Trading crypto is a breathtaking rollercoaster ride at the best of times, but high-ranking US celebrities are being sued for making the experience even riskier. Investors are suing boxer Floyd Mayweather Jr, basketball player Paul Pierce and Kim Kardashian for collaborating with EthereumMax “misleadingly promote and sell” the crypto it was alledged.

The class action claims that EthereumMax was a classic “pump and dump” scheme where early day investors aggressively market an asset until selling on to unsuspecting buyers drawn into the market by the buzz of excitement. The charges being considered by a California court are that the A-listers are alleged to have issued “false or misleading statements to investors about EthereumMax, through social-media advertisements and other promotional activities”.

The court filing alleges: “In plain terms, EthereumMax’s entire business model relies on using constant marketing and promotional activities, often from ‘trusted’ celebrities, to dupe potential investors into trusting the financial opportunities.”

The Meme Stock craze, cryptos, and NFTs fall into a bracket where new ways of promotion, mainly via social media, make it hard for investors to make an informed decision. If EthereumMax is new to you, you may want to review your news filters, especially if you are trading in markets where news is the key price driver.

UK regulator, the FCA, has given the situation high enough priority for the head of the organisation Charles Randell to issue a statement which explained that Ms Kardashian had “asked her 250 million followers to speculate on crypto tokens”. That would mean that the post, marked as an advert, may have been the “financial promotion with the single biggest audience reach in history”.

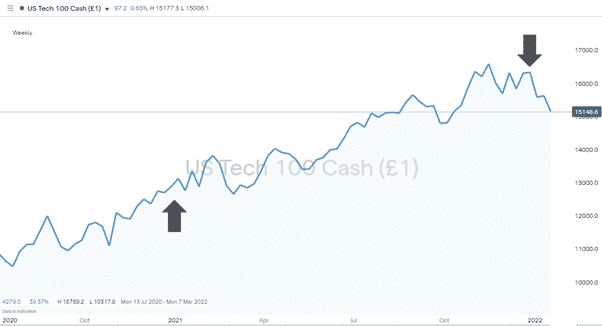

Those who didn’t pick up on the post from Kim K may be active in other ‘safer’ markets, which it has to be said are generating significant levels of price volatility. Stocks that tend to be considered a regulated market rose significantly through 2021 and at the start of 2022 have fallen away on inflation and interest rate concerns.

NASDAQ 100 Index 2021 – 2022

Source: IG

Source: IG

With the Nasdaq index of tech stocks posting a positive return of 26% in 2021 and a negative year-to-date figure of 8.06% only 18 days into the new year, there appears to be excitement enough in other, better-regulated areas. Ones where those who might have a stake in the game use their influence to draw in unsuspecting buyers.

EthereumMax has no legal or business connection with the Ethereum cryptocurrency.

Crowdsourcing information about scam brokers can help others avoid falling into the traps set by disreputable brokers and you can share your experiences here. If you want to know more about this particular topic or have been scammed by a fraudulent broker, you can also contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox