The Forex Fraud team has received more messages from scammed traders pointing out how recent crypto price rallies are bringing an old scam, the double-dip, back to the table.

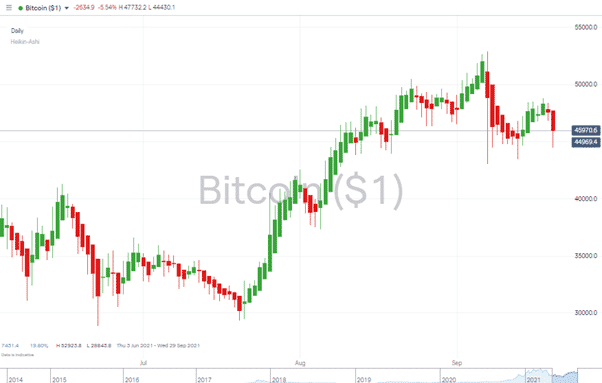

Bitcoin Price Chart – Daily Heiken Ashi Candles

Source: IG

Since mid-July, the rally in crypto prices has seen the price of market leader Bitcoin rise from $30,000 to $50,000. Many altcoins have matched or beaten that price surge. With gains close to 100% showing up in profit and loss accounts and price action showing weakness, traders looking to crystalise their gains are coming across an old problem.

The Double-Dip Scam Explained

One of the favourite techniques of scammers is to extract further funds from account holders to release profits. It has never made sense and continues to be a significant red flag. The most common scenario is that the initial deposit is as good as lost, and the scam broker is looking to squeeze more money out of the victim.

“Good Day David,

I wanted to share this, which I have come to believe is a scam. After investing 3000 USD, I got this.

Regards,

Anthony”

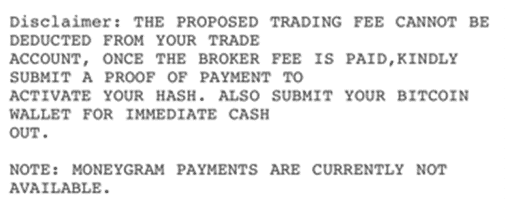

One broker under investigation has asked the account holder Anthony for $12,579.57 to be wired to them before profits are released. This ‘withdrawal fee’ forms a 20% surcharge on the total profits of the trade. The text on the broker’s message confirming in capital letters, as if that makes it a valid request, that:

“THE PROPOSED TRADING FEE CANNOT BE DEDUCTED FROM YOUR TRADE ACCOUNT”

Another warning sign is the notification that there is an ‘account manager’ on hand to facilitate the transaction. Contacting them represents signing up to a fast-track programme on how to be talked into the benefits of throwing good money after bad. It’s particularly prevalent in the crypto markets, where fraudulent brokers use technological smoke and mirrors to confuse clients.

The broker in question will be going onto the Forex Fraud list of brokers to avoid, which is as valuable for industry pros as it is to retail investors. A brokerage site should provide information on a firm’s regulatory status and registration number at the authority they claim to be licensed by. Cross-referencing that to the regulator’s website is the acid test. Another good approach to adopt is to stick to brokers regulated by Tier-1 regulators such as those listed below:

- The Financial Conduct Authority (FCA)

- The Australian Securities and Investments Commission (ASIC)

- The U.S. Securities and Exchange Commission (SEC)

If you are looking to trade with a reputable broker, please visit the Forex Fraud shortlist of trusted brokers. Alternatively, the Broker Review section of our site gives a breakdown of the pros and cons of different brokers. We only carry out reviews on brokers we rate ‘legitimate’. If you get the basics right and choose a safe broker, you can then fine-tune your selection by trying out a free Demo account and, by doing that, test the functionality of the site hands-on.

Crowdsourcing information about scam brokers can help others avoid falling into the traps set by disreputable brokers, and you can share your experiences here. If you want to know more about this particular topic or have been scammed by a fraudulent broker, you can also contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox