*Originally published on 15/06/2021

- In our last article here on USDJPY and USDCAD from 9th July we highlighted a positive tone for the US Dollar versus the Japanese Yen, but negative risks versus the Canadian Dollar.

- USDJPY has seen a correction lower, but whilst holding above the 110.25 level we still maintain an intermediate-term bullish view.

- For USDCAD, however, we warned of a potentially more negative tone and the surrender of the key 1.3063/61 area shifted the intermediate-term outlook to bearish.

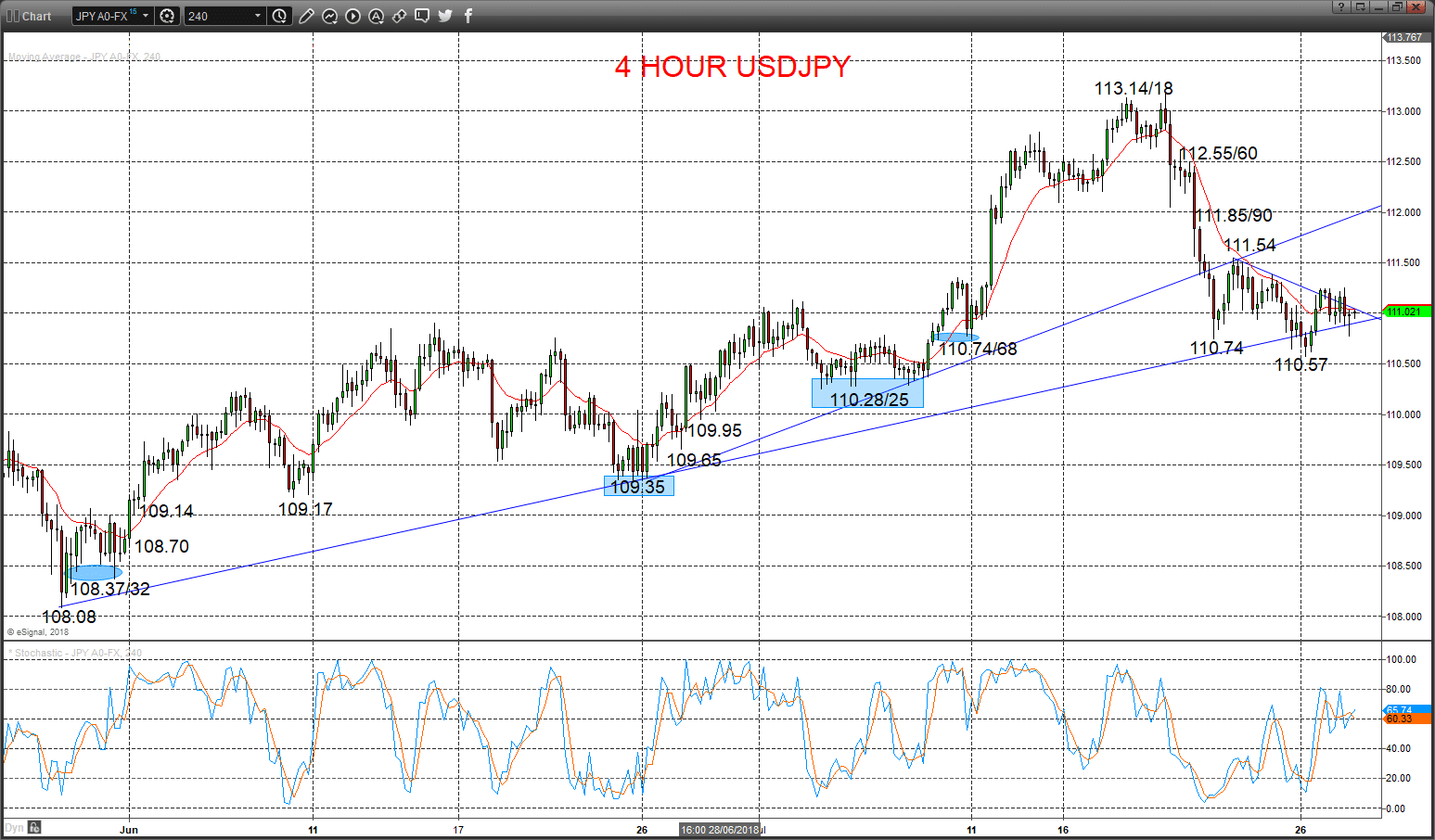

USDJPY

Immediate upside bias whilst above new 110.57 support

A solid Friday consolidation, after Thursday’s probe below the notable 110.74/68 support area and then rebound from new support at 110.57, and whilst holding here to keep risks higher Monday.

The early July push above 111.08 shifted the intermediate-term view to bullish.

For Today:

- We see a rebound bias higher for 111.54 and 111.85/90; break here maybe aims for 112.55/60.

- But below 110.57 opens risk down to key 110.28/25.

Intermediate-term Outlook – Upside Risks: We see an upside risk for 113.39/55.

- Higher targets would be 114.73, 115.50/63 and maybe towards 118.65.

- What Changes This? Below 110.25 shifts the outlook back to neutral; only through 109.35 signals for a bear theme.

Resistance and Support:

| 111.54 | 111.85/90 | 112.55/60 | 113.14/18* | 113.39** |

| 110.57 | 110.28/25*** | 109.95* | 109.65* | 109.35*** |

4 Hour Chart

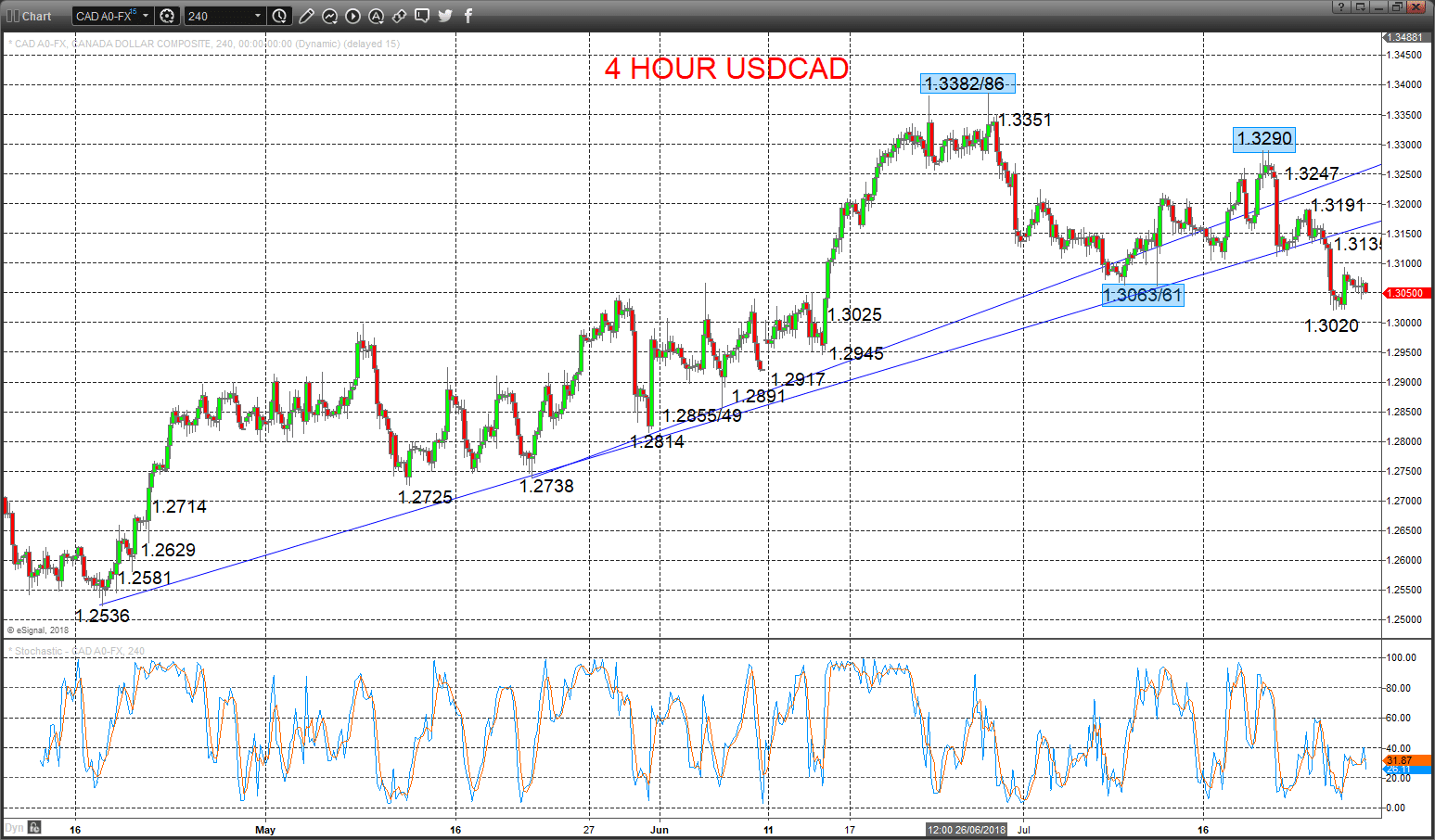

USDCAD

Risks still lower

A setback Friday, dismissing Thursday’s rebound effort, and whilst capped by 1.3135 resistance we still see negative pressures from the latter July selloff through the key 1.3063/61area (that completed a significant intermediate-term topping pattern) to keep risks lower Monday.

The surrender of the key 1.3063/61area shifted the intermediate-term outlook to bearish.

For Today:

- Whilst below 1.3135 we see a downside bias for 1.3020; break here quickly aims for 1.3000, maybe 1.2945.

- But above 1.3135 opens risk up to 1.3191.

Intermediate-term Outlook – Downside Risks: We see a downside risk for 1.2814.

- Lower targets would be 1.2725 and 1.2536

- What Changes This? Above 1.3290 shifts the outlook back to neutral; above 1.3386 is needed for a bull theme.

Resistance and Support:

| 1.3135* | 1.3191** | 1.3247* | 1.3290*** | 1.3351 |

| 1.3020 | 1.3000 | 1.2945** | 1.2917* | 1.2891 |

4 Hour Chart

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox