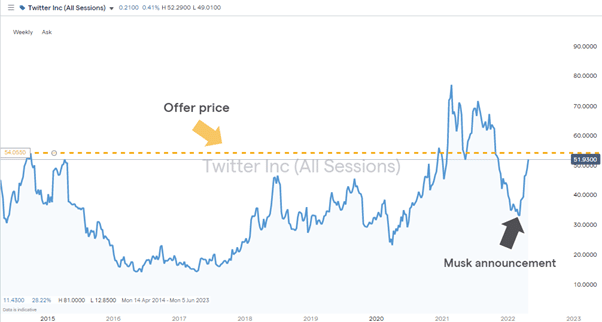

The announcement that Elon Musk’s bid for Twitter has been accepted has surprised many and raised even more questions. The Twitter board accepted the mercurial entrepreneur’s offer price of $54.20 on Monday rather than negotiating it upward, which has condensed the timeline of the takeover.

Uncertainty still dominates the situation. If you’re holding Twitter, Tesla or tech stocks or taking a position on the sidelines, distinct groups of winners and losers are already forming.

Twitter Shareholders – Winners

If you had bought Twitter stock at any time since August 2014, the price offered by Musk would likely represent a premium on your entry price. The only investors who will still be under the water on their trades are those who bought Twitter stock between December 2020 and October 2021. Even they will note they could be scrambling out of a bad position at a not too toxic price.

Source: IG

Twitter stock on Monday was trading at a +60% premium to where it was on 7th March before Musk built his position on the social media platform.

Tesla Shareholders – Losers

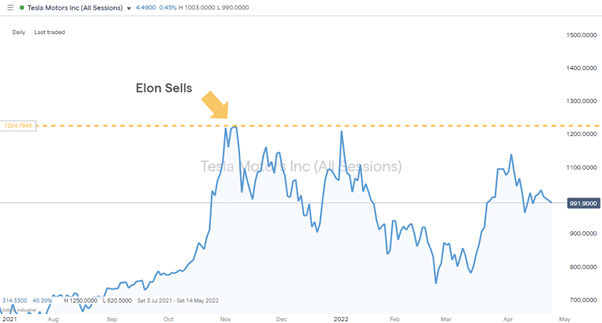

Elon Musk might be the wealthiest individual on the planet, but the $21bn he is putting up to secure the deal has mainly been sourced from his holding in Tesla stock. He has been selling some of his TSLA position since November 2021, when he offloaded $286m worth of shares after conducting his own Twitter poll. Signs that the founder and talismanic leader is prepared to consider the EV maker as overvalued puts a cap on a further upside for TSLA investors.

Tesla Inc Share Price – Daily Chart – July 2021 – April 2022

Source: IG

Another element to factor in is how Musk will divide his attention between the two companies. Tesla may be paying the bills, but the complex relationship Musk has with the social media platform is well documented.

Tech Stocks & Day Traders – Winners

Tesla is one of the most actively traded stocks in the market. The firm’s market cap is typically in the region of a quarter of Apple Inc (AAPL), but the daily trading volumes in TSLA are often two or three times those of AAPL. The news of the Twitter buyout will lead to greater volatility, especially as more day traders will be taking a negative view of Tesla’s fortunes and increasing the amount of short interest.

Twitter Staff & Free Speech – TBC

One of the biggest questions relates to the direction the content of the Twitter platform will take. Many of the platform’s problems have stemmed from ‘free speech’ being hard to define. The company’s policies have taken an approach aimed at trying to bolster advertising revenue by limiting access to some of the most controversial voices.

There is already talk of staff leaving the company on principle. While some will be cashing out employer-related stock positions, the fact that the firm is now going private limits the ability of employees and new hires to receive stock incentives as part of their remuneration packages.

Crowdsourcing information about scam brokers can help others avoid falling into the traps set by disreputable brokers, and you can share your experiences here. If you would like to know more about this particular topic or have been scammed by a fraudulent broker, you can also contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox