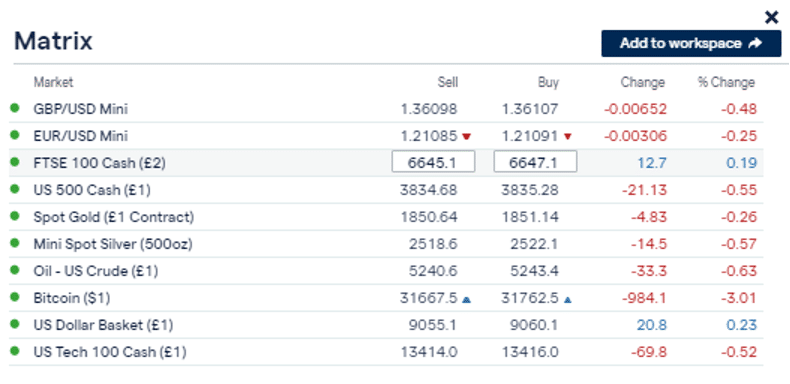

Monday saw the markets stall and nosedive on the back of more bad news for the aviation sector. Tighter anti-COVID restrictions were announced by a range of national governments which brought down the share prices of airlines and airline service firms.

Source: IG

In Tuesday’s session, Hong Kong airline Cathay Pacific closed at HKD 6.56 and is on a downward trend from its HKD 7.26 close on Wednesday.

This week was billed as the one where US stimulus measures would give the markets a second wind. Instead, equities, commodities, risk currencies and Bitcoin all saw interest drain out of their markets.

The direction of the price moves might be hard to guess but the pick-up in volatility makes sense and can be expected to remain until the end of the week.

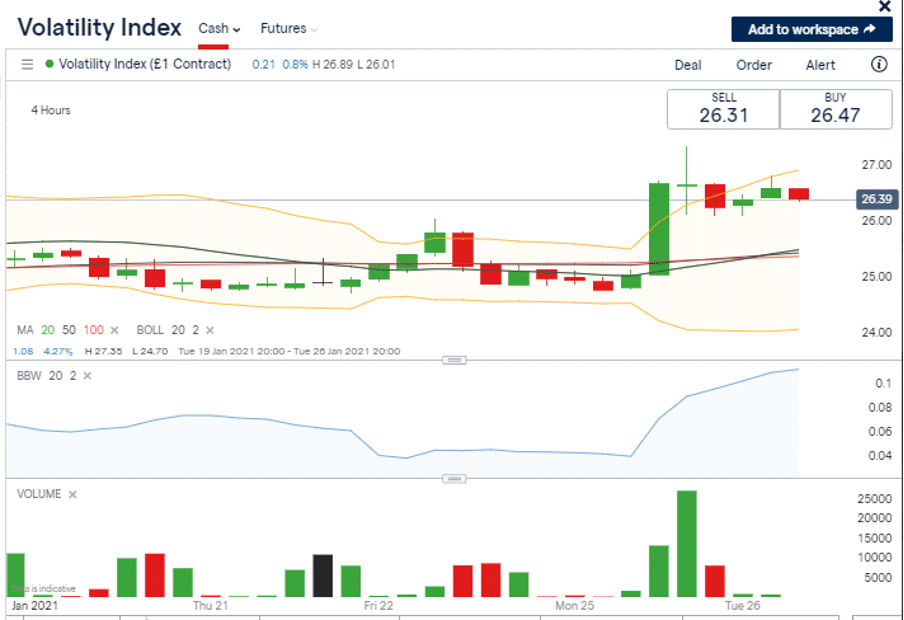

Keep an Eye on the VIX Index

Source: IG

The VIX index which broadly acts as a measure of volatility and fear, spiked in price as the US markets opened on Monday. It has been building momentum during the European session but Wall Street certainly didn’t like something about the markets.

Not only did price pick up but trading volumes also spiked. Not a good omen and a resulting sell-off ensued. Running into the US close, risk appetite returned, then waned. Sentiment softened during Tuesday’s Asian session and then picked up again as European exchanges opened.

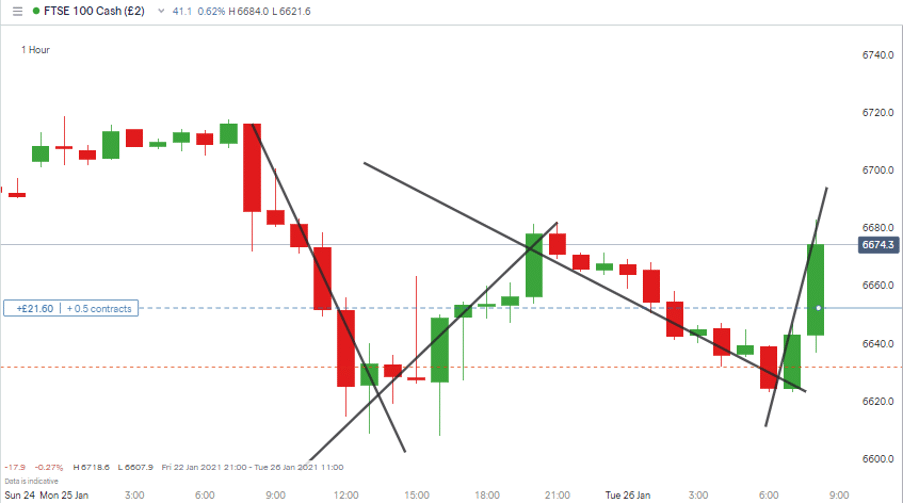

Source: IG

If you can pick the right positions, this could be a great market to trade. If you don’t, it could blow a big hole in your cash pile. Oscillating half-day trends are a risky proposition.

What Next for the Markets?

The short, sharp, shock caused by increased COVID restrictions is a reminder of how the virus is still a significant determinant of asset value; however, most eyes will be on the US Fed this week. It could even lead to prices stabilising to some extent in the run-up to the actual announcement.

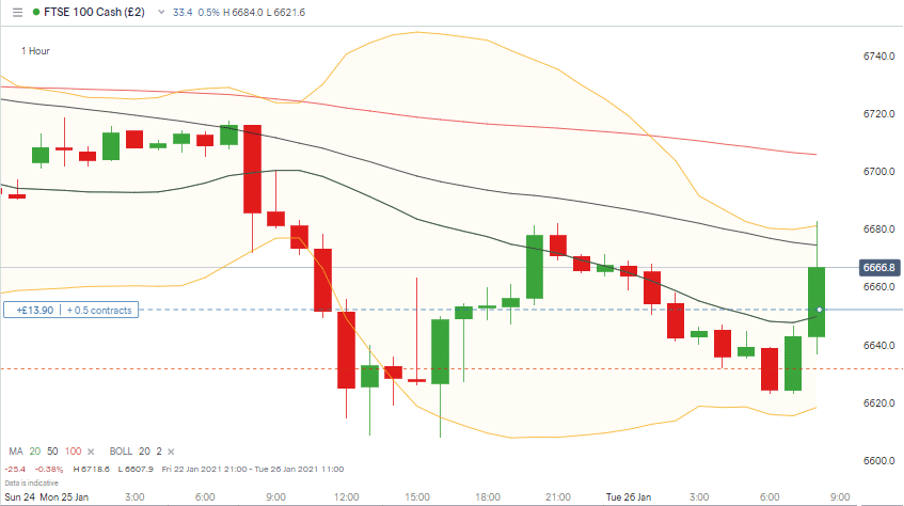

Source: IG

The Bollinger Bands on the FTSE 100 equity index are already beginning to narrow after Monday’s excitement.

Also Keep an Eye on the US Fed

Jerome Powell, chair of the Federal Reserve, will on Wednesday at 2.30 pm Eastern Time announce the conclusions of the FOMC’s two-day meeting. Few are suggesting any major changes to interest rates or policies. The main question is whether more-of-the-same is already priced into the markets, or not.

Within the last two weeks, there has been some suggestion from junior members of the FOMC that the monetary stimulus might not have to be in place for so long. Suggestions that Powell has been persuaded to be more open to that approach would significantly impact prices.

The devil will be in the detail and sifting through Powell’s speech will take time. There is a chance that price will flat-line in the run-up to his announcement. But that would be more down to uncertainty about what happens next and less to do with any shared consensus.

If you want to know more about this topic or have been scammed by a fraudulent broker, please contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox