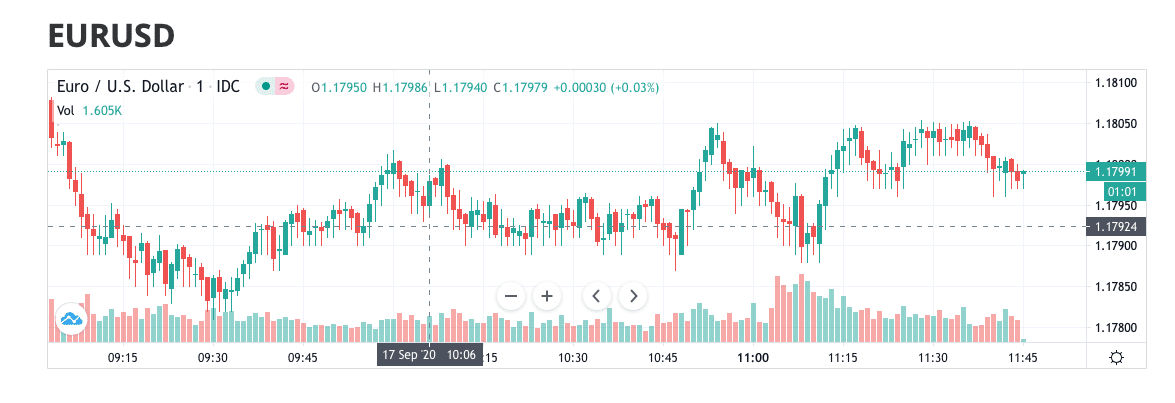

The euro is floundering in the forex markets at the moment – and this trend was emphasised on Wednesday and into Thursday after the Federal Reserve meeting. At that meeting, policymakers on the Federal Open Market Committee recommitted to their plans to target inflation and attempt to bring up employment. They also refused to change long-term ultra-low interest rate plans, and instead said that they had confidence in the prospect that the US economy would recover. For the euro, this was a real problem. It found itself reaching a new low point for the whole month, hitting 1.1737 at one stage. According to strategists, the price charts are offering a mixed picture of why this is happening.

Some have suggested that the euro’s recent reversal in fortunes is nothing sinister. The EUR/USD pair did, after all, reach an annual high point of 1.2011. Some analysts suggested that the move back down towards the 1.17 level is not an overall reversal but instead merely a sign of the pair’s uptrend running out of steam. However, there is also some evidence to suggest that there are some underlying downtrends in the pair. The Relative Strength Index (RSI) is showing that further dips could be on the horizon.

Analysts also suggested that if the currency does drop in value, it could eventually find itself looking at the 1.1600 to 1.1640 range. In a worst-case scenario, it could even go to the 1.1510 to 1.1520 area. In terms of the economic calendar, meanwhile, this currency pair is also facing a busy few days.

Friday morning will see some information released about the Eurozone’s ‘current account’ figures. This is due out at 8 am GMT.

This will be preceded by a range of other key indicators.

- German producer price index figures for August will be out at 6 am GMT, and they are due to show a month-on-month change from 0.2% to -0.1%. Year on year, however, these are expected to show a change from -1.7% to -1.4%.

- Italian industrial sales figures for July are expected to show a month-on-month change from 13.4% to 4.2% – a significant drop. These are due out at 8 am GMT.

- Looking ahead to Monday of next week, the German Bundesbank will release its monthly report at some stage over the day. There is currently no precise time for this yet.

- German consumer confidence figures for October will be out at 6 am GMT. These were last recorded at -1.8.

- Looking ahead to Tuesday, September’s preliminary consumer confidence survey will be out at 2 pm GMT. This was last recorded at -14.7. At present, there is no indication of where this is likely to go next

- Wednesday will see a purchasing managers’ index (PMI) release for the whole of the Eurozone. This will cover September and will again be preliminary. It will be released at 8 am GMT, and was last recorded at 50.5.

- A range of country-by-country releases of the same metric will also come out across the morning.

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox