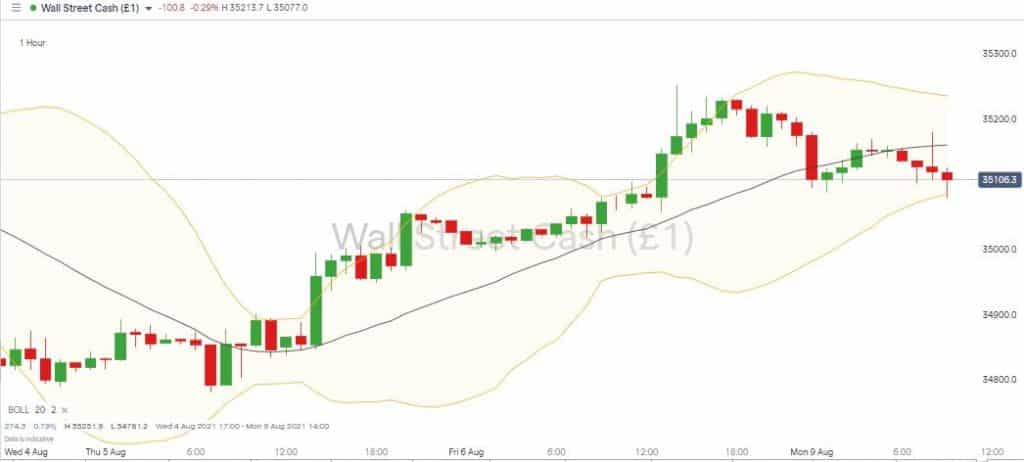

Markets have started the week in a nervous mood following Friday’s barnstorming run in risk-on assets. The positive news out of the US in terms of bumper Non-Farm Payrolls took a range of equity indices to all-time highs, with the Dow Jones Industrial Average printing above 35,000 for the first time ever as it ran into the end of the trading week.

Source: IG

Why the uncertainty?

The weekend has, though, seen sentiment swing the other way. At the open of the European markets on Monday, European exchanges were in negative territory, and US futures were trading flat. The most concern appears to be focussed on inflationary pressures, the flip side of a buoyant jobs market. When the US unemployment figure came in at 5.4% rather than the 5.7% analysts had forecast, the immediate reaction was to buy into risk.

All eyes now appear to be on Wednesday’s US inflation data announcement. The US Consumer Price Index will colour in the outline provided by the employment data on Friday. With analysts bracing themselves for a high inflation number, inflationary risk could be already priced in. There could be surprises to the upside for equities and bad news for the US dollar.

Reasons Any Rally Could be Short-lived

The US Producer Price Index is due to be released on Thursday. Whilst PPI data comes with the stigma of being the bridesmaid to CPI rather than the bride, it could offer insight into the duration of any market move which starts on Wednesday. If prices at the factory gates show upstream inflation is still a concern, then any rally would be short-lived. If the CPI and PPI align and both come in at lower than forecast levels, the only way is up.

The numbers would themselves suggest inflation is not as much of a risk as has been feared. It would also signal the US Fed was correct in its call that inflationary pressures are “transitory”. A boost in the credibility of the US central bank would be a tonic for the markets as, until the price pressure subsides, there is doubt about whether the call will turn out to be correct.

On the other hand, long-term downward pressure on equities and renewed USD strength can be expected if the inflation genie is really out of the bottle. It does, after all, take months, if not years, of higher interest rates to get the genie back where it belongs.

It’s looking like a relatively busy week for the sometimes-sleepy summer markets. A mishmash of positive and negative news can’t be discounted and would fit into the default pattern for August. Suppose the fireworks expected to be let off halfway through the week end up being a damp squib. In that case, sideways trading can be expected, a time to opt for trading strategies designed to pick off short-term pricing anomalies rather than a paradigm shift.

Crowdsourcing information about scam brokers can help others avoid falling into the traps set by disreputable brokers and you can share your experiences here. If you want to know more about this particular topic or have been scammed by a fraudulent broker, you can also contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2024

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex & CFD Broker |

Best Trading Conditions

Visit broker

|

||

| #2 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #3 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #4 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

Global CFD & FX Broker |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #7 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #8 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox