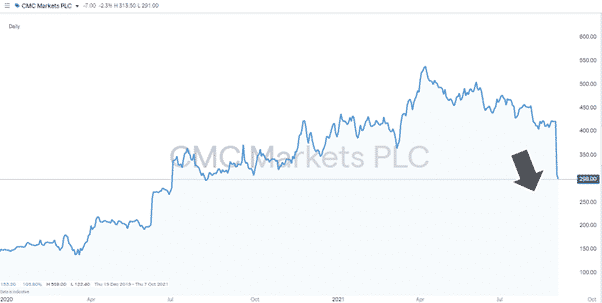

Anyone trading using the CMC Markets platform needs to note Thursday’s poor trading update that included a profit warning that wiped 30% off the firm’s share price. Whether this is an “amber” or “red flag” for the broker’s clients is yet to be seen. The platform has a functionality that is well regarded in the trading community and a loyal customer base. Still, the security of funds is the number one priority for any trader or investor. A profit is not a profit until the money is banked and the broker has fully paid any gains.

Source: IG

CMC boss, Lord Peter Cruddas, who with his family owns 62% of the shares in CMC Markets Plc, saw his wealth take an almost £200m hit on Thursday. The self-made billionaire has a personal net worth that Networthlist estimates to be in the region of $1.3bn. He has given no indication he’ll be scaling back his position in the broker. But the £80 cut in the future profit guidance number will even hurt those with the deepest pockets.

Source: Networthlist

Is it Time to Jump Ship?

Given the amount of technical and fundamental analysis which goes into running a successful investment strategy, it’s surprising how many traders skip analysing the health of their broker. The broker sector is a competitive space with many new entrants setting up to try and gain market share during the lockdown boom in home trading. Those newer entrants would appear to be more vulnerable to a market downturn than CMC Markets. CMC has, after all, been around since 1989, and Cruddas would be in the group of business leaders who have seen it all before.

The poor trading performance in July and August can also be attributed to investors finally taking a break from the markets after more than a year of uncertainty. Lower trading volumes directly translates as lower revenues for brokers, particularly firms like CMC, which attract traders rather than investors.

Some CMC account holders will be considering a move, and there are many alternative trusted brokers from which to choose. Many of them have been upgrading their platforms, and it’s worth keeping up to date with the neat new tools they are rolling out to clients. Developing a plan B by setting up a Demo account with another broker is always recommended. If institutional investors spend so much time and money developing a detailed Business Continuity Plan, then so should retail investors.

Why Choose a Listed Broker?

The fact that CMC Markets Plc is a listed company required to share its financial updates with the public is, in terms of transparency at least, a good thing. There is also the fact that it is regulated by the FCA, and UK clients can benefit from the protection of the FSCS scheme.

One of the key metrics used by the Forex Fraud review team is whether a company is listed or privately owned. If a broker is not obliged to issue market updates, then clients are kept in the dark about the broker’s financial health.

Crowdsourcing information about scam brokers can help others avoid falling into the traps set by disreputable brokers and you can share your experiences here. If you want to know more about this particular topic, or have been scammed by a fraudulent broker, you can also contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox