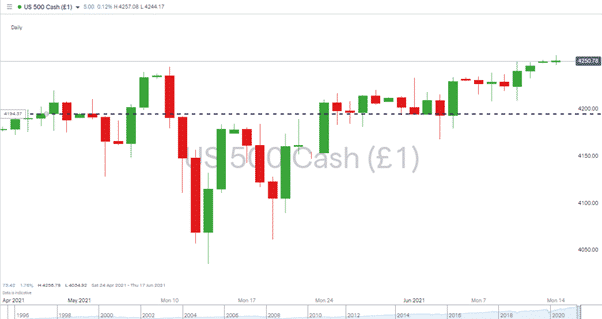

Given the unprecedented events of the last 16 months, it’s not necessarily surprising that ‘Sell in May’ looks like it might not be panning out in line with historical trends. The global benchmark S&P 500 index was down 3.80% mid-month but finished in positive territory and on Friday posted a new all-time high.

Buy-back in June?

The sell in May strategy does, of course, extend over a more extended period than the month itself and aims to capture market weakness over the slow summer months. Those tempted to scale back in risk after the six-month bull run will now be suffering from FOMO. Any last-minute changes of heart and buying back into the markets would offer extra momentum to the upside.

Source: IG

Strong Fundamentals for Equities?

Major global equity indices posted a positive week starting on the 7th of June. EURUSD and GBPUSD posted negative weeks in the forex markets, suggesting a move away from risk, but equities went in the other direction. That wasn’t the only disconnect. In the precious metals market, gold was down 1.28%, but silver was up 0.87%. A significant move for the pair, not only due to the reverse correlation but also because of the size of the movement.

| Instrument | 7th Jun | 14th Jun | Hourly | Daily | % Change |

| GBP/USD | 1.4125 | 1.4108 | Strong Sell | Sell | -0.12% |

| EUR/USD | 1.2149 | 1.2112 | Neutral | Strong Sell | -0.30% |

| FTSE 100 | 7,062 | 7,171 | Strong Buy | Strong Buy | 1.54% |

| S&P 500 | 4,218 | 4,251 | Strong Buy | Strong Buy | 0.78% |

| Gold | 1,881 | 1,857 | Strong Sell | Sell | -1.28% |

| Silver | 2,748 | 2,772 | Strong Sell | Neutral | 0.87% |

| Crude Oil WTI | 68.99 | 71.14 | Strong Buy | Strong Buy | 3.12% |

| Bitcoin | 35,960 | 39,575 | Buy | Buy | 10.05% |

Source: ForexTraders

Those wondering what all this might mean for the markets might lean towards explaining the disconnects in terms of economic activity. A boom in production would explain the relative strength of silver, which is used in industry to a greater extent than gold. Equities picking up pace and risk-on currencies sliding would also be explained by analysts forecasting the global recovery will be better than expected.

FTSE in Focus

The FTSE 100 index has still not returned to pre-Covid levels. While other indices, particularly those in the US, have not only clawed back their losses but have moved up further. The index has been a perennial underachiever. Brexit fears loomed over the economy, and the uncertainty was matched by the firms which make up the index being out of favour. Oil stocks crashed during the 2020 lockdown, and banking stocks struggle in low-interest-rate environments. A little bit of inflation would help the commodity sectors and finance. That could be on the cards after the US posted its Consumer Price Index data last week.

Source: IG

The US Federal Reserve meets on Wednesday when it will indicate how committed it is to be sticking with a stock-friendly monetary policy. While inflation is historically bad for share prices, the FTSE 100 index offers better protection than most others. That might partly explain why buyers are moving into the market.

If you want to know more about this topic or have been scammed by a fraudulent broker, please contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox