*Originally published on 25/03/2019

- Back in early March we reported on the AUDUSD and NZDUSD currency pairs here and highlighted negative outlooks for both the Australian currency and New Zealand currency versus the US Dollar.

- Despite US Dollar weakness since then, which has seen both AUDUSD and NZDUSD Forex rates rally higher, key resistance levels for both remain intact.

- Furthermore, recent US Dollar rebounds late last week (despite a more dovish tone from the Federal Open Market Committee (FOMC) on Wednesday 20th March), have seen both AUDUSD and NZDUSD FX rates reinforce negative intermediate-term outlooks.

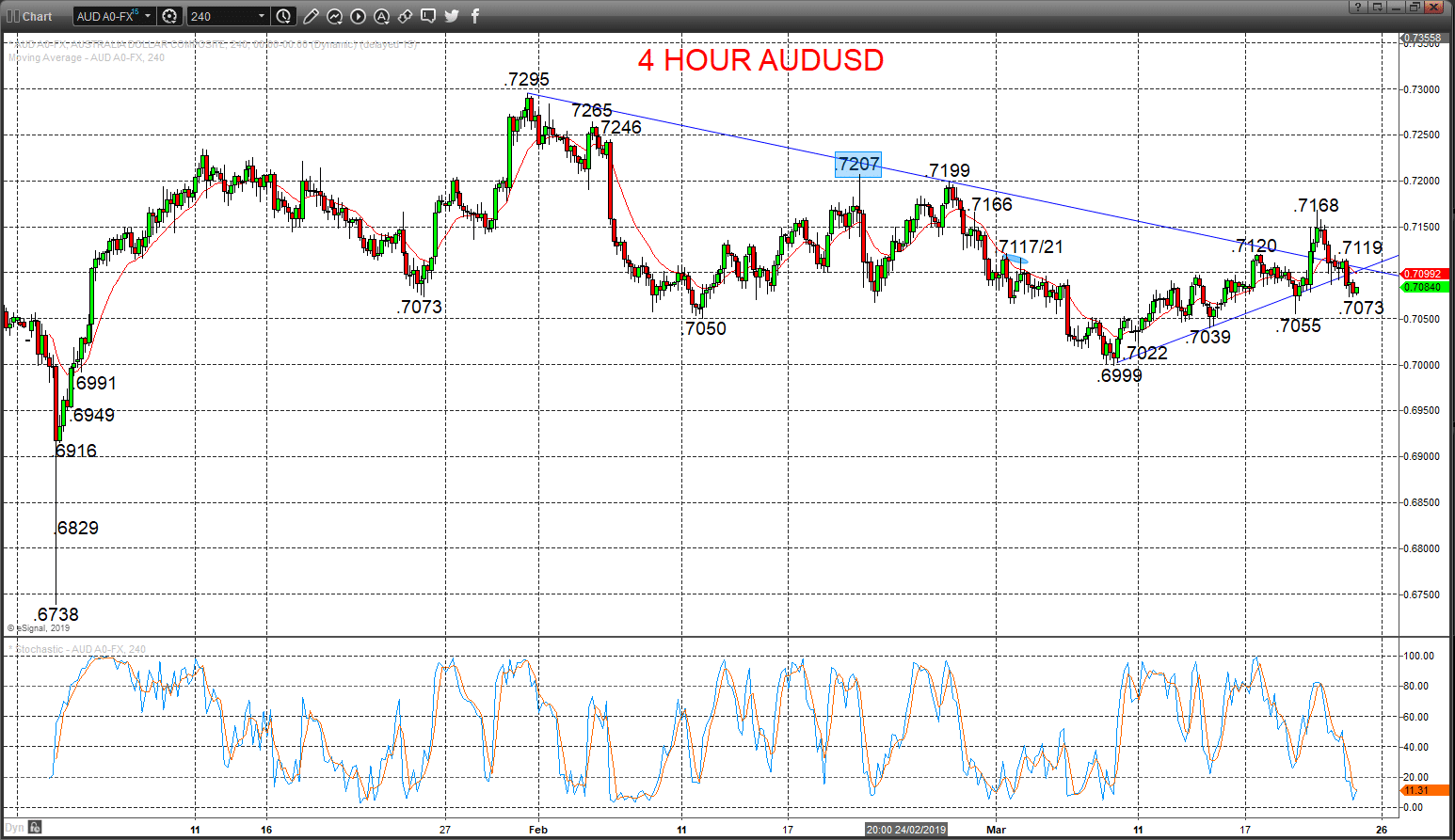

AUDUSD Bull threat further rejected; risks stay lower

Another probe lower Friday just below .7078 support (to .7073), after Thursday’s rally failure from a prod just above our .7166 resistance level (down from .7168), now fully rejecting Wednesday’s post FOMC surge (through the down trend line from late January), to keep risks lower for Monday.

The early February push .7073 set an intermediate-term bear trend,

For Today:

- We see a downside bias for .7073; break here aims for .7055, maybe .7039.

- But above .7119 opens risk up to .7168, maybe .7199.

Intermediate-term Outlook – Downside Risks: We see a downside risk for .6916.

- Lower targets would be .6829 and .6738

- What Changes This? Above .7207 shifts the intermediate-term outlook straight to a bull theme.

Resistance and Support:

| .7119 | .7168* | .7199* | .7207*** | .7246* |

| .7073 | .7055* | .7039* | .7022 | .6999** |

4 Hour AUDUSD Chart

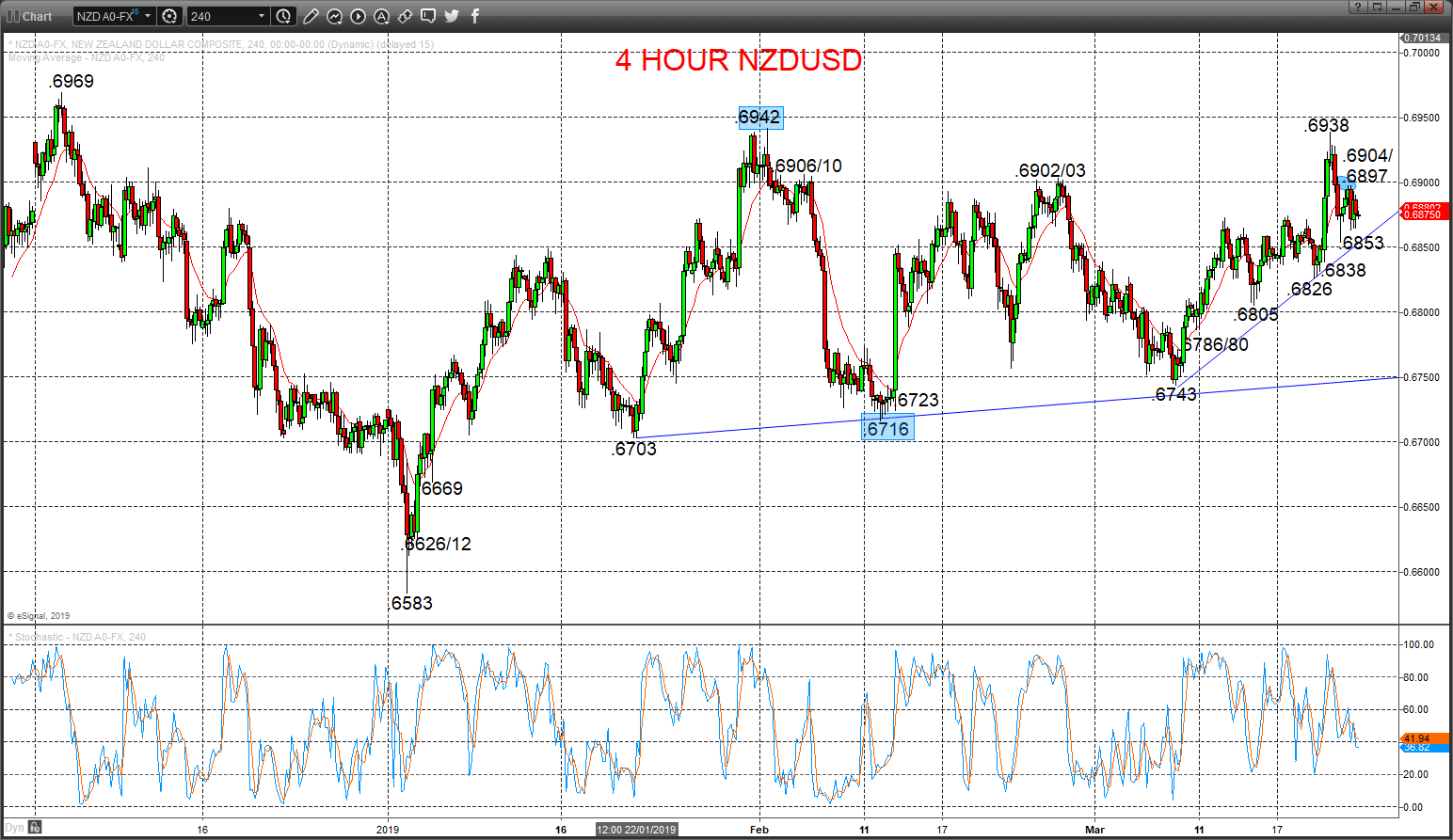

NZDUSD Negative tone after bullish failure from below key .6942 resistance

A negative consolidation tone Friday capped by our .6904 resistance (at .6897), after Thursday’s failure lower from just below the key February spike high at .6942 (from .6938), to fully dismiss Wednesday’s post FOMC surge (through the down trend line from late January), to keep risks lower for Monday.

We see an intermediate-term range defined as .6716 to .6942, BUT with growing risk for an intermediate-term shift straight to bullish above .6942.

For Today:

- We see a downside bias for .6853; break here aims for .6838 and .6826.

- But above .6897/6904 opens risk up to key .6942.

Intermediate-term Range Breakout Parameters: Range seen as .6716 to .6942.

- Upside Risks: Above .6942 sets a bull trend to aim for .6969, .7060 and .7437.

- Downside Risks: Below .6716 sees a bear trend to target .6583, .6347 and .6195.

Resistance and Support:

| .6897/6904* | .6938/42*** | .6969*** | .6984 | .7000* |

| .6853 | .6838* | .6826** | .6805** | .6786/80* |

4 Hour NZDUSD Chart

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox