In our last report on ForexFraud.com here we looked at the key USD breakout levels for major spot rates, with The Market Chartist view for the underlying USD bull trends to extend.

We now examine the longer-term targets for EURUSD, GBPUSD and USDJPY through mid- April.

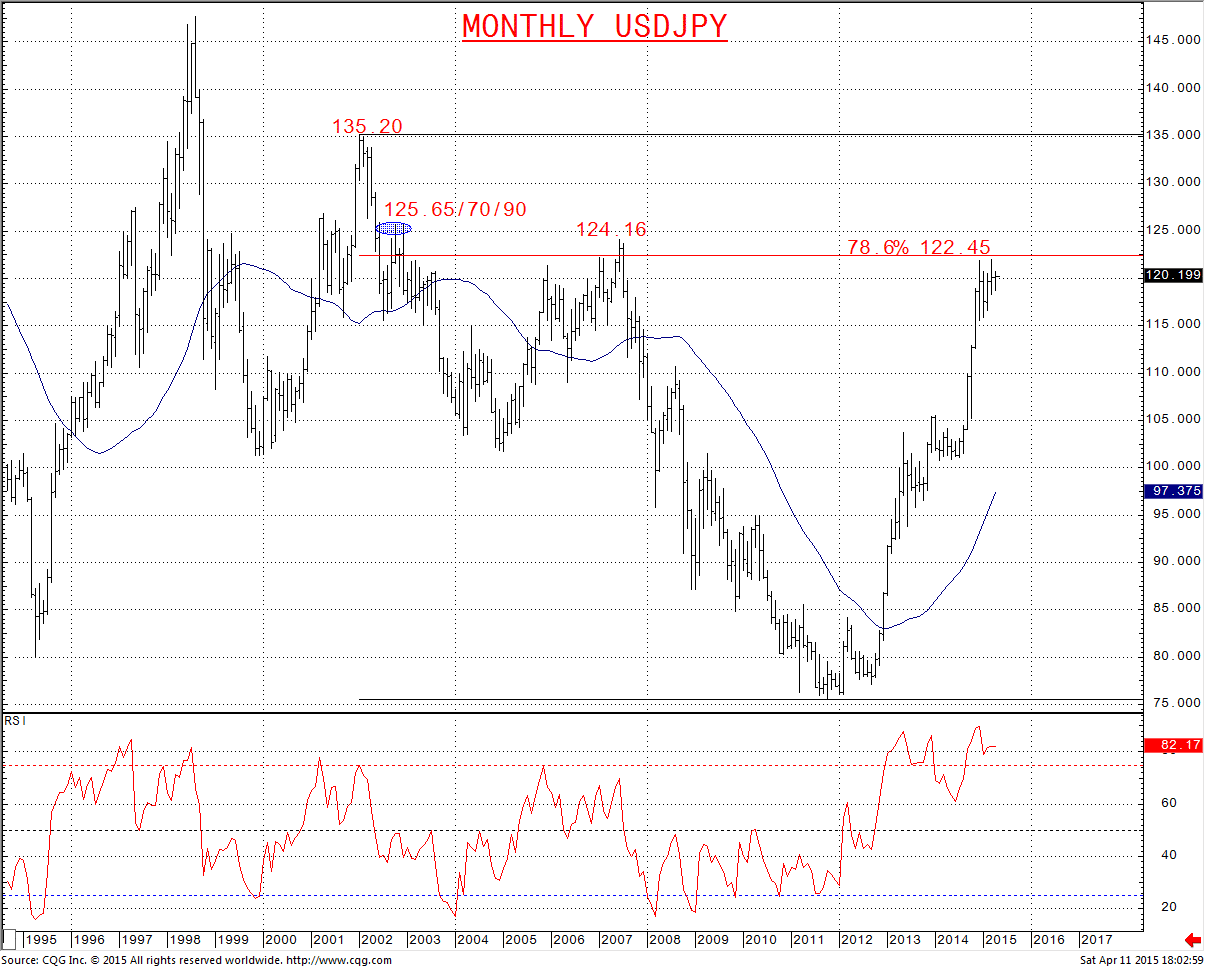

EURUSD

- With key supports at 1.0713 and 1.0613 surrendered last week, the bearish bias is back to the March cycle low at 1.0462.

- A break here opens risk down to a monthly chart support from 2003 at 1.0335.

- Key targets, however, are the psychological/ option target at parity, 1.0000, then the 78.6% retracement of the entire 2000-2008 bull run at .9900.

Monthly EURUSD Chart

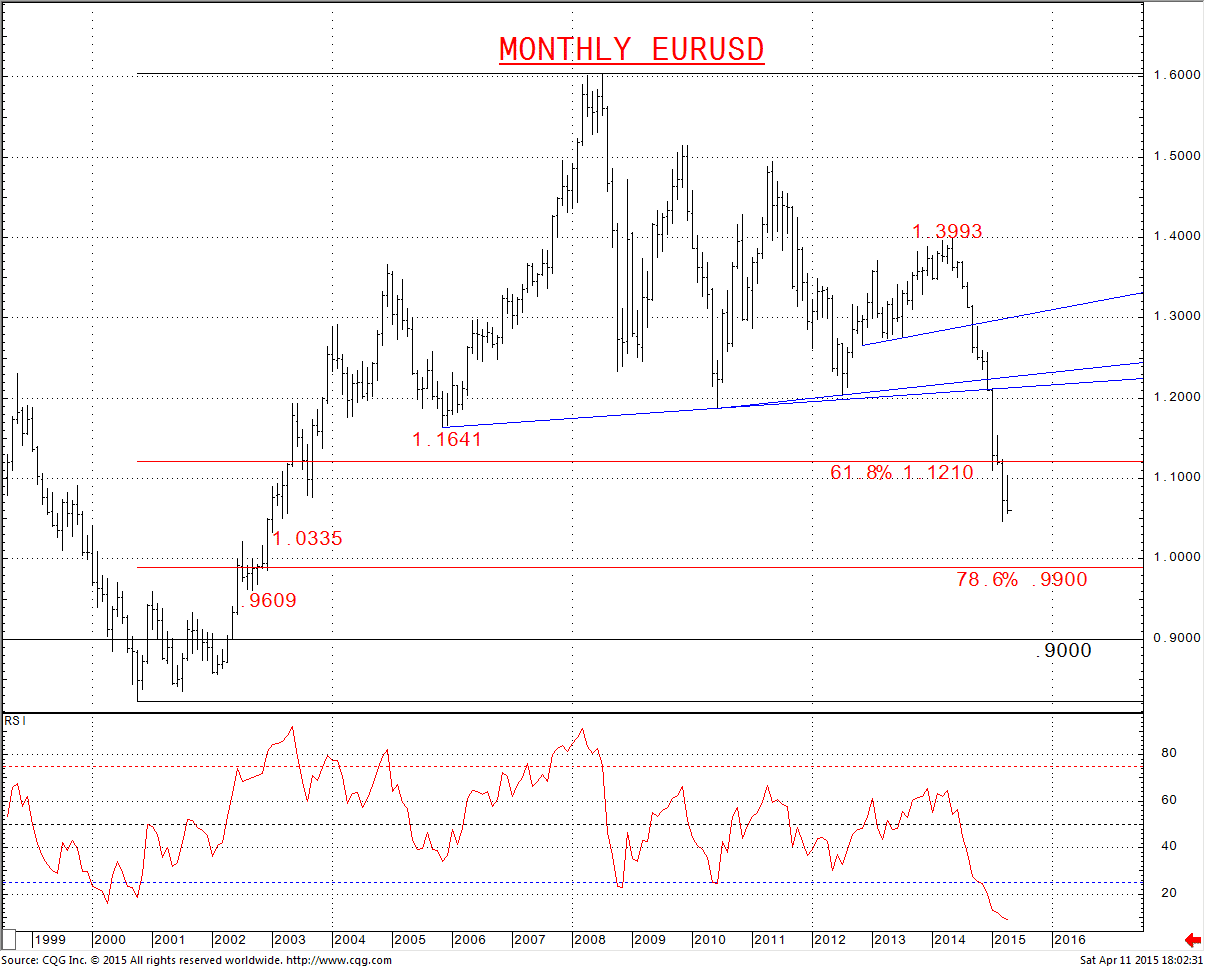

GBPUSD

- A break below the cycle low set in March at 1.4634, to the lowest level for Cable since June 2010 and the risk is through this new low at 1.4587.

- Below quickly aims for the psychological/ option target at 1.4500.

- The threat through mid- April is lower, to the 78.6% retracement of the 2009-2014 rally range, 1.4295 and the 2010, multi-year low, 1.4228.

- Risk for a deeper correction is a further option / psychological target at 1.4000.

Monthly GBPUSD Chart

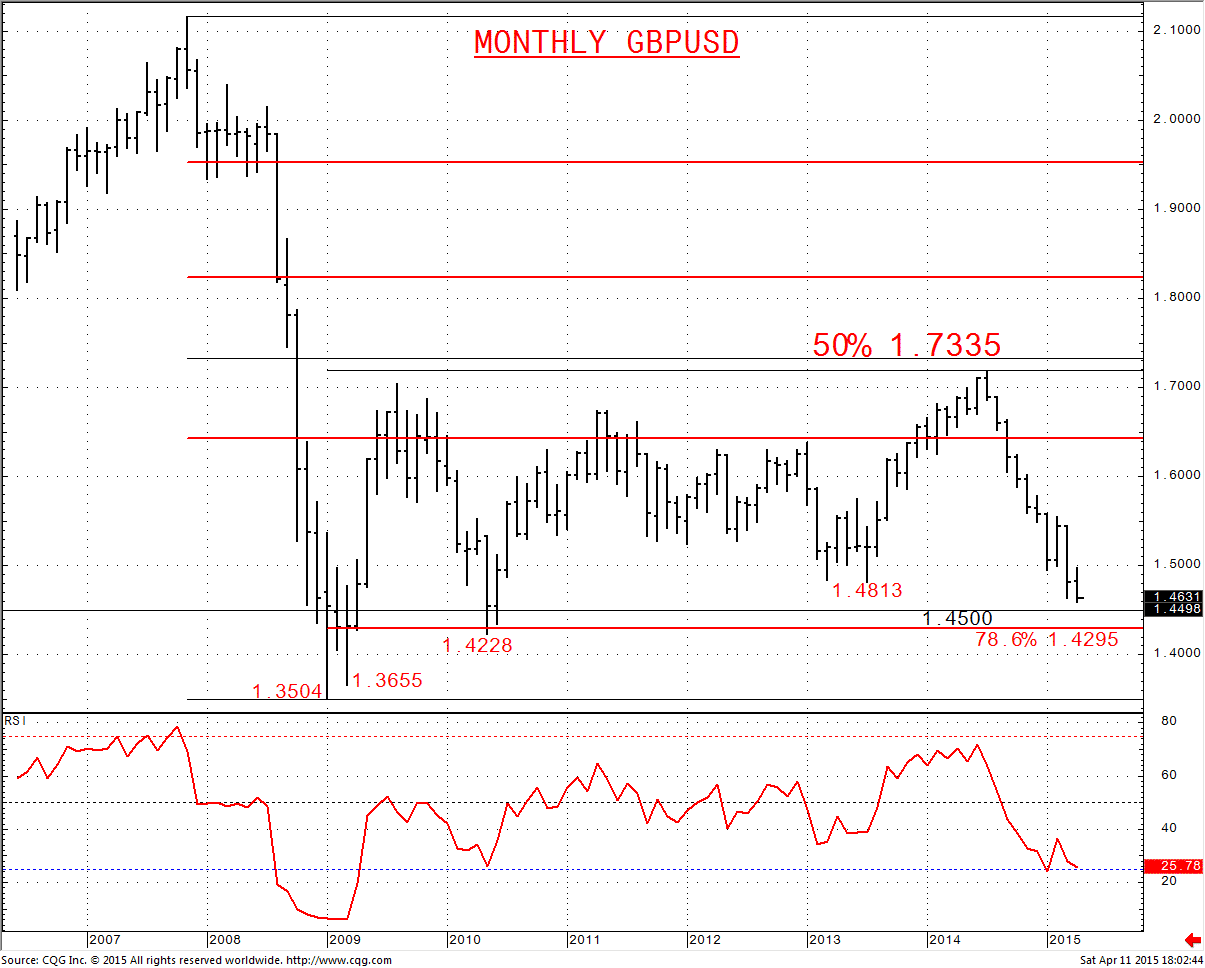

USDJPY

- Having rejected a more negative theme in March with the rebound above 118.15, we see a positive tone within a range theme, with USDJPY poised for a more bullish signal again above 121.20.

- Above 121.20 aims higher to target the new March 122.02 peak. Above here aims for a key long term retracement, 78.6% level of the entire 2002-2011 sell off at 122.45.

- Overshoot risk into mid-Q2 is higher for the twelve year high from 2007 at 124.16.

Monthly USDJPY Chart