data for January is due out later at 10 a.m. Eastern Time.

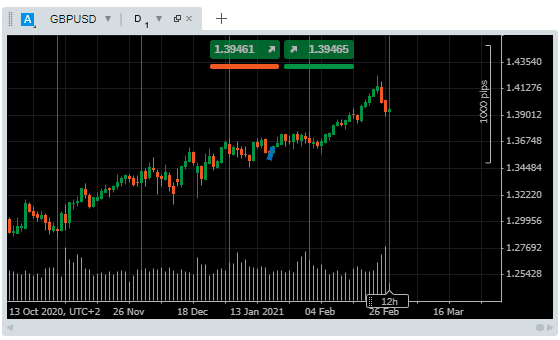

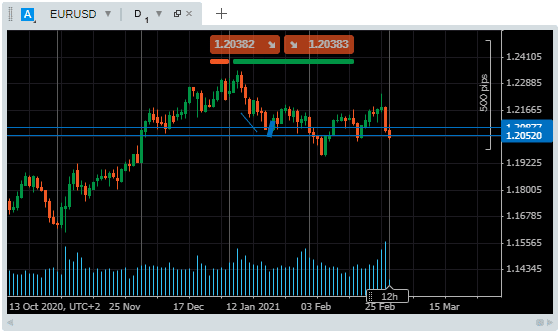

GBPUSD & EURUSD

Both of the European currencies have seen a slight price drop over the last week. Sterling is down -0.33% and the euro by -0.55%. The dollar’s strength doesn’t yet suggest a break of the long-term downtrend in DXY, and this could reflect the currency pairs consolidating before further upward moves occur. Trading volumes in both currencies are on the slide.

GBPUSD Daily Price Chart – Consolidation?

Source: Pepperstone

EURUSD Daily Price Chart – Consolidation?

Source: Pepperstone

GBPUSD

Sterling is still showing relative strength compared to the euro. The vaccine rollout in the UK continues without hitting any significant snags. Reports over the weekend stated that 20m Brits have now had at least one dose of the jab.

GBPUSD – The case for the upside:

Target 1: 1.3985

Target 2: 61.8% retracement at 1.4069

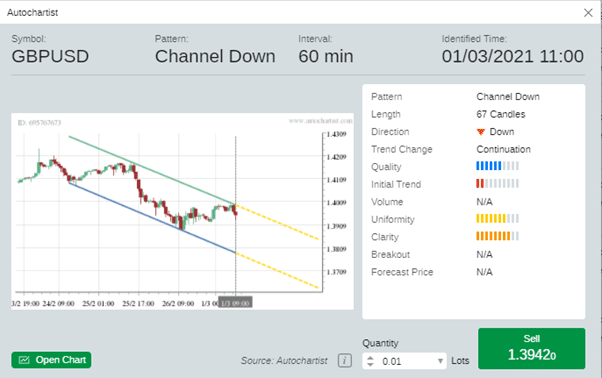

GBPUSD – The case for the downside:

Autochartist has picked up bearish sentiment on the hourly chart.

Source: Pepperstone

Target 1: Low of 28th Feb at 1.392

Target 2: Lower trend line, currently below 1.380

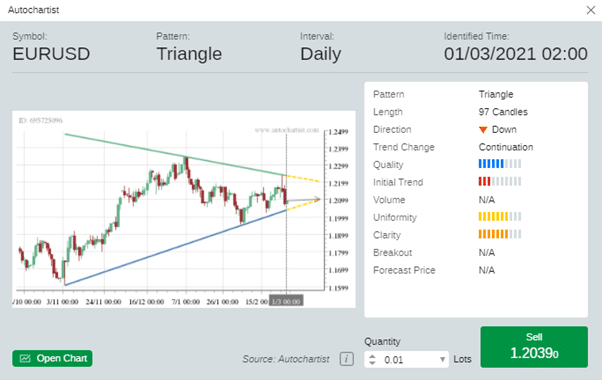

EURUSD

Wedge pattern on the daily chart is coming to the end of its funnel. Low trading volumes suggest price could continue to trade within the current pattern and a burst of activity and break out of either line signalling the start of the next price trend.

Source: Pepperstone

EURUSD – The case for the upside:

Target 1: Resistance at 1.2110

Target 2: Upper daily trend line at 1.2199

Target 3: February high / Year to date high at 1.22430

EURUSD – The case for the downside:

Target 1: Lower trend line, prices below 1.2029

Target 2: February low / Year to date low at 1.19522

Bond Yields Fall

Completing the circle and confirming a move into riskier asset groups, US bond yields slipped in the first trading session of March.

The yield on the benchmark US 10-yr Treasury note fell to 1.429% at 3:50 a.m. Eastern Time.

If you want to know more about this topic, or have been scammed by a fraudulent broker, please contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox