Extreme market conditions have resulted in some retail clients being forced out of trading positions by their brokers. Reports from the trading community suggest this applies to certain Russian stocks held as CFD positions and too long positions bought outright in a ‘share dealing’ format.

The explanation given by the platforms is that they are prioritising risk management, and they’ll be contacting investors to offer a ‘gesture of goodwill. But for some investors, there is a feeling that they have just been forced out of positions at a loss, instead of being able to hold on and wait for prices to recover, though a bounce in price is not guaranteed.

Brokers Restrict Trading in Magnit Holdings

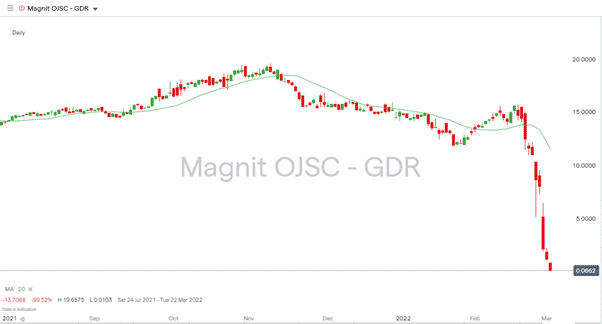

The stock which appears to be the centre of attention is the Russian supermarket chain Magnit Holdings. Recent share price activity doesn’t tell a pretty story for investors in the stock. The dramatic price crash, which started in the middle of February, has seen the value of the stock almost wiped out.

Source: IG

Whilst nothing is ever guaranteed in the markets, a supermarket chain would usually be considered a more defensive position by traders because everybody’s got to eat. That would have encouraged some investors to decide to try and ride out the storm, but the option of doing so has been removed after brokers such as eToro forcibly closed out positions.

How Do GDRs Work?

The stock has been available to investors in GDR (Global Depositary Receipt) format. The company is listed on international exchanges and could be bought and sold using USD and GBP. These GDR markets offer a convenient way to gain exposure to developing markets without getting set up to trade on the local exchange using local currency.

Prices of GDR stocks are derived from the primary exchange, in this case, the Moscow Exchange. When trading on exchanges is suspended, the automated price feed breaks down, and investors and brokers are left in a dilemma.

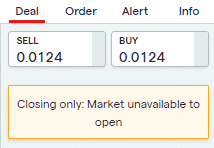

Broker IG has taken a similar course of action and is steering its clients towards closing positions themselves. They are not allowing new positions to be opened.

Source: IG

The Different Kinds of Risk Management

It’s probably little comfort for retail investors that professional traders on the dealing desks of hedge funds will likely be facing the same situation. In that case, being forced out of a position will more likely come in the form of a phone call from the firm’s risk officer. For all traders, the current situation is a reminder that making a profit from the markets can be as much about broker choice and risk management as it is about stock selection.

Crowdsourcing information about scam brokers can help others avoid falling into the traps set by disreputable brokers and you can share your experiences here. If you want to know more about this particular topic or have been scammed by a fraudulent broker, you can also contact us at [email protected]

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2024

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex & CFD Broker |

Best Trading Conditions

Visit broker

|

||

| #2 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #3 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #4 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #5 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #6 |

|

Global CFD & FX Broker |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #7 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #8 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox