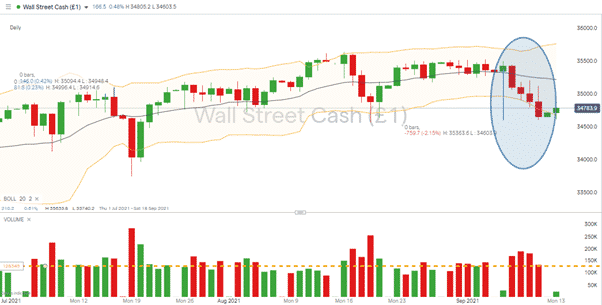

Global US stock indices have started the week holding ground after several days of negative returns. Last week, futures in the Dow Jones Industrial Average posted four negative days in a row and a week on week return of -2.15%.

Source: IG

The September Effect

Billed “the worst month of the year” by finance news sites, September has on average recorded a fall of 0.5% in the S&P 500 index. That might not sound like a large number, but every other month of the year over the past 50 years has posted a positive return on average.

Friday’s Price Move in the Nasdaq

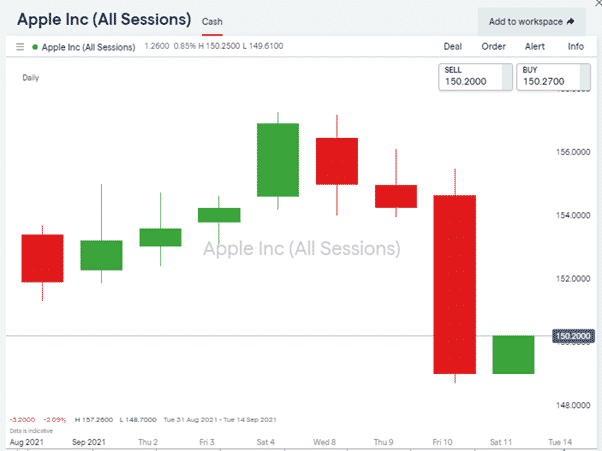

Events at Apple Inc. on Friday cemented the move into the red. Any temptation for investors to step in before the weekend and cause the markets to rally into the US close was blown away by the tech giant receiving bad news on a lawsuit.

The court case between Apple and Epic Games still has some way to run; however, Friday’s conclusion by Judge Yvonne Gonzales Rogers took 3.65% off the value of the world’s largest company. The news that Apple can no longer prohibit developers from providing links to non-Apple payment systems could leave a hole in the company’s balance sheet.

Source: IG

Reasons for Potential Upside From Here

With the S&P 500 currently down -1.08% on the month, the temptation now is to step back in and pick up risk-on assets at lower levels.

The trading volumes might support such a move. During last week’s sell-off, volume was in line with seasonal averages, so it was far from a market rout. Nor was the change in price levels a result of price distortion due to low trading volumes during quiet market conditions. After four down days, it looks like some hot air was released from a market that was overvalued on a lot of short-term metrics.

Apple’s court case was bad news for the markets everywhere. The firm is so widely held that the price slide in that one stock would have dragged performance down across millions of portfolios and things like that dampen the market mood. The firm does, though, still have a market capitalisation of more than $2Trn, and the court case was a known risk factor rather than a shock event. The court also offered some upside to Apple stockholders – Judge Rogers said that Apple was not monopolistic and that “success is not illegal”.

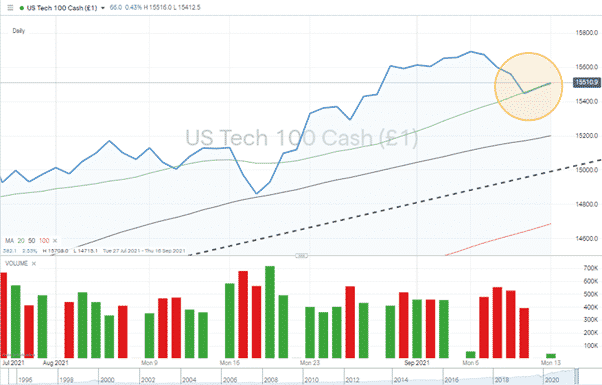

Source: IG

Has the September Effect already played out?

Patience could still be needed. Nasdaq futures on Monday morning were trading in line with the Daily 20 SMA. If it continues to hold that trajectory, then modest returns could be on the horizon. The treasury markets are often described as having the feeling of “picking up nickels whilst walking in front of a steam roller”. That adage could best explain the options available to equity traders this week. Modest returns while prices consolidate with whispers that an overdue crash could be around the corner.

If you want to know more about this topic or have been scammed by a fraudulent broker, please contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox