If you missed last week’s US election inspired market bounce, it might be too late to join in. The Dow Jones, Nasdaq 100 and S&P 500 all posted their best weekly price rises since April.

After a week of up days, there is potential for at least a short-term correction. Some markets are entering ‘overbought’ territory. It could be a quiet trading week and a time for traders to sit on their hands, as it also looks too early to sell. Market euphoria is a bear’s worst enemy.

As the attention of the news channels turns from Biden and Trump, they will probably pick up on COVID-19 and the likelihood of a smaller than expected US fiscal stimulus. Political stalemate and lame-duck presidents aren’t good for business.

Market prices are back at a range where there is potential for breakouts to both the upside and downside.

The FTSE 100 has posted seven consecutive up-days to reach the test of the long-term trend line resistance. Even so, the bulls still have momentum and the daily RSI is still off the key trigger lever of 70. RSI at European open on Monday was 61.

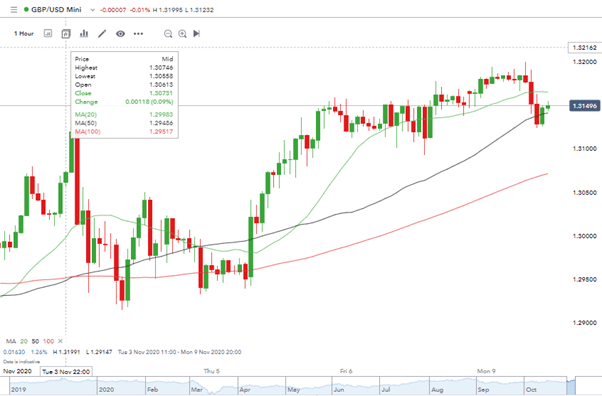

GBPUSD

Sterling is the first of the markets to start factoring in news features which are not Biden-Trump related. The Brexit negotiations are never too far from centre stage for the GBPUSD forex pair.

As risk on currencies such as EURUSD have held their bullish price patterns, GBPUSD has shown weakness during the first European trading session of the week.

Source: IG

Currency traders, in general, will be realigning themselves to read the subtle hints of central bankers. The ECB is this week hosting a forum where US Federal Reserve Chair Jerome Powell, the Bank of England’s Andrew Bailey and ECB President Christine Lagarde will all speak.

Things to look out for:

Jerome Powell – most attention will be on the US Fed chair. Powell kept a low profile during the election race but now appears ready to become more influential. Suggestions are that he may announce further fiscal easing in December. Waiting until the election is resolved and more up to date economic data is in would appear to be a wise move. He’ll also want to gain a better idea of the chances of the US Fiscal stimulus bill making progress.

Andrew Bailey – the BoE’s preparedness of negative interest rates is not doubted. Confirmation that such a move is more likely would put pressure on GBPUSD. If Bailey is going to turn that screw, he may well prefer to do so when GBPUSD is trading above not below the psychologically important 1.30 level.

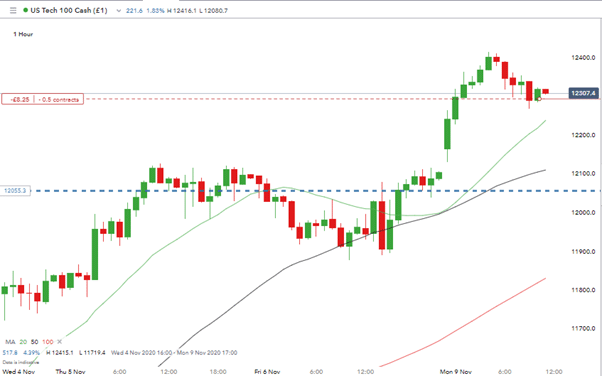

Another potential leading indicator of the next move is the US Tech index (Nasdaq 100). It too has had a soft start to the trading week. Halfway through the Monday morning European session tech stocks were trading almost 1% off Friday’s highs.

Source: IG

Successful trading can be as much about the trades you don’t place as the one’s you do. Preserving capital is the key, and with markets currently consolidating, momentum-based strategies might need to be put to one side.

Any information contained on this Website is provided as general market information for educational and entertainment purposes only, and does not constitute investment advice. The Website should not be relied upon as a substitute for extensive independent market research before making your actual trading decisions. Opinions, market data, recommendations or any other content is subject to change at any time without notice. ForexTraders will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox