Elon Musk’s announcement that he wants to buy Twitter has been described as surprising, interesting, and fascinating; however, away from those news headlines, day traders are getting down to the business of making money off short-term stock price moves. The stock they are targeting is not the social media platform, but the EV maker Tesla with which Musk is more usually associated.

Should I Buy or Sell Twitter?

Musk’s offer to buy Twitter for $43bn has rekindled the debate about the platform’s actual value. The management has stated a price tag of $54.20. That significantly undervalues TWTR stock despite that offer representing a healthy premium on the $39.91 price per share before Musk’s announcement.

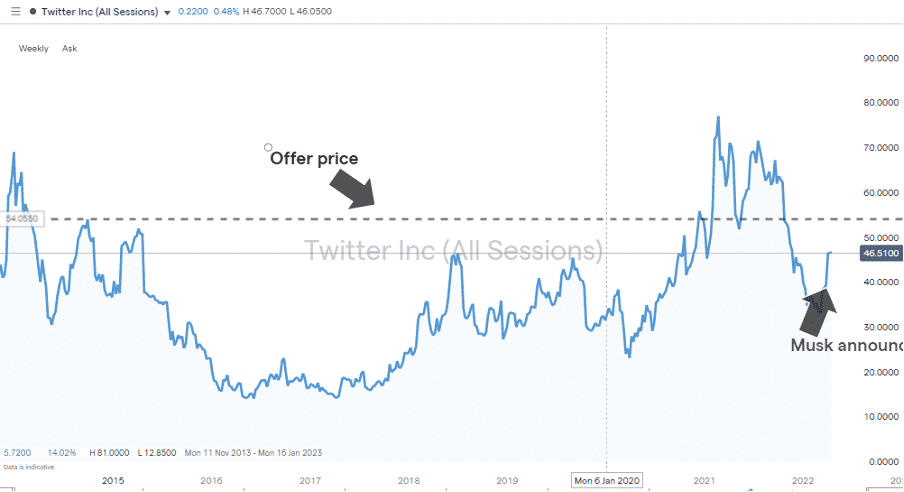

Twitter Inc – Weekly Price Chart – 2013 – April 2022 – Serial Underperformer

Source: IG

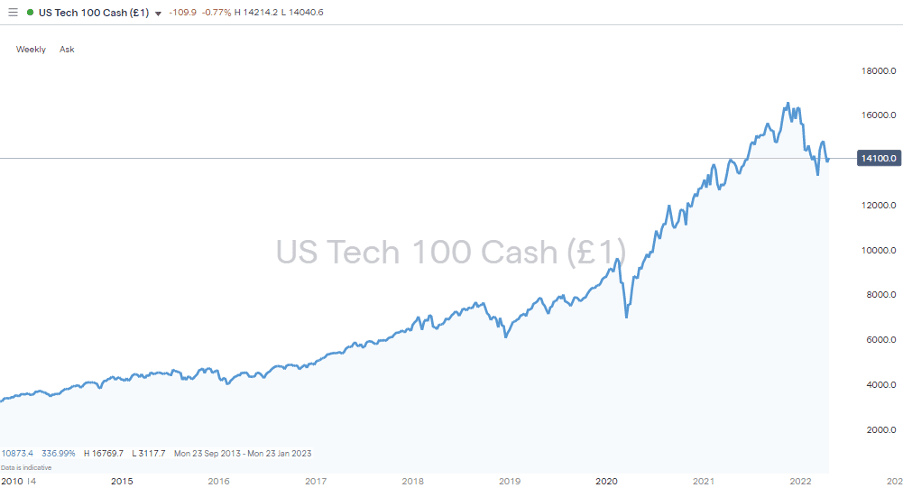

Between November 2013 and April 2022, the Twitter share price has spent the vast majority of the time trading sideways below the $54.20 price level. Throw in the fact that the firm’s peer group, represented by the Nasdaq-100 index, has risen by 297% over that time, and there seem to be good reasons for shareholders wanting to sell out now. One major caveat is whether Elon has the financing in place to make the deal happen.

Why is Elon Musk Interested in Buying Twitter?

Twitter continues to struggle to balance the demands of free speech, content moderation, and the fact that advertisers don’t want to be associated with sometimes toxic debates. The update to investors on its Q1 trading performance is due on the 5th of May, but with the current management team in place, there appears little reason to hope for too many surprises to the upside.

Few would want to take on the formidable task of reading into Musk’s intentions, but it would appear a change at the top could act as a catalyst for value in Twitter stock being unlocked.

NASDAQ 100 – Weekly Price Chart – 2013 – April 2022 – Almost three-fold growth

Source: IG

How to Day Trade Tesla?

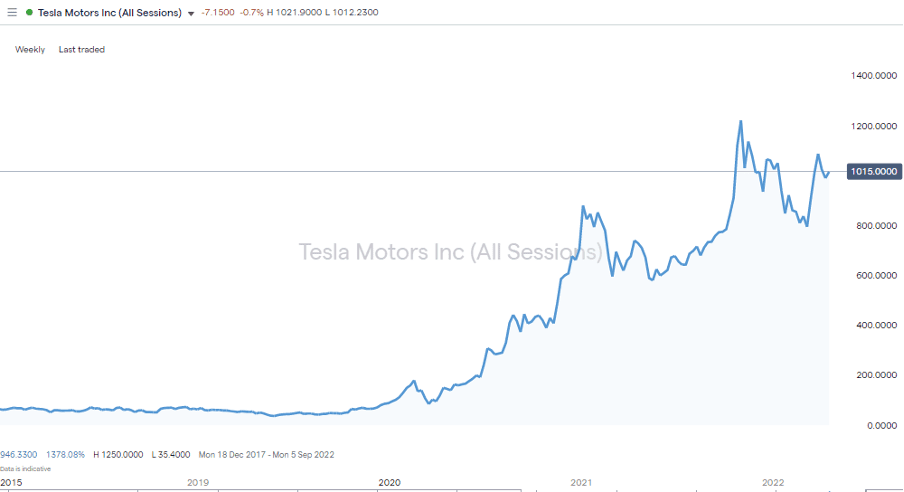

Under Musk’s stewardship, Tesla shares have outstripped both TWTR and the NASDAQ. Since March 2020, TSLA stock has surged in value by more than 840%.

Tesla – Daily Price Chart – 2018 – April 2022 – +800%

Source: IG

The strength of the Tesla brand in one of the biggest growth markets in the world is now being backed up by impressive business fundamentals. With the Berlin Gigafactory coming online, global production levels are due to double in 2022, up to two million per year rather than the one million produced in 2021. The Lonestar model, which is nearing production, is gaining rave reviews.

This means that investment strategies in Tesla stock have morphed from being speculative bets on the move to clean energy to momentum plays. Tesla’s market capitalisation might be a quarter of that of Apple Inc, but the daily trading volumes in TSLA are consistently double or triple those in AAPL.

While the Twitter takeover story remains the headline event, many looking to trade the situation will be watching Tesla price charts. The EV maker is an easier market to trade for day traders who will be priming themselves for increased trading volumes and price volatility.

If Elon Musk is going to try and find $54bn to fund his purchase of Twitter, then selling or borrowing against his Tesla shareholding is definitely on the table. When Elon is around, there’s not much which isn’t on the table, which looks likely to be good news for day traders.

What Next?

The Musk-Twitter stand-off looks like it still has some way to run, and with earnings reports due for both Tesla and Twitter, there are plenty of trading opportunities to consider.

- Tesla Earnings Report Due – Wednesday 20th April

- Twitter Earnings Report Due – Thursday 5th May

Crowdsourcing information about scam brokers can help others avoid falling into the traps set by disreputable brokers, and you can share your experiences here. If you would like to know more about this particular topic or have been scammed by a fraudulent broker, you can also contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2024

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex & CFD Broker |

Best Trading Conditions

Visit broker

|

||

| #2 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #3 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #4 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

Global CFD & FX Broker |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #7 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #8 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox