There is a lot to learn when you are new to forex trading. Choosing the right forex or ‘contract for difference’ (CFD) broker is one of the first things you will need to address, and one of the most important. If you are a brand new forex trader, you will want to find a safe, regulated broker. When regulated brokers are accused of breaking the rules, enquiries are launched against them, and they may have to pay fines or face far more severe consequences, such as the revocation of their licence, or even criminal charges.

There are offshore brokers who may or may not be regulated locally, but nevertheless provide a service some traders find attractive for various reasons. Offshore CFD brokers may be of particular appeal if you are unable to trade CFDs legally in your own country; if that is the case you should also check whether you are even permitted to trade them elsewhere. US residents, for example, may be hoping to trade forex with leverage, which is not permitted in the US. Current laws also prevent US citizens from trading CFDs internationally; many offshore brokers will therefore reject sign-ups from US clients.

In this article we will discuss the difference between regulated, unregulated, and offshore brokers, why you might be tempted to forex trade offshore, and what the drawbacks are.

Regulated vs Offshore vs Unregulated

Generally speaking, we advise forex traders to use a fully regulated broker with a licence issued by a reputable regulating body, such as the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC) in Europe, or the Financial Industry Regulatory Authority (FINRA) in the US. There are, however, many international brokers who are regulated outside of Europe, the US, and the UK by smaller local entities who may not be as stringent in what they require of brokers, yet offer some level of protection. There are also unregulated brokers operating in offshore locations, with no oversight from any governing body.

Offshore forex brokers are often licensed by local regulators in countries such as the Seychelles or Vanuatu to improve their trustworthiness. While this offers some level of protection — and a third party to whom you can make a complaint — it is likely the degree of monitoring and oversight, as well as the rules imposed on these brokers, will be far less than for brokers in regions such as Europe or the US. They may, for example, be able to offer much higher leverage, which appears to be a good thing, but can actually be very dangerous for inexperienced traders, as it means they could lose a lot of money very quickly when the market goes against them.

For this reason, we strongly advise new traders to only use fully regulated brokers licensed by well-known and trusted governing bodies, and avoid high leverage. More experienced traders may wish to use offshore brokers and take advantage of high-leverage offers, but should remain fully aware of the risks. As most traders know, experience does not protect you from losing large sums of money in forex trading; it just becomes a little less likely.

Recommended Offshore Brokers

As we have already stressed, beginner traders should always avoid offshore brokers; even experienced traders who want to trade with offshore brokers should proceed with extreme caution, and ensure they are fully aware of the risks involved. That said, if you are determined to use an offshore broker, some are more reputable than others. If you have done your research and are still interested in using offshore brokers, here are our recommendations.

| Broker | Features | Min Deposit | EURUSD Spread | ||

|---|---|---|---|---|---|

Your capital is at risk

US Clients: No Regulated : Yes Your capital is at risk

US Clients: No Regulated : Yes

|

|

$5 | From 0.0 pips | ||

|

|

$100 |

Sign

Up

69% of retail investor accounts lose money when trading CFDs with this provider.

|

|||

Your capital is at risk

US Clients: No Regulated : Yes Your capital is at risk

US Clients: No Regulated : Yes

|

|

Starting from $10 on Standard and $200 on Professional accounts | As low as 0 on Raw Spread and Zero accounts | ||

|

|

|||||

How to Register With an Offshore Broker

Many of the brokers above are also regulated in Europe, so if you specifically wish to trade offshore, you will need to select offshore regulation when signing up. Signing up with an offshore broker is not much different to signing up with any other broker. In fact, depending on the broker, you may find there are fewer checks and verifications, making the sign-up process even easier than with a broker in your own country.

For example, if you sign up with XM, you have the choice of opening a real or a demo account.

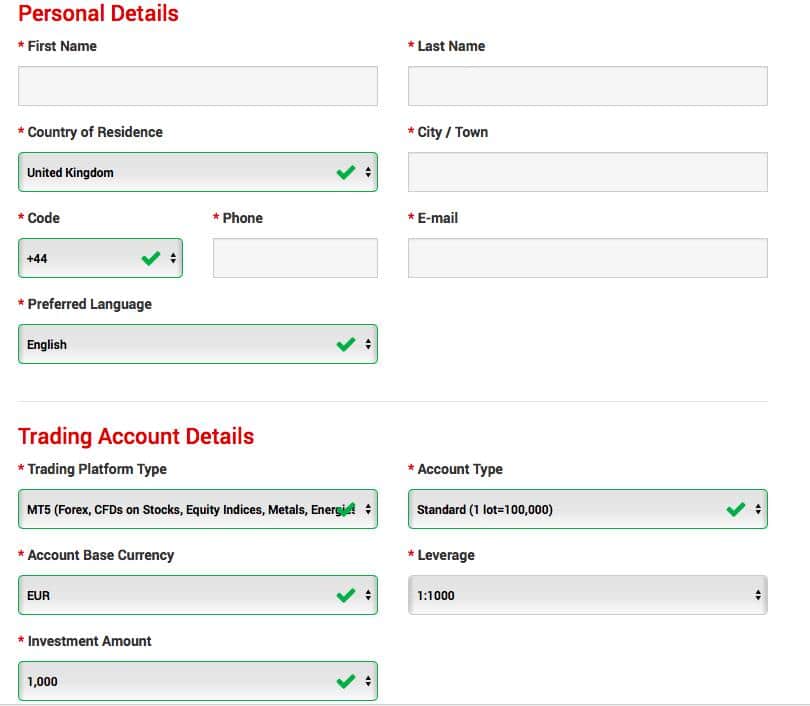

If you choose a demo account, you can get started in minutes by simply filling in the following details. You will have the opportunity to select a base currency, a virtual fund amount (from $1,000 to $5 million), and set your preferred leverage (up to 1:1,000). You will also be required to select your account type and trading platform.

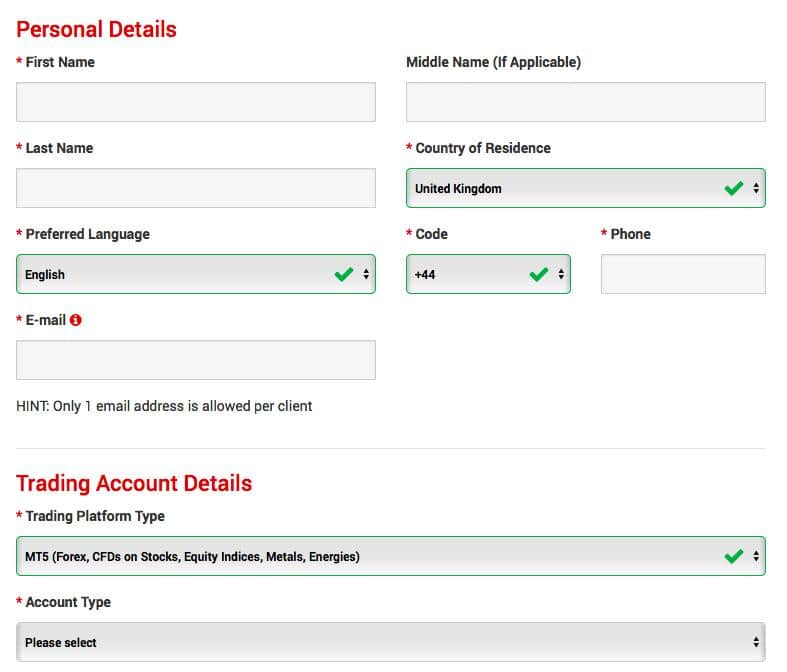

Opening a live account is also quite simple. Simply select ‘live account’ and fill in your personal details, along with your preferred trading platform and account type (you will need to carefully review the account types in advance to see which one suits you).

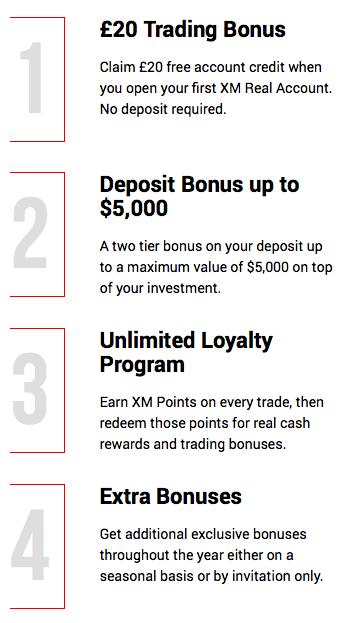

After signing up for a live account, you will need to confirm your account details and deposit your funds. At this point in the process, you will also have the option of claiming any bonus for which you are eligible.

Why Would You Use an Unregulated or Offshore Broker?

The fact unregulated or offshore brokers do not have to follow the same strict rules as European or US brokers may seem like a disadvantage, and when things go wrong, it is. However, many traders can also view this lack of rules as an advantage.

One obvious example is leverage. Leverage allows you to trade with more capital than you have, which means you do not need a lot of money to trade and can potentially achieve bigger profits (as well as bigger losses if your trade goes against you). Leverage is strictly controlled by various governing bodies. In the EU, for example, the absolute maximum leverage you can access is limited to 1:30 when forex trading, meaning you may be offered much less than that. Unregulated and offshore brokers can, however, offer much greater leverage. They may offer 1:500, 1:1,000, or even more.

These brokers can also offer deposit bonuses, which are banned in Europe and the US. Strict governing bodies do not like the idea of brokers offering sign-up incentives, believing it can lead to unethical practices, so regulated brokers in those countries will not offer any kind of sign-up bonus. Offshore brokers, however, are free to tempt traders with whatever incentives they wish, so may well offer deposit bonuses, or even no-deposit bonuses, loyalty schemes, and other perks.

Unregulated brokers may also offer lower start-up costs, for example by allowing accounts to be opened with a very low deposit. Be aware that when something appears cheap, it often means costs are being passed on to you as a client in some other way, for example through higher commissions or other fees.

The Drawbacks of Using Offshore and Unregulated Brokers

There are various dangers involved in using an offshore or unregulated broker, especially if things go wrong. If you have a problem with the broker, you will receive little or no protection from the regulator. It is also possible for an unregulated broker to go bankrupt, taking all the funds you have invested with them. If the broker is slow to pay out your funds when you withdraw, or charges you extra ‘hidden’ fees that were not mentioned up front, you have no third-party authority to complain to, and you cannot threaten to have their licence revoked if they never had one in the first place.

If you use a locally regulated offshore broker, you do have some recourse if things go wrong, but you will be dealing with a foreign entity in a distant region, possibly in a language you do not understand. Because local regulations are often less strict, you may find the regulator is unwilling or unable to do anything about your situation. You may even be told your broker is following the rules and has done nothing illegal, even though you may feel they are acting unethically or unfairly.

Investing offshore is a dangerous game to play, especially if you choose a completely unregulated broker. We advise you to stick with licensed and regulated brokers in your region wherever possible, and always if you are a new or inexperienced trader. If you are an experienced trader and feel the advantages of an offshore broker outweigh the risks, you can certainly consider it, but be aware of the many drawbacks of using an offshore broker before taking the final step and signing up. In the end, you have no real rights if you deal with an unregulated broker. If anything goes wrong, there is nothing you can do about it. You may use their services if you wish, but you do so at your own risk. Stay safe, not sorry!