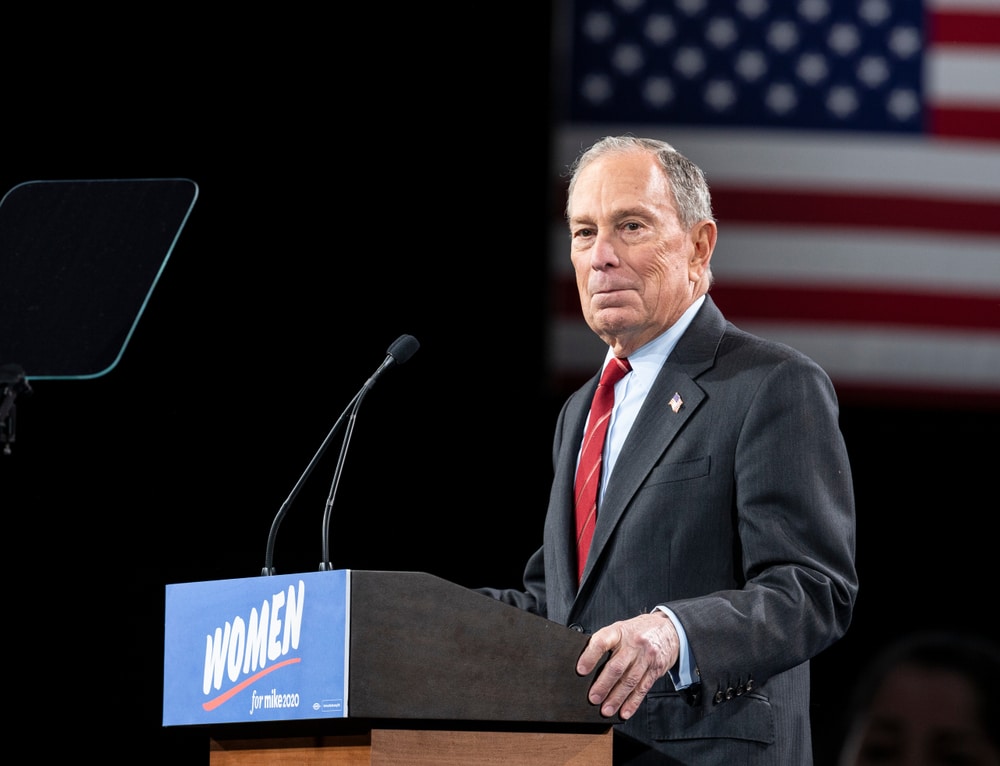

Mike Bloomberg suggests regulatory framework for crypto

Mike Bloomberg, the billionaire candidate for the US Democratic presidential nomination, has announced his policies on cryptocurrency.

Bloomberg, who has only just recently entered the race to win the nomination after staying out of some of the earlier stages of the campaign, said that he would seek to regulate crypto by increasing “oversight”.

He also highlighted that “fraud and criminal activities” can take place in the sector.

“Cryptocurrencies have become an asset class worth hundreds of billions of dollars, yet regulatory oversight remains fragmented and undeveloped”, his proposal read.

“For all the promise of the blockchain, Bitcoin and initial coin offerings, there’s also plenty of hype, fraud and criminal activity”, it added.

His campaign specifically promised to tackle ICO fraud by “providing a framework for initial coin offerings, by defining when tokens are and are not securities.”

This is an issue which has plagued regulators for many years and is a thorny issue for many in the sector.

He also said he would clarify “how investments in cryptocurrencies will be taxed” and would define “capital and other requirements for financial institutions holding cryptocurrencies”.

Bloomberg is considered a major candidate to win the nomination and hence take on Donald Trump in the general election in November.

However, the internal Democratic race is not yet over and he will need to beat other major candidates including Bernie Sanders, Joe Biden and Pete Buttigieg before he secures the nomination.

Bloomberg previously served as Mayor of New York City, and for that he was elected as a Republican.

He is the ninth richest man in the world.

Singaporean police investigate forex firms

A group of foreign exchange trading firms have been placed under investigation by authorities in Singapore.

The firms, which have been named as Pareto SG Pte Ltd, Pareto International Holdings Limited and Veritas Global Exchange, have been targeted by the Commercial Affairs Department of the Singapore Police.

The firms traded in foreign exchange on a contracts for difference (CFD) basis.

CFDs are a form of trading which operate using leverage, meaning that they can be higher risk.

Last year, Pareto SG was believed to have provided investment schemes on a CFD basis with international broker Veritas Global Exchange.

The cash that came through from this went to bank accounts associated with Pareto International.

Now, however, the firms are under investigation for potentially breaking the Penal Code and the Securities and Futures Act.

One of the directors of Pareto International has been charged with deception-related crimes.

As part of that investigation, one of the directors of Pareto SG has been taken into custody.

According to reports, police in Singapore have asked anyone else who may have been affected by the alleged crimes to make themselves known to police.

The news was reported by Channel News Asia, a media company based in Singapore.

Singapore is one of Asia-Pacific’s major financial hotspots.

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox