Regulators are not sitting on their hands in 2017 when it comes to protecting consumers from fraud and unscrupulous business practices in the foreign exchange industry. We have highlighted many of the reasons in previous articles for what many have perceived as an all out assault on the brokerage community. Suffice it to say that complaints have swamped regulatory agencies, consumers have lost millions right and left, and the largest forex scandal in banking history has tarnished the pristine image that regulators had crafted over the past decade.

2017 began after the FCA and CySEC shocked even well established brokers with new draconian guidelines on how leverage, bonuses, and transparency must be administered across the UK and the European Union. These actions and the reactions that ensued consumed the headline stories in January, but the CFTC and the NFA in the United States grabbed that honor in February when they excommunicated the then market share leader in the region, FXCM, fined the firm $7 million, and sent their CEO and Chairman packing, never to do business in the U.S. for evermore.

While the “Big Boys” may have dominated the news, regulators across the globe were busy uncovering shady business practices, exposing scams, and publishing alerts on their various consumer warning website pages. It has truly been a busy quarter for regulatory staffs across the planet, which is a good thing in many respects. There is, however, a downside risk to take into account. Many brokers are already experiencing financial stress due to competition, declining revenues, and customer attrition. New regs will only exacerbate the current situation. You will want to closely monitor your broker’s performance and determine if there are any early warning signs that it may be in trouble.

With that prelude as a backdrop, here is a recap of what is happening across the globe:

FCA and the UK Market:

After announcing proposals in December that would severely limit the use of leverage and curtail altogether the prevailing use of bonuses as a marketing tool, the FCA went about its business of collecting input from banks, brokers, and traders on a systematic basis. Its self-imposed deadline for comments was March 7th, and recent reports are that it received over 4,000 submissions regarding the reductions in leverage and the elimination of enticement bonuses.

The level of response has forced the agency to delay publishing final guidelines to sometime in May. It had hoped to be up and running in April. Insider opinions suggest that bonuses are DOA, but that more lenient leverage guidelines may be forthcoming. “50:1” had been proposed, with lower values for beginners. Current thinking is that “100:1” may be in the cards, with a “soft” opt-out capability defined.

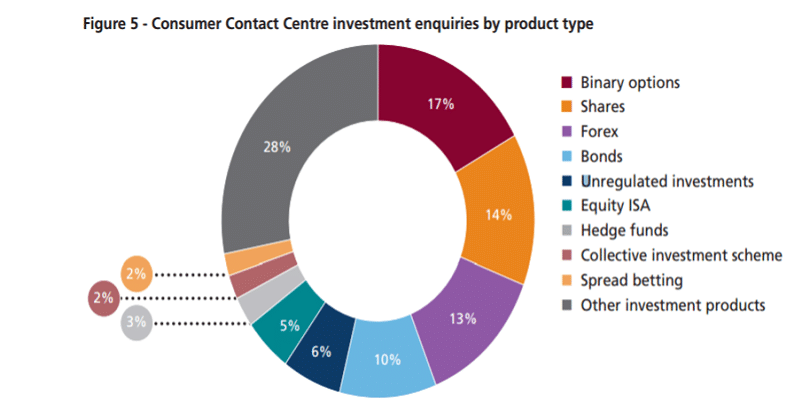

From a purely information reporting perspective, the FCA presented a summary of consumer enquiries over the twelve-month period ended last November. It included binary options in the mix, even thought responsibility still remains with the UK Gambling Commission. It now appears that a final transfer of those responsibilities will occur before 3 January, 2018, when the edicts of the Markets in Financial Instruments Directive (MiFID) II in the EU take effect. A summary of enquiries by product line is shown below:

Unfortunately, binary options are at the top of the list for specific products, if you ignore for the moment the large “Other” grouping. Binary options and forex together comprise 30% of the total activity, a rather disconcerting statistic from a risk purview. The message is to be on your toes. Perform due diligence when considering any new products, especially those offered by offshore firms. The FCA is there to help you.

CySEC and the EU Market:

Unlike the FCA, CySEC wasted no time with a proposal/comment period. It published its new guidelines with a “hard” compliance implementation date. As we reported: “Their published circular gives forex and binary option brokers until January 30, 2017 “to take the appropriate measures and actions in order to operate with the new rules”, related to bonuses leverage, and fund withdrawals.”

CySEC officials did not stop there. They have issued two additional circulars. The first one in early February was one “relating to sales and marketing practices, outsourcing of third party services, the provision of investment advice and the competence / compliance of sales staff.” The second circular soon followed and laid out specific guidelines of behavior for the binary options industry. The flurry of activity on CySEC’s part was attributed to ongoing pressure from the European Securities and Markets Authority (ESMA), an independent EU Authority, which had been critical of prior shortcomings.

To demonstrate that it meant business, CySEC fined Novox Capital for €175,000 for violating several of the new rules that it had recently put in place for all to follow. These violations had to do with “providing advice on investment without authorization by the regulator, failing to act in the best interest of their clients, sending misleading information to clients, improper outsourcing of company activities to third parties, failure to warn clients of the risks involved in binary options trading, and failure to maintain an adequate control of advertising material or adequate records”. Novux Capital operates several trading companies, with OptionBit as its primary binary options offering.

CFTC, the NFA, and the U.S. Market:

Regulators occasionally make an example out of an offender of their rules in order to send a clear message to everyone else that justice will be swift and harsh. At any point in time, the regulator would not generally have difficulty finding one of these offenders, since there are usually enough industry participants operating on the fringe that would provide ample targets for agency action. The CFTC and the NFA singled out one broker for just such swift and harsh action in early February, but they chose to bring down the market share leader in the region, FXCM, with great public fanfare.

What was the crime? According to the press release: “FXCM engaged in false and misleading solicitations of FXCM’s retail foreign exchange (forex) customers by concealing its relationship with its most important market maker and by misrepresenting that its “No Dealing Desk” platform had no conflicts of interest with its customers.” FXCM had profited handsomely by deceiving its customers. The firm was fined $7 million, forced to sell its U.S. portfolio, and its CEO and Chairman were forbidden from ever dealing in this market ever again. Will FXCM, now re-branded as GLBR, survive? It will depend on whether other regulators follow suit or the outcome of litigation from disgruntled shareholders. GLBR has $600 million in global assets, so it is possible.

ASIC and the Australia Market:

2016 was not a good year for the Australian Securities and Investments Commission (ASIC). The agency, often characterized as ultra-modern and a leader in the Asia Pacific region, came under criticism for its inability to follow though on its litigation strategies versus a number of high profile banks. A government audit review subsequently found “that ASIC was a dysfunctional, overworked and under-resourced organization.” The year ended with paltry fines for forex rate-fixing scandals, but the group’s intrepid chairman, Greg Medcraft, was determined to turn things around. Armed with new resources and a broader mandate from the government, the folks at ASIC are planning a major offensive in 2017, with more in the way of proactive scrutiny for forex brokers.

Israel:

2016 was also a year in which the dark underbelly of the binary options industry was exposed in a series of articles by Simona Weinglass, an investigative reporter for The Times of Israel. Aggressive sales operations that deliberately fleeced unsuspecting clients of their savings were found to be concentrated in Israel and a few other countries. They had escaped Israeli prosecution by avoiding Israeli citizens, but the activities of these boiler room operations were doing “doing unprecedented damage to the reputation of Israel.”

Israeli regulatory officials have been slow to react, but it appears that they have finally made a dent in the proceedings. The latest headline article read, “Israel Police arrested 20 people this week in conjunction with a global FBI sting against an international crime ring that has allegedly scammed tens of millions of dollars from individuals and companies over the Internet. They are suspected, variously, of fraud, aggravated fraud, conspiring to commit crimes, threats, extortion, money laundering and running a criminal organization.” This raid may only be the beginning of an all out assault on local crime.

Ireland:

It was only a matter of time before other regulatory agencies picked up the gauntlet thrown down by the FCA related to curbing CFD trading and possibly forex trading, as well. The Central Bank of Ireland (CBI) released a report that found that, “Clients who deposited real money to trade CFDs and FX did indeed lose about $7,300 per person on an average trade. The study also showed that about 75% of the clients lost money each year for the last four years.” The agency is presently seeking feedback from participants in the market, but insiders suspect that a full clampdown may be in the offing.

Turkey:

Regulators often act quickly, sometimes too quickly, to right perceived wrongs in the marketplace. A case in point is with the Capital Markets Board of Turkey (CMB), the national financial regulatory and supervisory agency. We can only surmise that the CMB was beset by a rash of consumer complaints from forex traders. In order to deal with the problem, the agency suddenly placed two severe limitations on how brokers may offer their retail forex trading services: 1) Clients must maintain a minimum account balance of TRY 50,000, roughly equivalent to $13,500, and 2) leverage may not exceed “10:1”. These rules take effect immediately, despite loud protestations from the brokerage community

Malta:

The tiny nation of Malta, a group of islands in the central Mediterranean between Sicily and the North African coast, is a financial hub for several retail forex and binary options brokers. As a member of the EU, it is a gateway for access to the European market. The Malta Financial Services Authority (“MFSA”) has been active in publishing consumer alerts for specific unauthorized brokers, but it recently published an alert for the general public “regarding the high risks associated with investments in contracts for difference, binary options, forex and other highly speculative products.” What’s next?

Concluding Remarks

The tenor of global retail forex regulators has changed dramatically in 2017. Under the belief that the best defense is a good offense, regulatory agencies have come out swinging, wasting little time in throwing their weight around in some cases. We expect more to come. Stay tuned!

Related Articles

- Forex vs Crypto: What’s Better For Beginner Traders?

- Three Great Technical Analysis Tools for Forex Trading

- What Does Binance Being Kicked Out of Belgium Mean for Crypto Prices?

- Crypto Traders and Coin Prices Face New Challenge as Binance Gives up its FCA Licence

- Interpol Declares Investment Scams “Serious and Imminent Threat”

- Annual UK Fraud Audit Reveals Scam Hot-Spots

Forex vs Crypto: What’s Better For Beginner Traders?

Three Great Technical Analysis Tools for Forex Trading

Safest Forex Brokers 2025

| Broker | Info | Best In | Customer Satisfaction Score | ||

|---|---|---|---|---|---|

| #1 |

|

Global Forex Broker |

BEST SPREADS

Visit broker

|

||

| #2 |

|

Globally regulated broker |

BEST CUSTOMER SUPPORT

Visit broker

|

||

| #3 |

|

Global CFD Provider |

Best Trading App

Visit broker

|

||

| #4 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #5 |

|

Global CFD & FX Broker (*Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more) |

ALL-INCLUSIVE TRADING PLATFORM

Visit broker

|

||

| #6 |

|

Global Forex Broker |

Low minimum deposit

Visit broker

|

||

| #7 |

|

CFD and Cryptocurrency Broker |

CFD and Cryptocurrency

Visit broker

|

||

|

|

|||||

Forex Fraud Certified Brokers

Stay up to date with the latest Forex scam alerts

Sign up to receive our up-to-date broker reviews, new fraud warnings and special offers direct to your inbox