The operational “challenges” facing El Salvador’s adoption of Bitcoin as legal tender are still to be fully revealed. For now, there’s an air of excitement. The American cryptocurrency evangelist Brock Pierce was in the country to help with cheerleading as the transition came into place. Even Pierce demonstrated an understanding of the difficulties ahead, saying:

“Like all things, I’m assuming it’s going to be less than perfect at first. But perfection is the enemy of progress.”

Source: Wired

The devout believers of the superiority of cryptocurrencies may be focussing on resolving technical glitches, such as Apps failing to process payments as well as expected. However, there are other factors to consider. One of the major concerns is that the move shifts the risk of price volatility from college educated American geeks trading crypto in their bedrooms to shop-keepers, cleaners, and other more vulnerable citizens of one of Latin America’s poorest countries. Businesses and workers in El Salvador are obliged to accept BTC as legal tender, so their revenues and assets will fluctuate in line with the highly volatile global price.

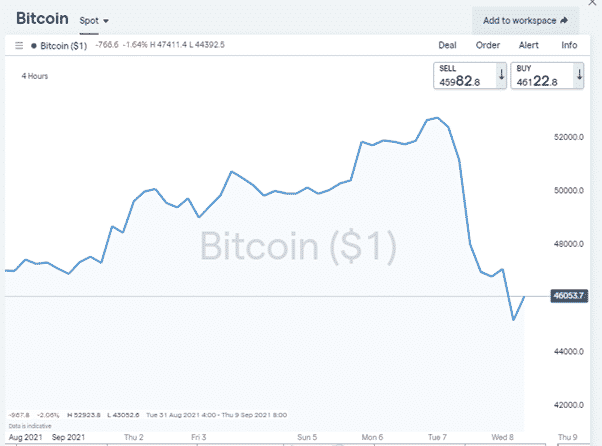

On Tuesday, when BTC dropped from above $52,000 to $43,000, the alarming price move demonstrated what might lie ahead for the El Salvadoran population. El Salvadorans paid in Bitcoin for services provided on Tuesday morning were effectively 17% poorer by tea-time.

Source: IG

Did the US Authorities Just Spike the Bitcoin Price?

Tuesday’s events also raise some questions about market manipulation. The unregulated nature of the market that appeals to the maverick spirit of its supporters potentially left the door open to a concerted effort to drive down prices.

Firstly, despite the likelihood of technical glitches being associated with the roll-out, the move by El Salvador should have been positive for BTC’s price. It was a watershed moment for cryptos as the holy grail of being used as legal tender took BTC a step closer to being the currency of the future.

Bitcoin price moves are hard to explain at the best of times, but a surge in price would not have been surprising as the crypto announced a new dawn.

The Bitcoin price crash could demonstrate the financial establishment flexing its muscles. The temptation to derail El Salvador’s project would have been immense.

According to usethebitcoin.com the fourth-largest holder of Bitcoin in the world is the FBI. The US government and central bank benefit immensely from the role of the US Dollar as the world’s base currency. It could be said the dollar being the world’s reserve currency props up the US economy. With the authorities having everything to lose from BTC’s move into the mainstream, a bout of selling and a startling price crash would have been just what was needed to rain on El Salvador’s parade.

Is This A New Trading Signal for BTC?

No other countries are close to following the move of El Salvador. But if, and when, they appear, the high-stakes nature of the shoot-out between the US Dollar and Bitcoin could be a sure sign to sell up and stand out of the way.

If you want to know more about this topic or have been scammed by a fraudulent broker, please contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox