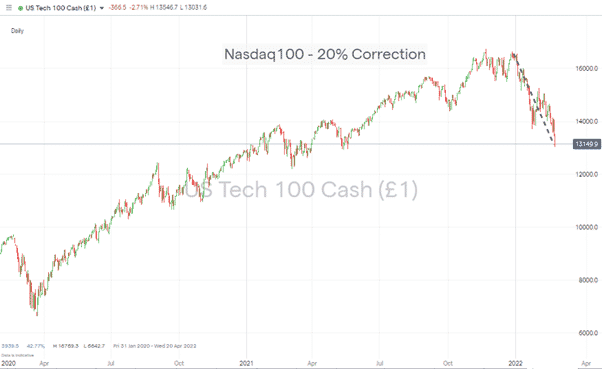

Between 28th December 2021 and 24th February 2022, the Nasdaq100 index gave up a staggering 20.30% of its value and now ticks the box according to the generally accepted definition of a bear market.

“A 20% loss in the Dow Jones Industrial Average, S&P 500 or Nasdaq 100 index over 2-3 months.”

Nasdaq 100 Index Price Chart 2020 – 2022 – Bull Market Confirmation

Source: IG

Those who have been in positions on the way down will likely confirm that it’s felt like a bear market for longer than that – the painful slide in tech stock prices feeling like a death from a thousand cuts. But it is what it is, and the question for many is what to do now?

Answering that question depends on your view of the military conflict in Ukraine and even your take on how inflation and higher interest rates might impact the economy over the long term. More importantly, it requires a realistic assessment of your situation and attitude to risk. Then it’s a time for not panicking and remembering that it is possible to make profits from a market sell off.

How to Profit from a Market Sell-off

If you’re approaching the situation with no current holdings and think stock prices will continue to tumble, then there is the option to trade with the trend and sell short the market.

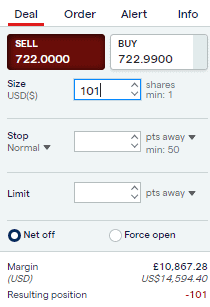

1. Short CFDs

CFDs (Contracts For Difference) offer functionality that traditional share-buying services do not. They can be used to make gains from falling prices as it’s possible to sell at one price level with an understanding that when you buy that short position back, you’ll book a profit or loss depending on whether the market went down or up.

How To Sell Short Using An Online Broker

Source: IG

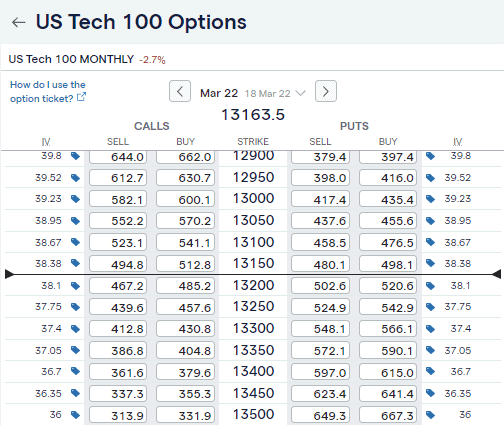

2. Buy Put Options

Options are derivative instruments that allow but do not oblige the holder to carry out a transaction at a future date. Buying Put options offers you the right to sell that market at a certain price. If the underlying market price is lower than the strike level of your options, your profit will be the difference between those prices.

If the price doesn’t go your way, there’d be no incentive to exercise them. In this instance, your options will expire as worthless, leaving the premium you paid to buy them in the first instance as the loss on the trade.

S&P 500 Index Options Markets Monitor – March 2022 Expiry

Source: IG

Derivative instruments are high-risk, but options markets were initially developed to help institutional investors manage risk. With billions of dollars of long equity positions on their books, big-money managers use options to hedge their positions against the risk of a market crash.

Good online brokers such as IG now offer option markets to retail investors, and you don’t need to have an existing portfolio to trade them. ‘Naked’ positions, where you trade options rather than use them to hedge, is an increasingly popular way to profit from market sell offs.

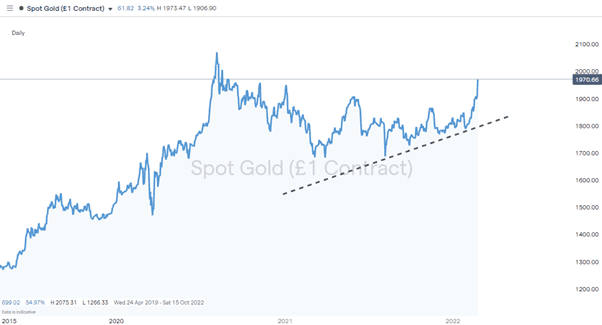

3. Buy Safe Haven Assets

Assets such as gold that are considered ‘safe haven’ assets can see their value rise even if the rest of the market is selling off. The US dollar is also regarded as a safe haven asset thanks to its role as the world’s base currency so that trading forex pairs can offer returns during times of heightened geopolitical risk.

Gold Price Chart 2019 – 2022 – A safe haven asset rising in price

Source: IG

4. Adopt Market Neutral Strategies

Long-short strategies which profit from the respective price move of two similar stocks are market neutral. If you own a stock that you thought you’d never sell, then short selling a competitor which you feel has less promising prospects is a way to hedge against the broader market falling in value. Whilst the hedged position is in place, the returns on the strategy will be based on the differential between their two stock prices.

5. Buy The Dips

Bear markets are a time when the standard risk warning that “previous price performance isn’t a guarantee of future returns” really hits home. However, historical data points to equities being a sound long-term investment. Market corrections tend to be dramatic. Short, sharp price falls can cause panic and a rush for the door, just at the time when a cool head could be looking to buy the dips. It can be more challenging for traders who are already “all-in” to take advantage of these situations. Still, those approaching the situation with long cash could find bargains appear during the shakedown.

6. Hold Tight

Selling out of positions in a “dash for cash” is an obvious option but doing so at the bottom of the market can mean investors miss out on any rebound. Sitting tight and weathering the short-term noise isn’t easy and will largely come down to your assessment of risk.

The most dramatic market sell-offs occur when investors are forced to sell positions to avoid going bust. It is a real risk for hedge funds and other investors who trade using leverage. When that happens, stocks become an ATM, and a downward spiral comes into play with lower prices causing increased selling, causing lower prices and more selling.

The prospect of higher interest rates and war in Ukraine has caused the sell-off. Few might be willing to second guess the next move of the Kremlin, but the central bankers of the world at least have the ability to fix at least one of those problems. A return to dovish interest rate policy, at least in the short term, would bring comfort to those weathering the storm.

Final Thoughts

Not all options will be available to all traders. Those who are already long in positions showing losses will have a very different approach to someone coming to the market for the first time. For that second group, this could be a rare opportunity to pick the bottom of the market.

The number of different approaches does offer a reminder that panicking is not the only game in town.

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox