About TradeMarkets

TradeMarkets is a financial services provider operated by SEMANTIC FUND MANAGERS (PTY), a limited liability company incorporated under Republic of South Africa laws. The company is regulated by the Financial Sector Conduct Authority of South Africa, and they have recently entered online trading with some ambitious objectives. It seems that protecting customer funds, ensuring a tailored customer experience, and having a contribution when it comes to educating traders, are its top priorities as a brand in this sector.

Backed by a team of experts with a long track record in finance, TradeMarkets has the potential to offer a good service from day one to all types of traders. Because the trading infrastructure looks appealing at first glance, we decided to dig deeper and find out more about this provider.

Products and Trade Offers

When you open a trading account with TradeMarkets, choosing a suitable account type for your needs is the first step. Note that it’s currently possible to choose between Silver, Gold, Platinum, and VIP.

The company has everything set, so traders with limited or abundant capital available for trading can find the right fit. It’s good to see that even small account holders are not neglected. They have access to an account manager, market updates, and even VIP services.

Account upgrades are rewarded with tighter rates, and more educational resources, in exchange for bigger deposits. Also, there is an account suitable for beginners who want to start small until they achieve consistency.

TradeMarkets asset coverage

At a time of elevated volatility across major asset classes, it would be better for traders to consider broader diversification capabilities. Fortunately, TradeMarkets is prepared for this environment, offering a wide range of assets to trade. They provide a range of markets, including indices, forex, CFDs, metals, stocks, and energies.

It’s possible to buy or sell-short assets such as currency pairs, commodities, and cryptocurrencies, among other options, taking advantage of excellent execution, multiple transaction types (market and limit orders), and decent trading costs.

Platform features and tools

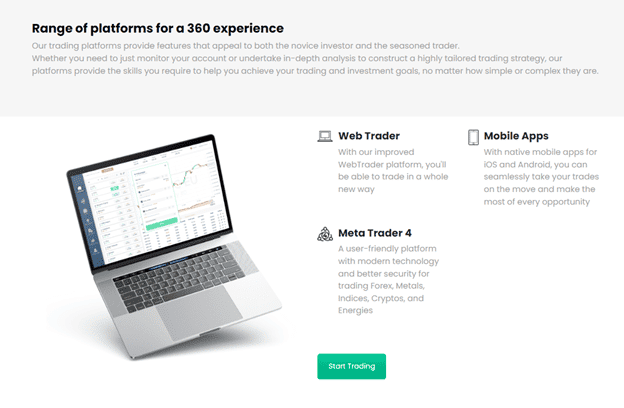

Another requirement for most traders is the assortment of platforms covered. TradeMarkets sticks with its diverse approach and offers a range of solutions, hoping to satisfy all customers. TradeMarkets uses MetaTrader4 (MT4), a Web Trader platform and you can also trade on the go with their mobile app. The MT4 platform can be installed on any device, and users benefit from technical analysis tools, expert advisors, and lightning execution.

WebTrader has similar capabilities, except for automated trading, but it is a browser platform. You can use it on both desktop and mobile with no installation requirement, benefiting from the same instruments, even if you switch from one device to another.

Our summary

Faced with competition from other financial providers, TradeMarkets comes with a highly customisable trading offer, updated with some of the latest trader demands. This is a regulated brand, so there’s no question about its integrity. Also, it seems to be a company aware traders need access to competitive terms. Even small account holders get professional tools and features, which is uncommon in the broader market.

Please be advised that certain products and/or multiplier levels may not be available for traders from EEA countries due to legal restrictions.

Safest Forex Brokers 2025

-

-

-

-

-

4.8-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

4.9-

-

-

-

-

5-

-

-

-

-

5Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox

Stay up to date with the latest Forex scam alerts