The US Dollar Basket index has finally broken 100, which has set an important marker for the rest of the market. The index, which measured dollar performance against the basket of other major currencies, first reached the psychologically important price level on 4th April 2022. All eyes are now on whether it can hold above 100.

It’s a big deal. The index acts as a bellwether of the global economy and measures the appetite for risk-on assets ranging from equities, AUD, NZD, commodities and even crypto. Money drains out of the dollar when bullish sentiment dominates. The reverse is also the case, and the rise in USD dating back to June 2021 is now seen as a leading indicator of the weakness in equity markets in Q1 of 2022.

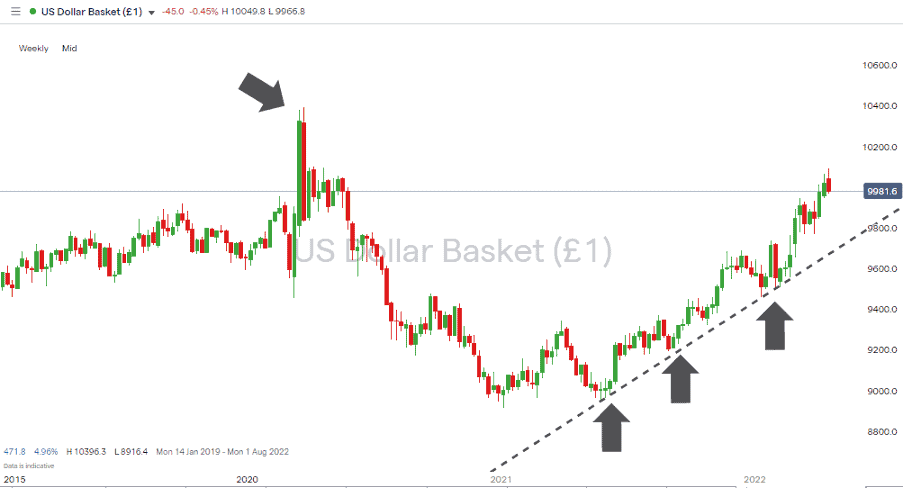

USD Basket Index – Weekly Price Chart – 2019 – April 2022 – Hitting 100

Source: IG

Technical Analysis of USD Basket Index

So far, technical analysis points to further strength for the USD:

- During the multi-month bull run, there have been no signs of the supporting trendline being breached

- The double-bottom price pattern formed by the lows of January and May 2021 was confirmed on 29th March 2021, when the price broke above 93.47

- The next significant resistance level is 103.96, which marks the intraday price high of 23rd March 2020

- The one caveat is that price can sometimes be drawn to an obvious target; for USD, that level is 100. Even if that were the case, there is ample room for price to consolidate and trade sideways before it begins to test the supporting trendline.

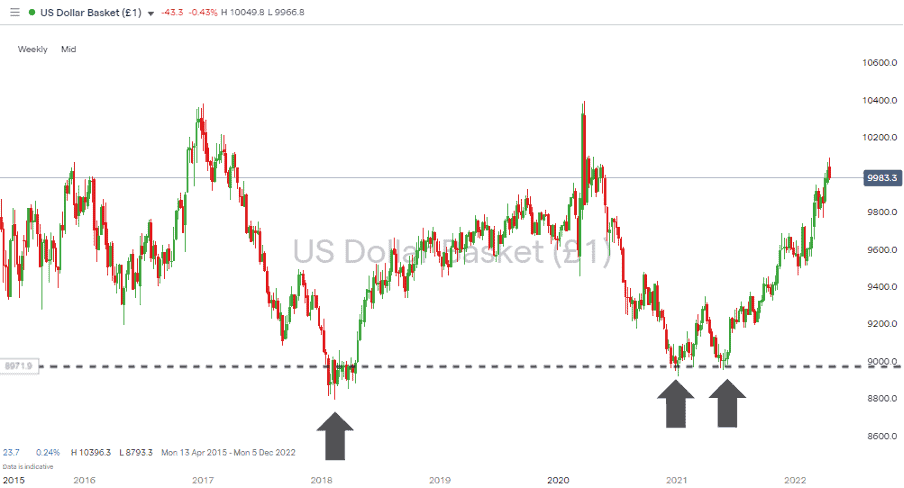

USD Basket Index – Weekly Price Chart – 2015 – April 2022 – Double or Triple Bottom

Source: IG

Macro-Economic Pointers From USD Strength

One of the reasons for USD strength is the prospect of rising interest rates. The dollar is seen as one of the winners when interest rates rise; however, there could be more to it than that.

The Covid pandemic that dominated the markets for almost two years was an event that realigned asset valuations and the prospects of many areas of the global economy. However, it was a one-headed monster, and in hindsight, some of the challenges it threw up appear relatively straightforward. Will there or won’t there be an effective vaccine? Will new variants be more contagious, more virulent, or both?

As it turned out, the investors who backed the pharma industry to be able to create vaccines in a relatively short time were proved correct and would have made substantial returns. On their side was the fact that many of the decisions were binary, but that has now changed, with dilemmas for investors being faced on various fronts.

The Ukraine-Russia conflict and spiralling oil prices have been followed by the stock market darling and FAANG member Netflix losing 30% of its value after posting disappointing Q1 earnings. At this point, the dollar looks to be a measure of uncertainty as it is economic fundamentals. Until that changes, the path of least resistance still appears to be upward.

Crowdsourcing information about scam brokers can help others avoid falling into the traps set by disreputable brokers, and you can share your experiences here. If you would like to know more about this particular topic or have been scammed by a fraudulent broker, you can also contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2024

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex & CFD Broker |

Best Trading Conditions

Visit broker

|

||

| #2 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #3 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #4 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

Global CFD & FX Broker |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #7 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #8 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox