Safer and wider use of blockchain technology took another step forward on Friday when online broker eToro announced that it would be the first major exchange to back the Flare network.

The advantages of blockchain technology are widely accepted. The open-ledger approach means all users are aware of the positions held by other participants. Those holding cryptocurrencies are effectively playing cards with all the cards already laid face up on the table.

Building on that ultra-transparent approach in a safe and regulated way is the ultimate aim which is why eToro’s announcement is so interesting.

How will prices react to cryptos becoming more mainstream?

eToro’s role as part of the Sparks airdrop lends a lot of weight to the Flare network. The popular broker has 16 million registered users, so its support of the new program will be welcomed. The truth is that blockchain technologies and cryptocurrencies have a lot going for them but they do need to get past the inertia factor.

The Flare network is a new blockchain protocol which enables the use of smart contracts for existing crypto tokens. Spark, the native token of Flare will therefore improve the functionality of cryptos that do not natively have their own token. The first crypto to have the Flare treatment is Ripple (XRP).

Source: eToro

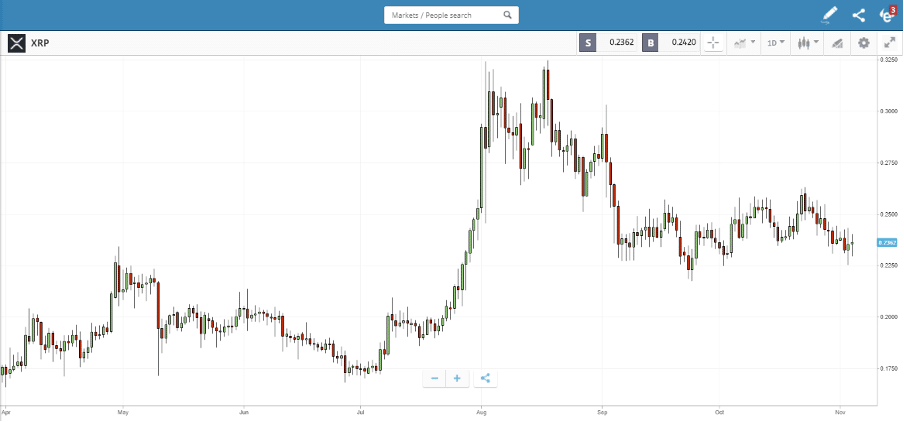

Running in parallel to the tech upgrade is the price of cryptos. Flare and Spark could open up the XRP network to decentralised finance applications. If successful, it could be rolled out to other coins. That doesn’t confirm which of the hundreds of cryptos will ultimately become dominant but it does boost the sector as a whole. Flare and Spark make it more likely that cryptos will become more widely used – that is good for prices.

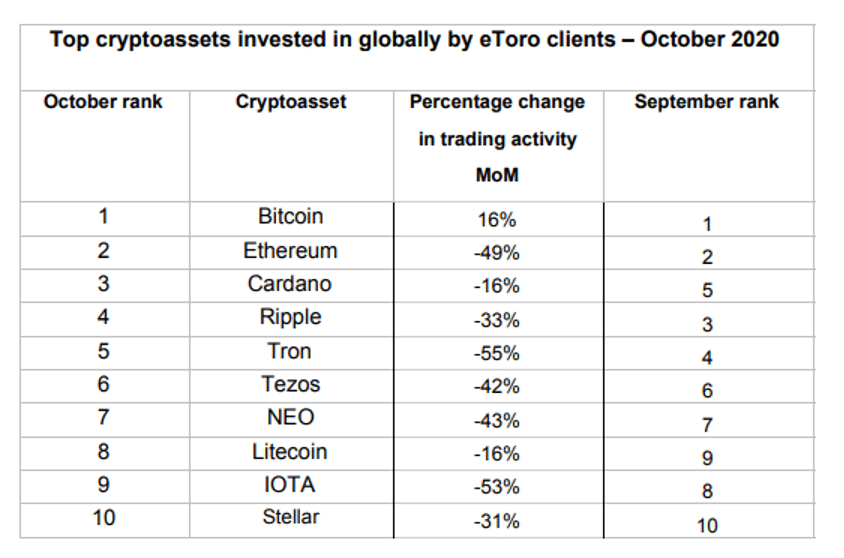

Ripple and other Alt-coins saw a drop off in trading volumes in October. The total trading activity in XRP was 33% down on the September numbers. Ethereum (-49%) and Tron (-55%) saw a more significant drop off with Bitcoin the only one of the top 10 cryptos to show a pick-up in trading volumes (+16%).

Source: eToro

Source: eToro

Running in parallel to the tech upgrade is the price of cryptos. Flare and Spark could open up the XRP network to decentralised finance applications. If successful, it could be rolled out to other coins. That doesn’t confirm which of the hundreds of cryptos will ultimately become dominant but it does boost the sector as a whole. Flare and Spark make it more likely that cryptos will become more widely used – that is good for prices.

Ripple and other Alt-coins saw a drop off in trading volumes in October. The total trading activity in XRP was 33% down on the September numbers. Ethereum (-49%) and Tron (-55%) saw a more significant drop off with Bitcoin the only one of the top 10 cryptos to show a pick-up in trading volumes (+16%).

Trading volumes and the ability of cryptos to be used as a means of exchange do feed through into price. If the eToro news makes XRP more likely to become mainstream, there is the chance that the coin will increase in value.

There is still time for traders to get involved in the roll-out of Sparks tokens.

A snapshot of holdings of XRP tokens will take place on the 12th of December, 2020. Multiple exchanges will manage the registration process and decide how many Spark tokens these investors are entitled to receive. For example, clients who are holding XRP on certain exchanges will be eligible to receive spark tokens. Distribution of spark tokens is currently set for March 2021, according to Flare network.

It’s an exciting move. There are ramifications for the price of crypto assets as the tipping point moment of coins being viable and a trusted form of payment comes ever closer. Blockchain ultimately offers greater security, so those thinking of using it will welcome the news.

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox