Bitcoin’s price crash on the back of comments made by Tesla has provided another warning about the price volatility in the crypto markets. If the news at the end of last week from one of the largest corporations in the US wasn’t bad enough, there was more fall-out to follow over the weekend. On a week-to-week basis Bitcoin is now down 24.46% and the testing and subsequent breaking of the $50k price level has left the coin a lot of work to do if it is to push to new highs.

Tesla have come out on Monday morning to confirm they haven’t sold any of their Bitcoin holding. While they’ll be nursing P&L losses, that’s probably preferable to the fury they would have faced if they’d been exposed as pumping and dumping the market.

Rumours over the weekend emanated from Tesla founder Elon Musk’s personal Twitter account. Many interpreted his comments on the social media portal as pointing towards Tesla bailing out of its BTC position only days after stating that it wouldn’t.

Currently, as much thought is being given to the comments of Elon Musk as to the carefully crafted words of the Chair of the US Federal Reserve, Jerome Powell.

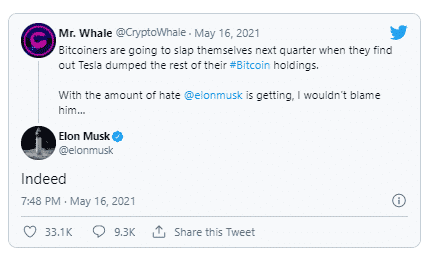

In response to the below Tweet from Twitter user @CryptoWhale, Musk replied “Indeed”

“Bitcoiners are going to slap themselves next quarter when they find out Tesla dumped the rest of their holdings. With the amount of hate @elonmusk is getting, I wouldn’t blame him…”

That was taken as a sign that the standard bearer of the crypto had fallen. Crypto exchange, Coin Metrics, which reports price on a 24/7 basis reports that BTC printed prices as low as $ 42,241 at 12.07am (ET) on Monday.

Source: Twitter

A recovery to over the $45k mark followed Musk Tweeting “To clarify speculation, Tesla has not sold any Bitcoin”. Of equal concern to those in long positions is the price action on the daily chart. The May month-to-date high of $59,272 now looks a long way off. Monday’s market price for Bitcoin is now over 30% off the 14th of April all-time high of $64,862.

Bitcoin Daily Price Chart – Year to date – 2021

Source: IG

This trend started long before Tesla and Musk shared concerns about the high-carbon footprint of crypto networks which use more energy than entire countries. It’s estimated that Bitcoin miners use half as much energy as all the data centres in the world combined. While Amazon, Google and Microsoft have extensive carbon-offset programs in place to ensure they comply with their CSR policies, crypto as an industry is a free-for-all, and that is giving it a bad name.

Bitcoin Daily Price Chart – Year to date – 2021 & price support levels

Source: IG

The next key support for BTC is the $43,028 low from the 28th of February.

After that there is support at $32,577 the low of the 27th of January. Followed by $27,974 – the year to date low on the 4th of January.

If you want to know more about this topic, or have been scammed by a fraudulent broker, please contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox