- When we last looked at GBPUSD and EURUSD on 28th January we highlighted a still bullish tone for GBPUSD and an positive EURUSD range theme.

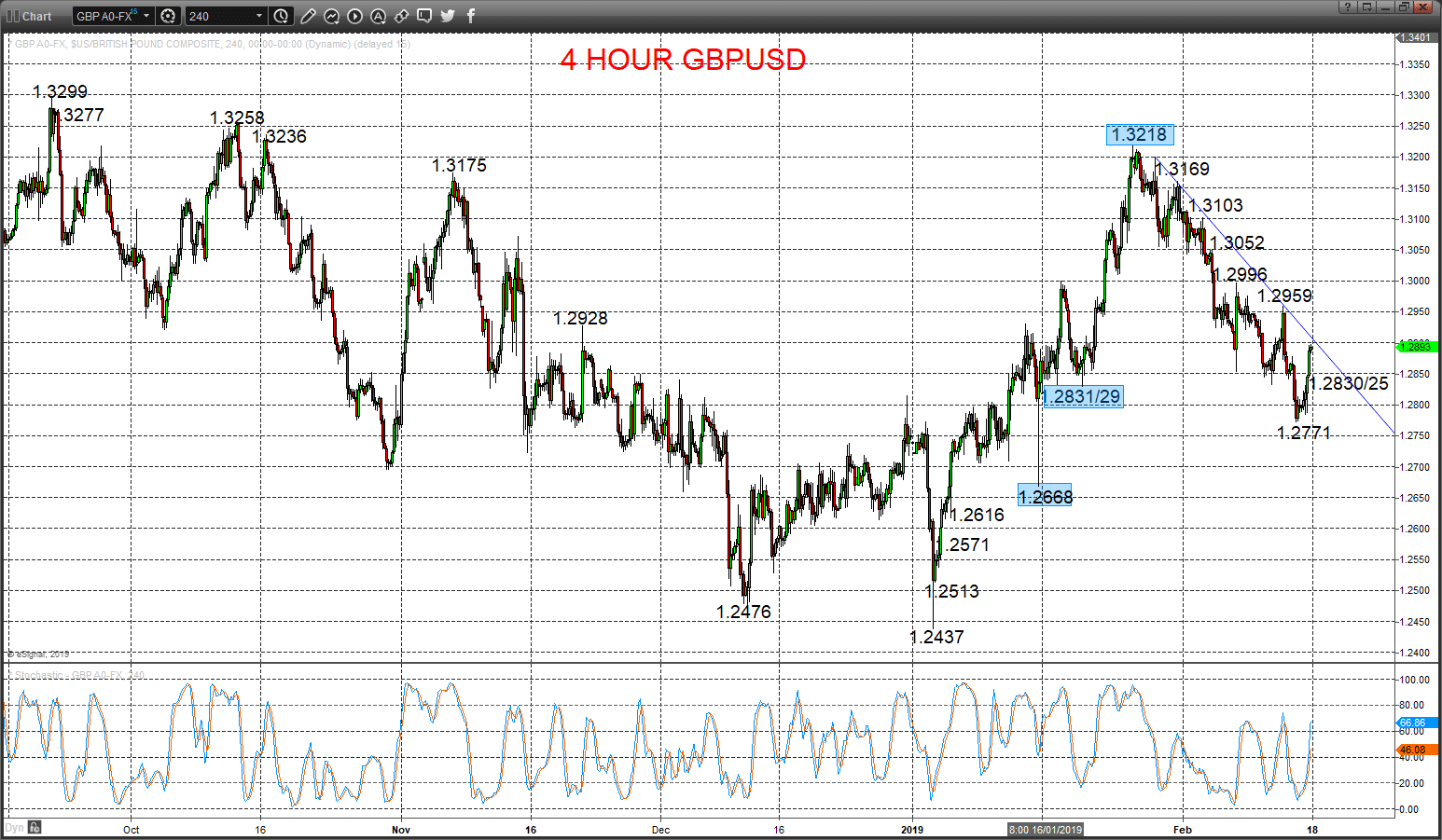

- The growing threat for a potential No Deal Brexit through early February has seen a broad selloff in the Pound, with the GBPUSD Forex rate breaking key 1.2831/29 supports to neutralise the bull trend (with risks skewed lower for the balance of February).

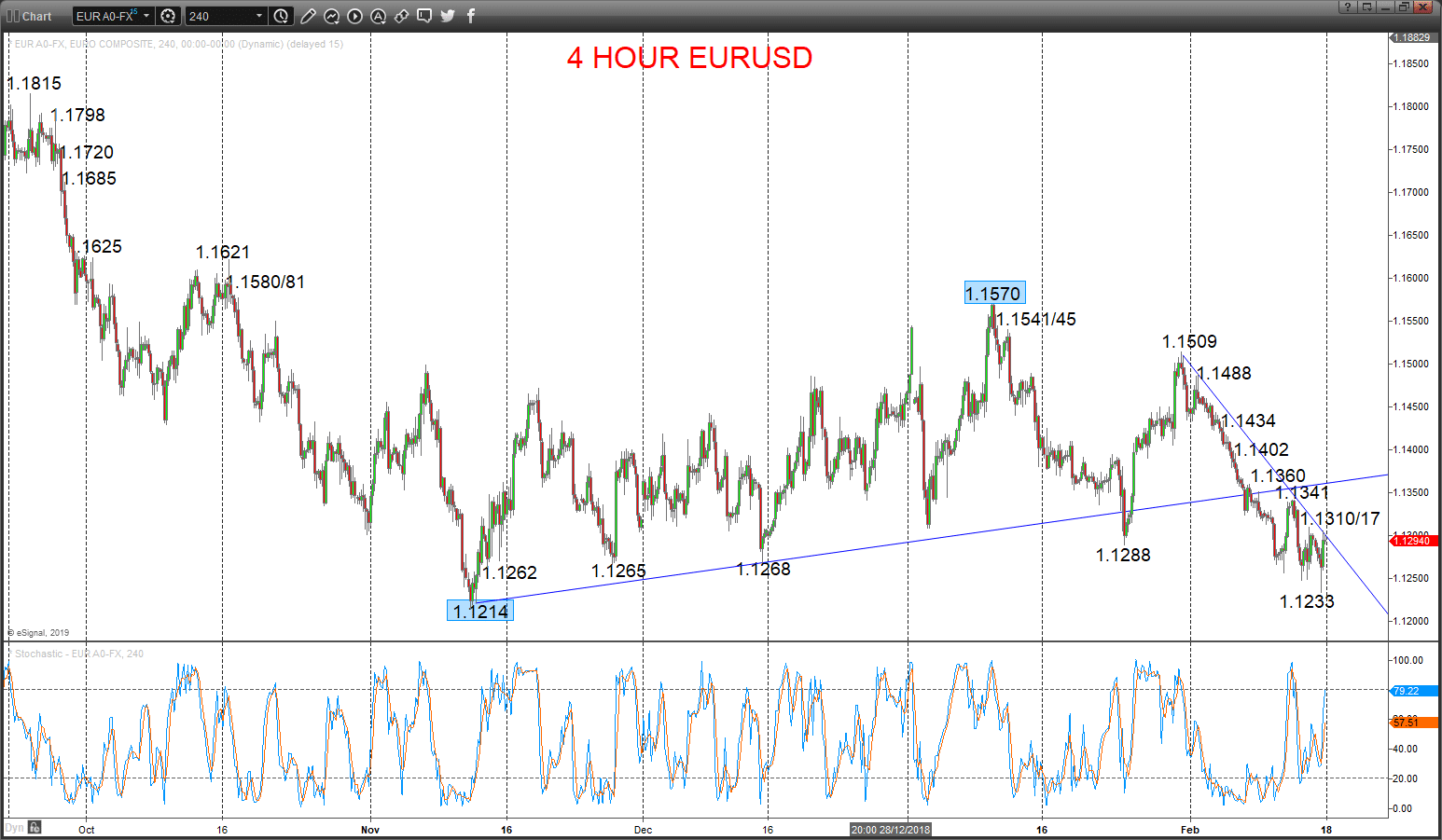

- The EURUSD currency pair remains within a broad, intermediate-term range we define as 1.1214 to 1.1570, but with negative February price action leaving the skewed risks for an intermediate-term shift to bearish through the lower support level.

GBPUSD bear forces intact

A rebound Friday we view as corrective in nature, whilst below 1.2959, with bear forces intact from the entire negative, February price action and Thursday’s surrender of the key 1.2831/29 area (to exactly hit our 1.2771 target), leaving risks lower into Monday,

The mid-February plunge through the key 1.2831/29 supports set an intermediate-term range we see as 1.2668 to 1.3218, BUT with risks skewed towards the lower level.

For Today:

- We see a downside bias for 1.2830/25, then 1.2771; break here aims for 1.2720 and maybe key 1.2668.

- But above 1.2959 opens risk up to 1.2996.

Intermediate-term Range Breakout Parameters: Range seen as 1.2668 to 1.3218.

- Upside Risks: Above 3218 sets a bull trend to aim 1.3299 and 1.3473.

- Downside Risks: Below 2668 sees a bear trend to target 1.2437 and maybe towards 1.2000.

Resistance and Support:

| 1.2959* | 1.2996** | 1.3052** | 1.3103 | 1.3169* |

| 1.2830/25 | 1.2771 | 1.2720 | 1.2668*** | 1.2616 |

4 Hour GBPUSD Chart

EURUSD downside bias, despite another bounce

Another push lower Friday just below 1.1256/47 supports to 1.1233, but reluctant to test the now key 2018 cycle low at 1.1214, then a rebound but still capped at modest 1.1310/17 resistance, thereby sustaining negative forces from last week’s failure from the 1.1341/60 resistance area, plus from the breaks below the previous key 1.1268/62 support area, keeping risks lower for Monday.

We see an intermediate-term range theme as 1.1214 to 1.1570, BUT with risks for an intermediate-term bear shift below the lower level.

For Today:

- We see a downside bias for 1.1233; break here aims for the key 1214 support, 1.1200, then 1.1177 and maybe 1.1151.

- But above 1.1310/17 targets 1.1341/60, which we would look to try to cap. Above aims for 1.1402.

Intermediate-term Range Breakout Parameters: Range seen as 1.1268/62 to 1.1570.

- Upside Risks: Above 1.1570 sets a bull trend to aim for 1.1621, 1.1815 and 1.2000.

- Downside Risks: Below 1.1268/62 sees a bear trend to target 1.1119, 1.1000 and 108.39.

Resistance and Support:

| 1.1310/17 | 1.1341/60** | 1.1402 | 1.1434 | 1.1488* |

| 1.1233 | 1.1214*** | 1.1200 | 1.1177 | 1.1151 |

4 Hour EURUSD Chart