If the first quarter events have left you wondering if we’re in a bull or bear market and about what to do next, don’t worry; you’re not alone. In fact, two top analysts from two of the biggest banks in the world have released conflicting statements on which way the markets might be heading.

Bull vs Bear

Bloomberg reports that Morgan Stanley’s Chief U.S. Equity Strategist, Michael Wilson, and JPMorgan strategists led by Mislav Matejka have taken opposite views on the current state of the markets.

Wilson’s take is that the surge in the value of risk-on assets, which has taken place since 15th March is a ‘bear market rally’. That means the +17% rise in the value of the Nasdaq 100, for example, is a momentary burst of buying activity that forms a natural, if short-lived, moment in a longer-term downward trend.

“The bear market rally is over … That leaves us more constructive on bonds than stocks over the near term as growth concerns take center stage – hence our doubling down on a defensive bias.”

Source: Bloomberg

Bearish Technical Analysis

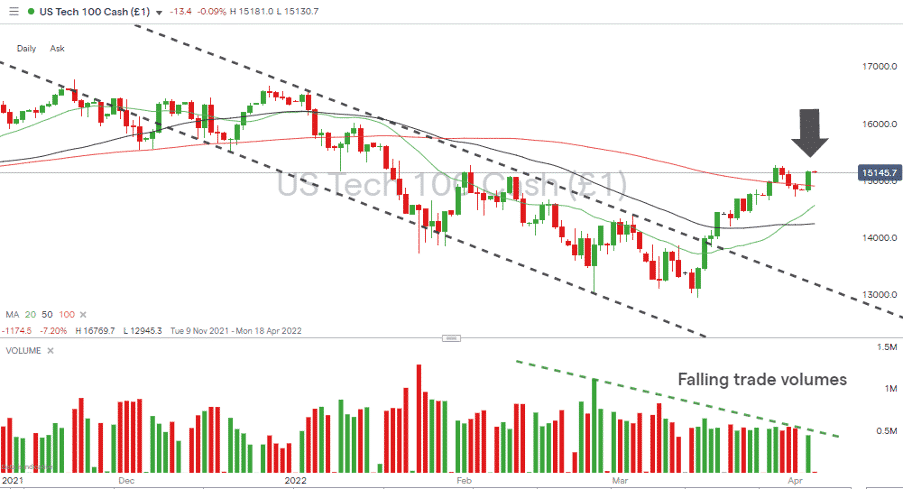

From a technical analysis perspective, the recent rally may be running out of legs. Trade volumes have declined during the bull run, suggesting that the bulls haven’t yet come across real selling pressure from the bears. This would make sense as the price lows of mid-March touched long-term price support levels at areas of the charts where speculative shorts aren’t usually put on.

With the Nasdaq 100 now back in the region of the 100 SMA on the Daily Price Chart, there could be more incentive to lighten up on risk, especially considering the disappointing data out of the US regarding manufacturing production levels in March.

NASDAQ 100 Index – Daily Price Chart – Q1 2022 – Bearish Appraisal

Source: IG

Bullish Technical Analysis

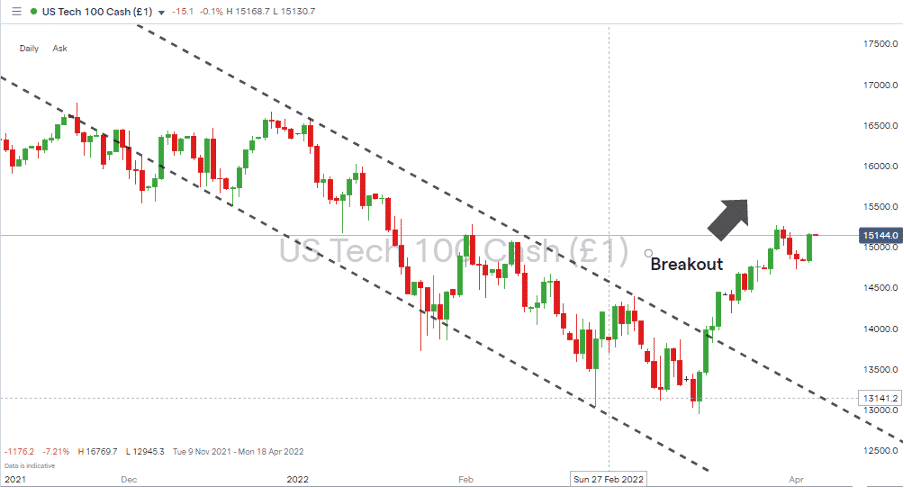

The alternative view is also hard to bet against. The trading rooms of the world are peppered with traders who lost out by betting against stock market rallies once again forming, even if all the data pointed to price heading downwards.

The breakout of the downward price channel might have been based on relatively low trading volumes, but the path of least resistance still appears to be upward. This sentiment is matched by the JPMorgan analysts who stated:

“We do not see equities fundamental risk-reward to be as bearish as it is currently fashionable to portray.”

Source: Bloomberg

NASDAQ 100 Index – Daily Price Chart – Q1 2022 – Bullish Appraisal

Source: IG

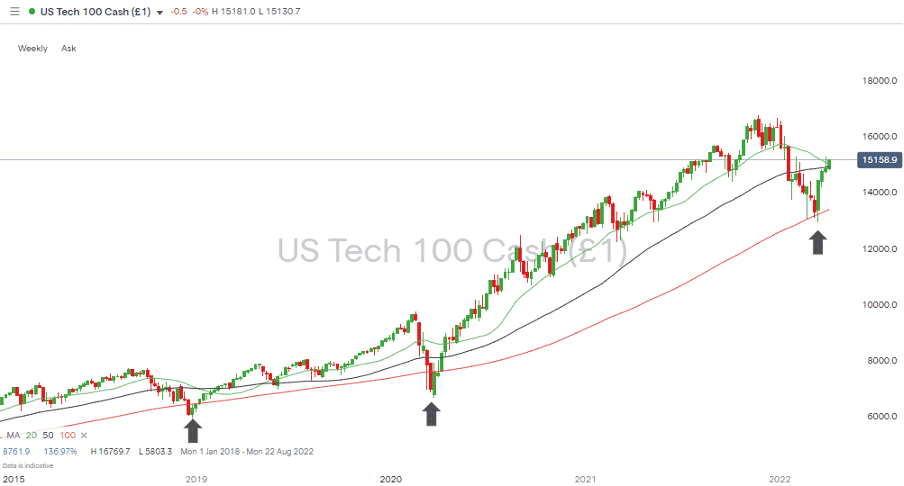

Using a longer time frame, it’s possible to see the bounce in mid-March was launched from the 100 SMA on the Weekly Price Chart. The two other times that price clipped that key metric marked the start of multi-month bull runs.

NASDAQ 100 Index – Weekly Price Chart – 2015 – 2022 – 100 SMA Support

Source: IG

Final Thoughts

With professional analysts struggling to reach a consensus, it could be a time for trading in small size or remembering that some of the best trading involves not trading but instead waiting for a clearer signal.

Crowdsourcing information about scam brokers can help others avoid falling into the traps set by disreputable brokers, and you can share your experiences here. If you would like to know more about this particular topic or have been scammed by a fraudulent broker, you can also contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox