Experts’ Viewpoint

The safety of an online broker is never a given. Traders should always be willing to research to assess the suitability of whichever broker they choose – both from a usability and security perspective.

Rating Overview

| Overall rating | ⭐⭐⭐⭐ |

| Regulation | ⭐⭐⭐⭐ |

| Fees | ⭐⭐⭐⭐⭐ |

| Range of Markets | ⭐⭐⭐⭐ |

| Platforms | ⭐⭐⭐ |

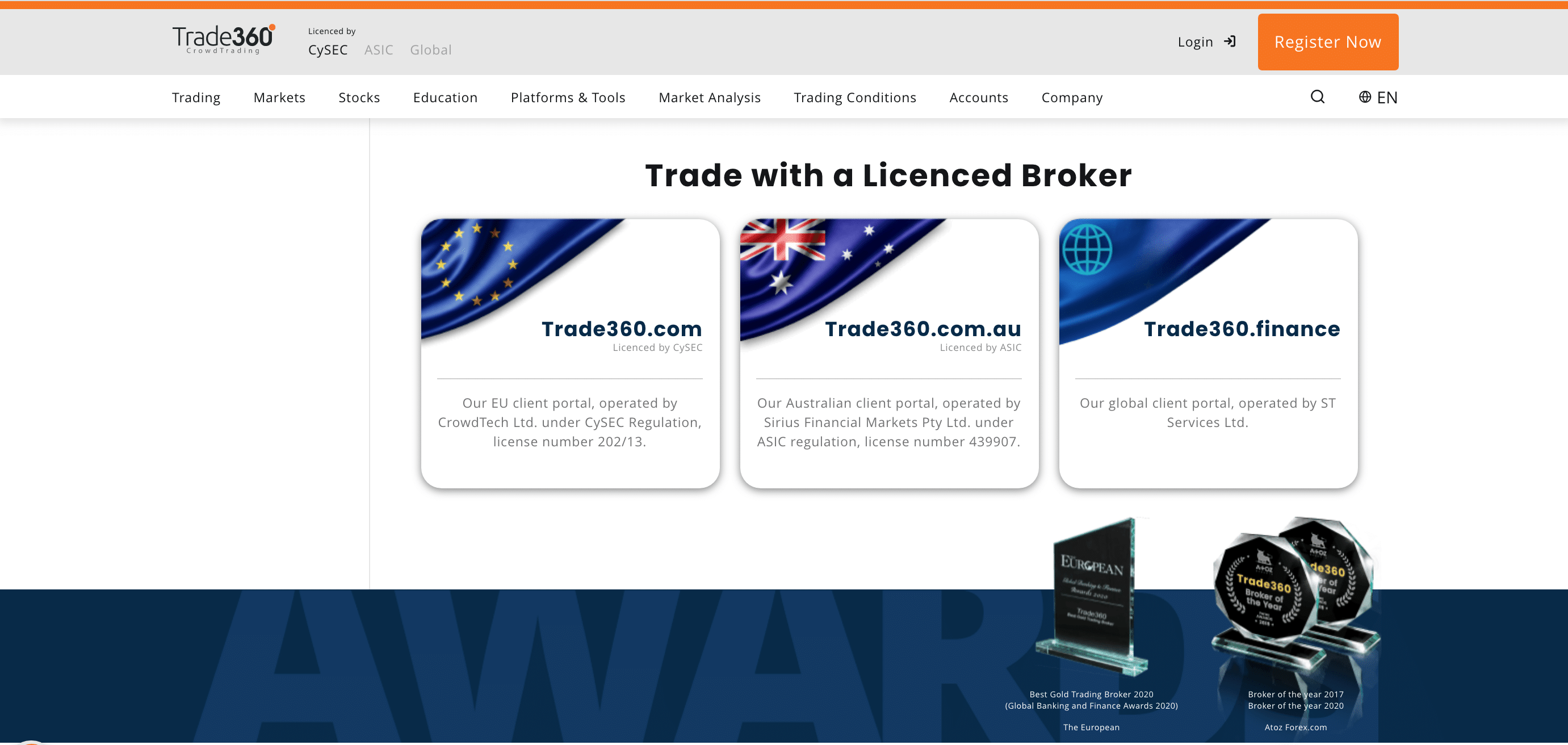

However, it is possible to undertake a general assessment of the likelihood that a broker is fraudulent, or that signing up to that broker will cause problems. In the case of Trade360, it does appear unlikely that fraud is taking place. The broker is heavily regulated through several major global regulators, including the Cyprus Securities and Exchange Commission (or CySEC for short) covering the European Union. In Australia, the relevant regulator is the Australian Securities and Investments Commission, or ASIC.

When using Trade360, traders will discover that there is a somewhat unusual approach to the trading process available. “CrowdFeed” is offered by this broker; a system under which traders can opt to have their open positions assisted by algorithms. This system is unusual in many ways, and can – when used correctly – be highly worthwhile. However, traders should ensure they are thoroughly familiar with how this system works before using it. It may be worth using a demo account without “real” money being placed, for example, or watching some tutorials on the basics of algorithmic trading.

When using Trade360, traders will discover that there is a somewhat unusual approach to the trading process available. “CrowdFeed” is offered by this broker; a system under which traders can opt to have their open positions assisted by algorithms. This system is unusual in many ways, and can – when used correctly – be highly worthwhile. However, traders should ensure they are thoroughly familiar with how this system works before using it. It may be worth using a demo account without “real” money being placed, for example, or watching some tutorials on the basics of algorithmic trading.

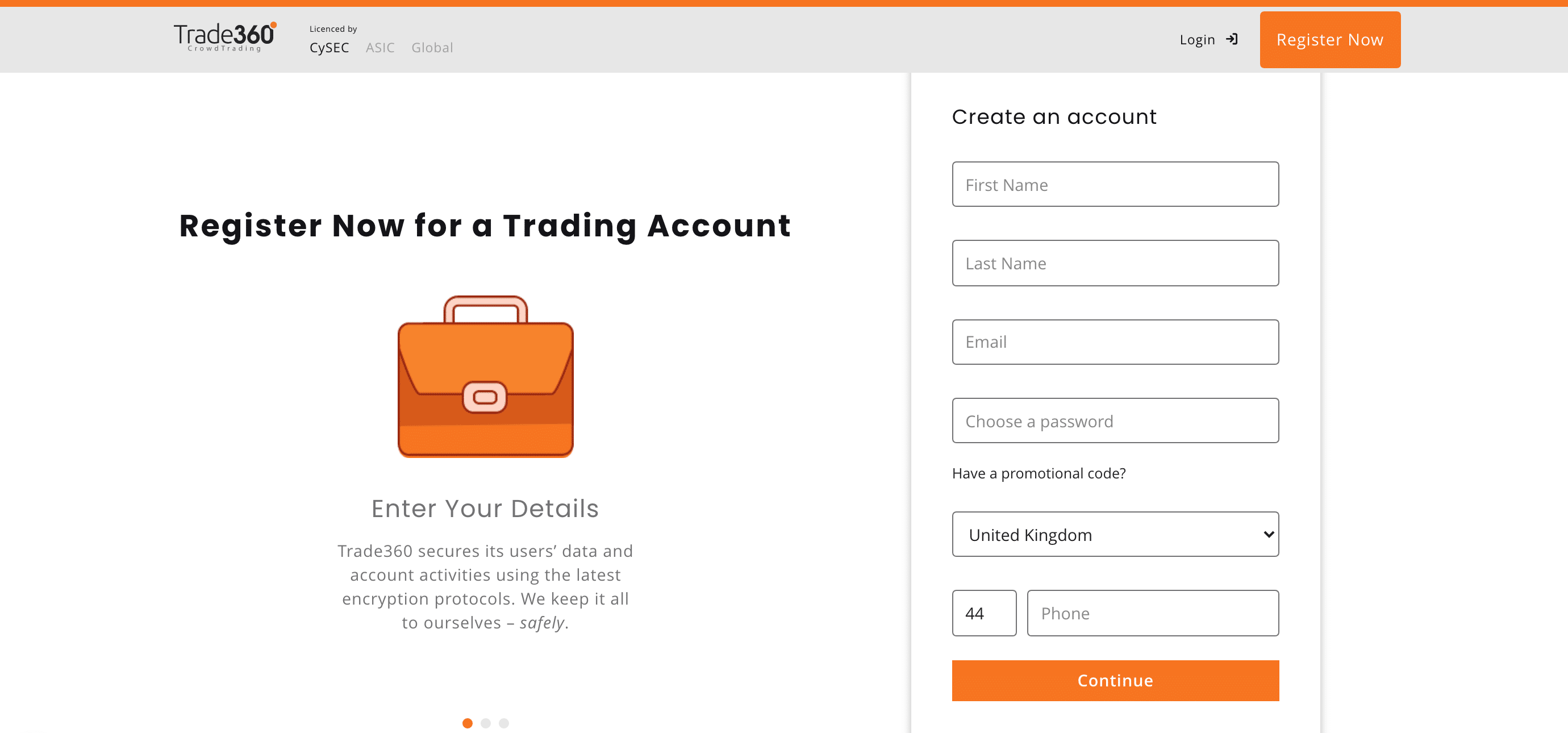

Finally, traders should be aware of the fact that some people have experienced over-active sales outreach from the Trade360 team and that this might well happen. On some occasions, telesales staff caused problems for reviewers of this broker. The reviewers found themselves unable to extricate themselves from calls regarding account structures and so on. It is therefore advised that traders exercise caution when sharing their telephone contact details with this broker.

Forexfraud Recommended Broker

Trade online safelyBroker Summary

This broker is an online provider of several different asset classes. It charges fees on its spreads and has a range of platforms, account types and more from which to choose. It is a regulated broker and has an accessible customer service system. It is suitable for traders at all levels of experience and expertise.

Broker Introduction

Trade360 is a multi-asset broker with a wide variety of asset classes available to trade. Foreign exchange pairs are the broker’s bread and butter, and there are several major global pairs for a trader to pick from. Also available are a range of other popular assets, including exchange-traded funds, stocks and shares, worldwide indices from various major markets and some big-name commodities.

The broker offers its assets via a system of contracts for difference, or CFDs: this means that the trader does not buy the tangible assets. A financial product known as a derivative, which is committed to tracking the performance of the underlying asset faithfully, is purchased instead. There are lots of different account types on offer at this broker.

This platform is a prime example of an online broker that has embraced the Internet. Its algorithmic trading service, “CrowdFeed”, is available for traders to use and offers benefits like market volume analysis, notifications and more. The platform also has a wide variety of account types, meaning that traders can select the account type that works best for their needs and their financial situation.

This platform is a prime example of an online broker that has embraced the Internet. Its algorithmic trading service, “CrowdFeed”, is available for traders to use and offers benefits like market volume analysis, notifications and more. The platform also has a wide variety of account types, meaning that traders can select the account type that works best for their needs and their financial situation.

Spreads & Leverage

This broker makes money by charging a percentage, the “spread”, between the amount for which the financial product the trader holds was a) bought for and b) sold for. The relative cost-effectiveness (or otherwise) of brokers tends to be calculated by looking at what proportions of the spread they set as fees.

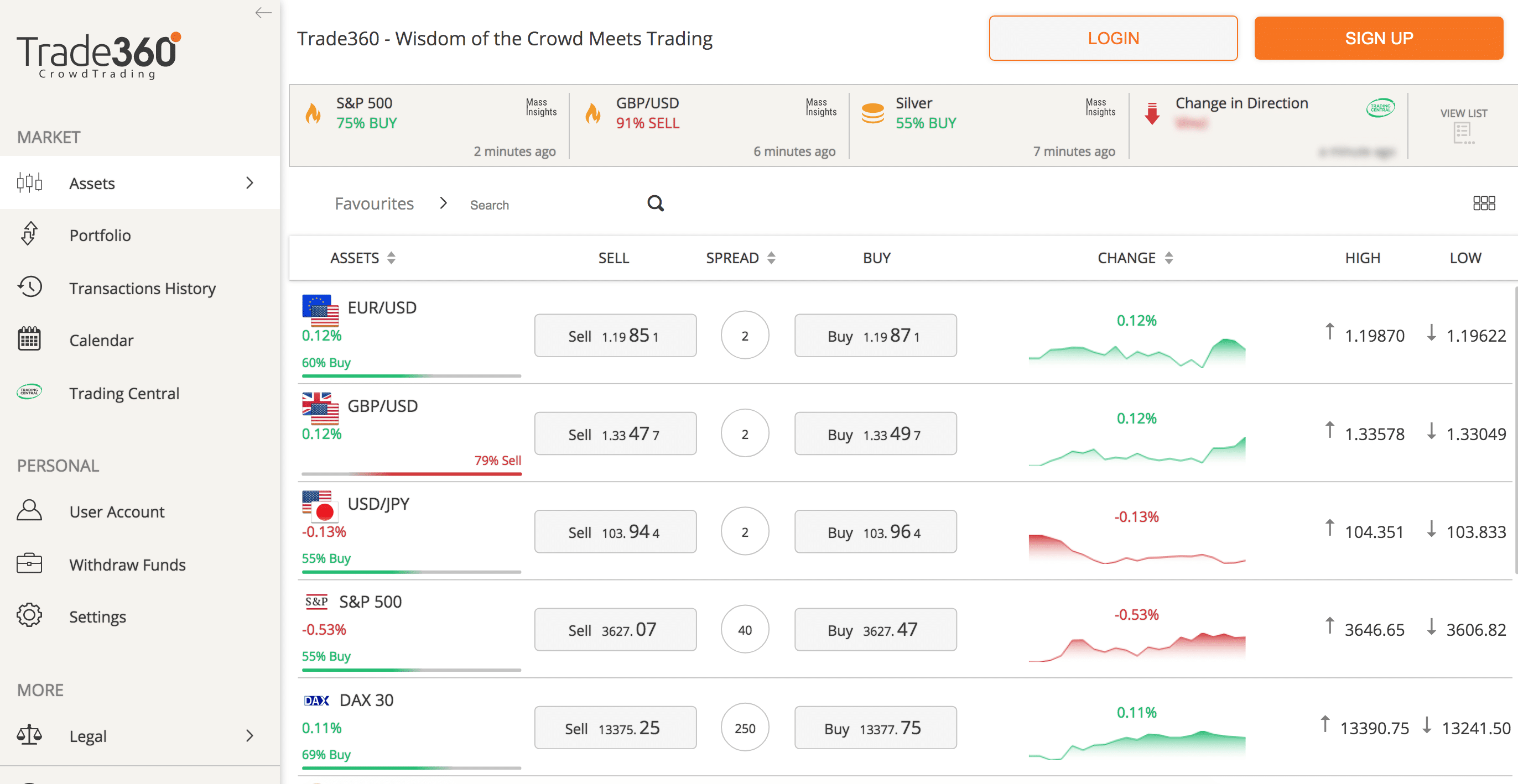

At Trade360, traders can expect to find a range of spreads that vary depending on the asset class in question. At the time of writing, for example, the EUR/USD foreign exchange pair had a spread of two at this broker, as did a range of other currency pairs including the GBP/USD and USD/JPY pairs. But when a trader moves away from looking just at currency pairs, the spreads can creep up quite rapidly. The spread on the S&P 500, for example, is 40, while traders of the DAX 30 can expect to pay a spread of 250.

It is also essential for traders to take into account the amount of leverage that a broker offers. Given that this broker provides contracts for difference (CFDs), the leverage amount on offer is a crucial figure. It refers to the amount of what, in essence, is debt – borrowing from the broker to expand the amount of capital that can be used for trading. The higher the leverage ratio, the more a trader can borrow – although the higher the level of leverage, the more the risk of loss.

It is also essential for traders to take into account the amount of leverage that a broker offers. Given that this broker provides contracts for difference (CFDs), the leverage amount on offer is a crucial figure. It refers to the amount of what, in essence, is debt – borrowing from the broker to expand the amount of capital that can be used for trading. The higher the leverage ratio, the more a trader can borrow – although the higher the level of leverage, the more the risk of loss.

Leverage levels at Trade360 vary depending on all sorts of factors. They include where the trader is based. Some global traders will be able to access leverage that is as high as 400:1. In the United Kingdom or the European Union, though, leverage rates – for foreign exchange pairs at least – are likely to go down to 30:1.

Forexfraud Recommended Broker

Trade online safelyPlatform & Tools

The platforms on offer at Trade360 are among some of the best in the business. Most traders at this broker can use MetaTrader 5 for their trading work, which is the latest iteration of the popular platform. It has a vast selection of top features, such as an extended range of charting tools. It ought to be emphasised, however, that those traders who opt for the “mini” account type at this broker will not be able to enjoy access to MetaTrader 5, and will instead have to make do with the previous version – MetaTrader 4.

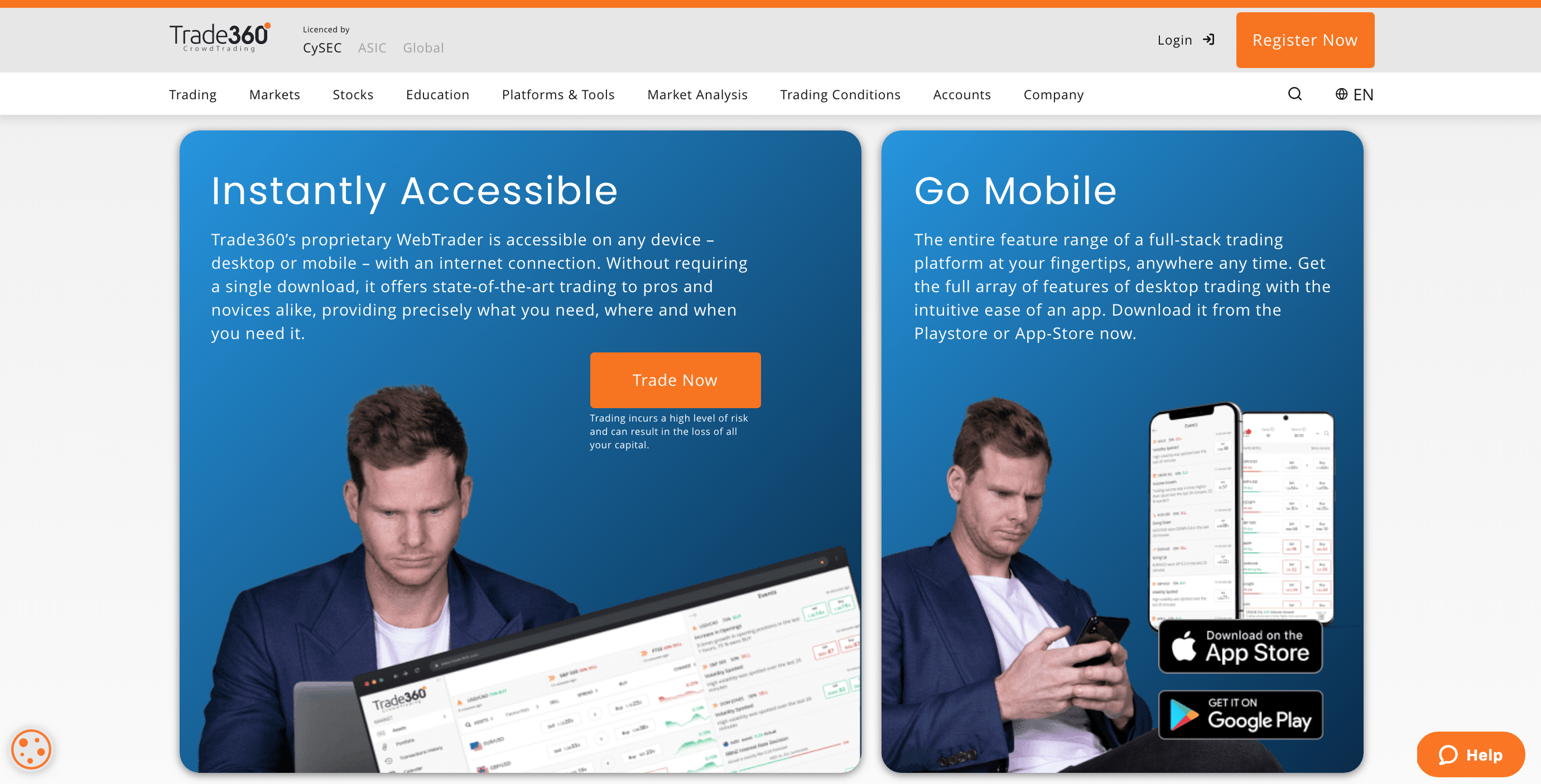

In terms of other tools, the broker provides mobile phone applications which enable trades to be conducted while out and about as well as when at a desk. The applications come with a trend-spotting service, for example, and can notify traders of potential surges. Customised versions are available for each of the two major mobile phone operating systems, Apple’s iOS and Android. The firm’s application won the Best Forex App award at the 2020 Forex Brokers Association awards, too – offering traders a vote of confidence in the service provided.

In terms of other tools, the broker provides mobile phone applications which enable trades to be conducted while out and about as well as when at a desk. The applications come with a trend-spotting service, for example, and can notify traders of potential surges. Customised versions are available for each of the two major mobile phone operating systems, Apple’s iOS and Android. The firm’s application won the Best Forex App award at the 2020 Forex Brokers Association awards, too – offering traders a vote of confidence in the service provided.

Commissions & Fees

As mentioned above, the primary way in which the company makes money is through charging fees on spreads. Overall, the picture for traders looks quite rosy when it comes to the wider commissions and fees structure on offer at Trade360. The firm makes it clear that it does not charge a commission on its CFD stock trades, for example – which does make Trade360 stand out compared to other brokers, some of which do charge. The firm does, however, emphasise on its website that what it describes as “aggressive” stock trading could incur a fee.

In terms of deposits and withdrawals, the company does not charge for either of those account-related processes. However, the broker does state on its foreign exchange trading intro page that a trader may face charges in terms of swaps and rollover fees. They would only arise if a position was left open overnight and the wording was unclear.

In terms of deposits and withdrawals, the company does not charge for either of those account-related processes. However, the broker does state on its foreign exchange trading intro page that a trader may face charges in terms of swaps and rollover fees. They would only arise if a position was left open overnight and the wording was unclear.

Education

Turning to the broker’s education offer, it is important to first of all note that the onus for becoming more acquainted with a trading platform and how to use it is the sole responsibility of the trader. An individual who lacks knowledge about how a specific platform or trading context works ought not to use that platform until they are sure about the procedure. A broker’s educational output should never be relied upon to provide the full range of information required.

Some of the best brokers do provide educational materials which traders can choose to use as part of their research and learning process. Trade360 is one such broker that maintains an extensive archive of educational materials on its website under the section entitled “Education”. Here, traders can find a basic, introduction-level piece on contracts for difference – CFD trading. There is also material available on a range of other topics, such as brief overviews on each of the asset classes available to trade. The material on these pages is suitable for use in conjunction with other educational resources, sourced by the traders themselves.

Forexfraud Recommended Broker

Trade online safelyCustomer Service

In terms of getting in touch to ask a question, traders can, first of all, navigate to the “help centre” at the bottom of the page. There they will find that a lot of questions have already been answered, helpfully organised into several relevant categories. These include admin, finance and tech issues.

The customer service operates 24 hours a day, five days per week. The website is available in more than ten languages, although it is essential to emphasise that the help desk is only available in two.

The customer service operates 24 hours a day, five days per week. The website is available in more than ten languages, although it is essential to emphasise that the help desk is only available in two.

The contact details for the company are listed below. It is worth emphasising to traders that some of the testers of this website found that upon supplying their phone number to the company they began to receive lots of marketing calls on topics such as account upgrades. Traders who wish to avoid this are advised to supply their details only after careful consideration, or to make their contact preferences clear to the Trade360 team.

Final Thoughts

Overall, there is plenty to celebrate about Trade360. Its exciting “CrowdFeed” system may well change the way traders experience the process. The company is undoubtedly open and contactable given the many different ways in which a message can be transmitted to the admin team in the event of any problems. The firm appears to be highly regulated by reputable names, while it also offers an immense variety of account types – perfect for those who want a highly bespoke experience.

As is the case with all brokers, the platform is not perfect. There have been some suggestions that the sales team is somewhat overreaching in the intensity of its contact, while the spread prices are not the most competitive on the market. But, overall, the Trade360 platform is still a good choice for most people who want to get started with trading – or to take steps up – using a modern and efficient broker.

Broker Details

Trade360 is simply a brand name and does not refer to an actual company. The company behind the brand is Crowd Tech Ltd, based in Cyprus. According to the broker, its registration number with the Cyprus Securities and Exchange Commission is 202/13.

On its website, Trade360 carries a succinct – although not highly prominent – risk warning at the bottom of most pages. This risk warning asks traders to take steps to ensure they are fully aware of the risk of loss involved in trading. It specifically mentions the leveraged nature of the contract for difference. Traders are advised to familiarise themselves thoroughly with the way this works before starting.

On its website, Trade360 carries a succinct – although not highly prominent – risk warning at the bottom of most pages. This risk warning asks traders to take steps to ensure they are fully aware of the risk of loss involved in trading. It specifically mentions the leveraged nature of the contract for difference. Traders are advised to familiarise themselves thoroughly with the way this works before starting.

Forexfraud Recommended Broker

Trade online safelyContacts

Trade360 provides traders with a variety of ways to get in touch if there are any problems.

Crowd Tech Ltd states that its registered office is at 116 Gladstonos, M. Kyprianou House, 3rd & 4th Floors, 3032, Limassol, Cyprus.

If the question the trader wants to ask is not listed in the help section, an online form can be used to send a message to the customer service team. Alternatively, the trader can make a phone call using the number +357-25-030-622. (+357 is the country code extension for Cyprus.)

A significant plus point of Trade360 is that it has an extensive range of other contact method choices, so traders will be able to select one that suits them. A fax can be sent to the number +357-25-281-710, for example, while there is also a live chat service that customers can use.

Compare Trade360 with other approved brokers

|  |  |  | |

| Regulation | CySEC | ASIC, MiFID, FSA, FSCA | FSPR | FCA, CySEC, FSCA, Seychelles FSA, Labuan FSA |

| Customer Support | email, phone, live chat | email, phone, live chat | email, phone, live chat | email, phone, live chat |

| Trading Platforms | MT4, MT5, WebTrader, Mobile Apps | MT4, MT5, Mobile App | MT4, MT5, WebTrader, Mobile Apps | MT4, MT5, WebTrader |

| Minimum Deposit | $450 | $100 | $200 | $100 |

| Leverage | Up to 1:500 | 400:1 | 1:500 | Tickmill Ltd 1:500, Tickmill Europe 1:30 (retail) & 1:300 (pro), Tickmill UK 1:30 (retail) |

| Total Markets | 1062 | 1260 | 182 | 637 |

| Total Currency Pairs | 49 | 55 | 72 | 62 |

| Total Cryptocurrencies | 0 | 17 | 0 | 9 (* CFD Crypto trading is available only to Professional Clients under Tickmill UK.) |

FAQs

What are the deposit options for Trade360?

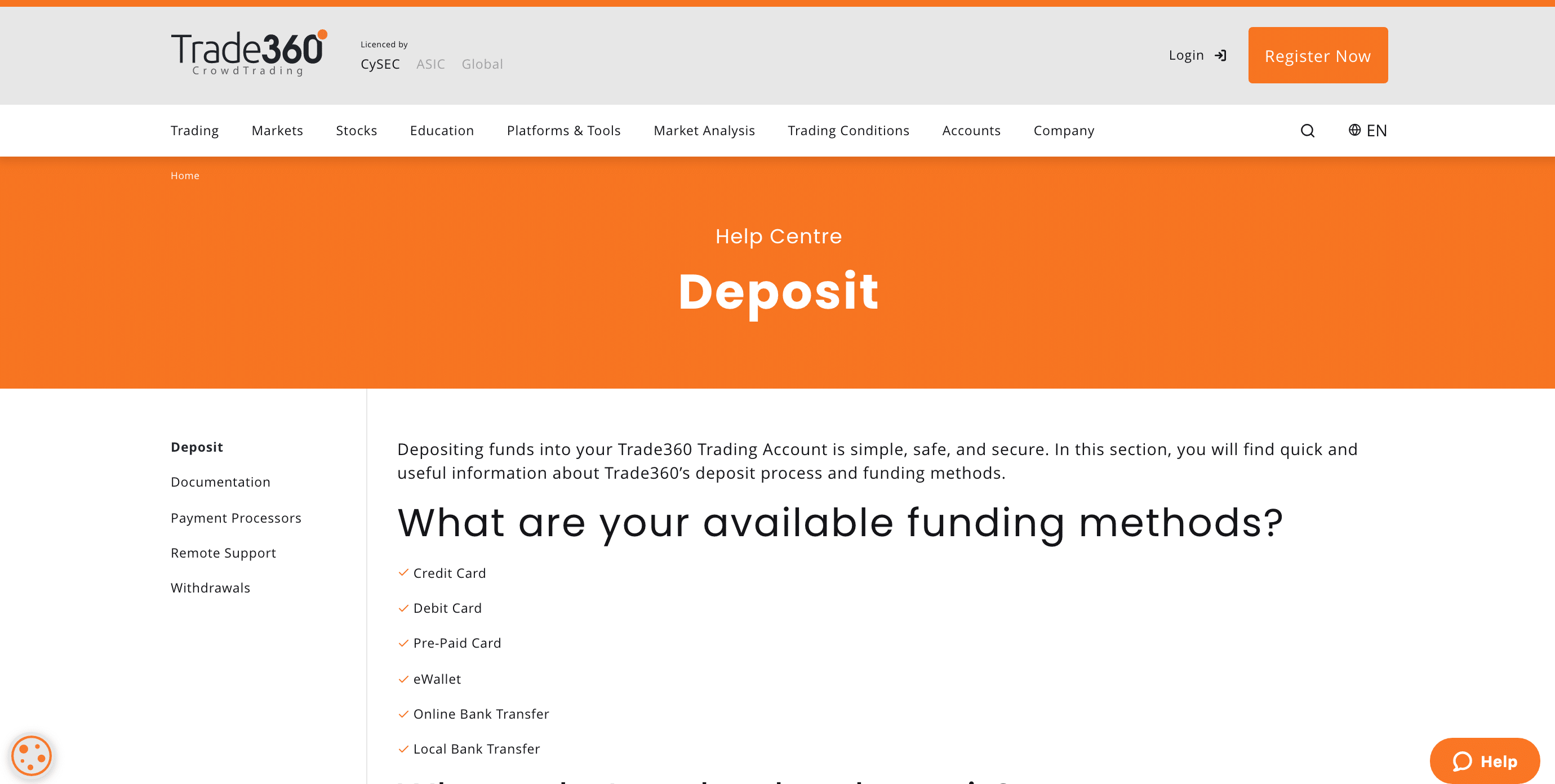

Traders looking to put down a deposit with this broker will find there are plenty of options. For many traders, the most convenient way to proceed is with a credit or debit card transaction. That can be done via the account interface on the Trade360 website and there is a secure payment page for the purpose. The same process applies to some of the other modes of deposit-making that are on offer, such as pre-paid card deposits, online bank transfer and e-wallet transactions. For a local bank transfer, however, more work – such as making the relevant order for a transaction at the bank will be required.

What bonus terms does Trade360 offer?

There is not an extensive amount of information available at this broker about the bonus terms on offer. It appears that bonuses may be subject to change and that traders who are looking to participate in a bonus scheme ought to keep checking to see whether the broker has any promotions on at the moment. It is worth emphasising that only traders who are not subject to the rules of the Cyprus Securities and Exchange Commission (or CySEC) regulator can engage in bonus programmes offered by Trade360.

Does Trade360 offer an Islamic account?

Yes, Trade360 does offer an Islamic trading account. These sorts of accounts are becoming increasingly popular as brokers move to ensure that there is a fair and inclusive trading environment in place across the sector. The rules for an Islamic trading account are slightly different to the usual trading rules. Islamic accounts need to be compatible with the aspects of Sharia Law that deal with finance and money. A trader who wishes to open an Islamic account is advised to consult with Trade360 to find out what conditions will apply to their account because they can vary.

How do I withdraw money from Trade360?

Withdrawing money from Trade360 requires going through a series of documentation provision processes. The information about what is necessary is located on the broker’s website. Once that is completed, traders can then make a withdrawal request. The broker aims to action withdrawals within three working days.

Other people have looked at this broker review:

Please be advised that certain products and/or multiplier levels may not be available for traders from EEA countries due to legal restrictions.

Safest Forex Brokers 2025

-

-

-

-

-

4.8-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

5Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts